Highlights

- The Santa Claus rally refers to an uptick in prices of listed stocks around the time of Christmas and New Year

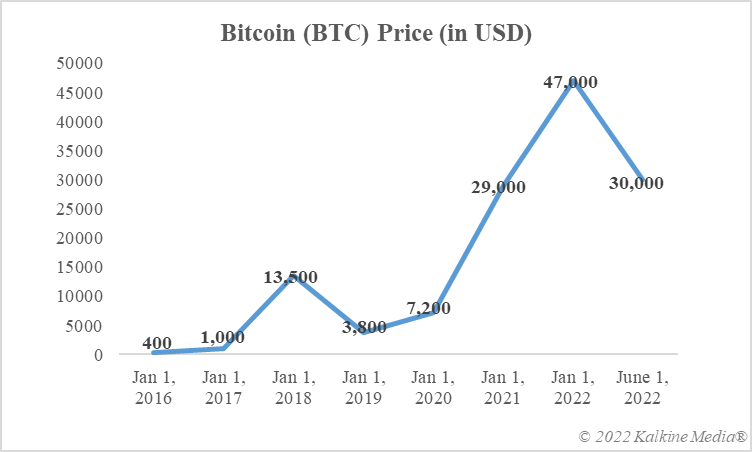

- Bitcoin’s all-time high was in November 2021, and in the following month, it could not hold on to that price level

- December 2020 was good for Bitcoin, but since cryptocurrencies are very volatile, nothing can be said about 2022

The market of riskier assets, including listed stocks, is shaped largely by fundamentals. New products, increased revenues, efficient management, and other factors generally push the company’s stock upward. However, there are some occasions when investors seem to care less about fundamentals. One such occasion is the time around the new year when the so-called ‘Santa Claus rally’ phenomenon hits the market.

This phenomenon is all about a rise in the value of listed stocks, and it is considered that Wall Street-based and most other stock indices usually perform well over the last week of December. Wall Street-based indices edged higher over the last days of December 2021, taking the S&P 500 Index’s annual rise in 2021 to nearly 27%.

Does a Santa Claus rally affect the cryptocurrency sector as well? Let us find out.

Bitcoin and December

Bitcoin (BTC), the biggest by market cap, is considered the barometer of the cryptoverse. Most Bitcoin enthusiasts would recall that BTC hit over US$68,000 in November 2021, which remains the cryptocurrency’s all-time high. In December 2021, Bitcoin could not hold onto that price level. However, there were some gains before Christmas when the BTC price jumped from nearly US$45,000 to over US$51,000. December of 2020 was even better when the BTC price rose steadily during the latter half of the month.

That said, it is notable that Bitcoin could not extend its November lead further in December last year. Besides, prices of Bitcoin and all other major altcoins, including Dogecoin and Ether, have remained under heavy pressure this year. Separately, the way names like FTX and TerraUSD have collapsed this year, it might have badly hurt sentiments.

What exactly is a Santa Claus rally?

The rally refers to an uptick in prices of riskier assets, primarily stocks, over the last few trading days of December and the first couple of days of January. Last year, even amid the Omicron variant fears, Wall Street experienced the Santa Claus rally. However, this year, there are expectations that a dull sentiment might not allow the phenomenon to make a positive impact on the prices of listed stocks.

Data provided by CoinMarketCap.com

Viewpoint

No predictions can be made about Bitcoin and altcoins due to a lack of fundamentals. Even though December 2020 was overall good for Bitcoin in terms of price growth, December 2021 was a mixed bag. This year, almost all cryptoassets have failed to shine, which is why many are not expecting any solid Santa Claus rally momentum in Bitcoin.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.