Highlights

- The Big Four banks of Australia have yet to become cryptocurrency-friendly in terms of depositing or trading

- Enthusiasts use cryptocurrency exchanges to engage in Bitcoin trading and to convert crypto into fiat currency

- Commonwealth Bank announced the launch of a trading platform in late 2021, but it backtracked in mid-2022

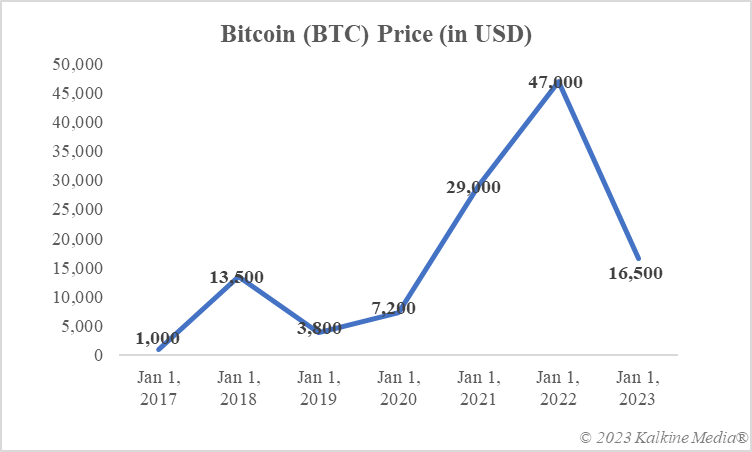

Popularity may not always mean wider acceptance. Cryptocurrencies like Bitcoin (BTC) are popular in Australia, but that does not mean these blockchain-based assets have gained broad acceptance. One of the primary reasons behind the limited acceptance of BTC is volatility in its value. In 2022, BTC’s value plunged by more than half, causing heavy losses to investors.

In November 2021, when BTC touched its all-time high value, one of the Big Four banks of Australia announced that it would soon launch a cryptocurrency trading platform. Commonwealth Bank, the country’s biggest lender, said in a statement that its CommBank app would facilitate the trading of 10 cryptocurrencies, including BTC.

Today, let us explore the progress of this big announcement and also know whether other big Australian banks allow Bitcoin.

Australian banks and Bitcoin

Four lenders dominate the banking landscape of Australia, including ANZ, NAB, and Westpac, and the abovementioned Commonwealth Bank. As of now, none of these banking entities are providing cryptocurrency trading services to their customers. Separately, one cannot deposit a cryptocurrency like Bitcoin directly into a bank account. In order to convert BTC to fiat currency, dedicated exchanges should be used.

Commonwealth Bank did announce the launch of the BTC trading platform in 2021. However, the plan was later suspended. It was reported in mid-2022 that the bank was awaiting clear regulatory guidelines around Bitcoin and altcoins before taking the plunge. That said, the country’s central bank, the RBA, has not outlawed cryptocurrency trading.

Risks

Many top-ranking banking officials across the world have warned that Bitcoin and altcoins pose many risks to the financial landscape. This is because there is a lack of consensus on the utility of Bitcoin as a currency or as a blockchain platform. Banks in Australia are aware of these risks, which is probably why they do not facilitate trading these speculative assets.

Data provided by CoinMarketCap.com

Bottom line

To some, the word ‘accept’ may mean a deposit of BTC in a bank account. This cannot be done directly, and the holder of BTC must first use the services of any exchange for cryptocurrency to fiat currency conversion. Even though one of the Big Four, Commonwealth Bank, announced a cryptocurrency trading platform in the year 2021, no progress has yet been made.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.