Highlights

- Bitcoin gained last year, but volatility can hit it at any time. It has largely lost in 2022

- Many regulators across the world are not keen on cryptos. However, BTC ETFs have been greenlit

- Wallets containing crypto holding may be hacked, which makes a case for better custody

Investment can be of different types. You may be looking for quick gains, a steady income, or a good corpus at the time of your retirement. From traditional assets like term deposits and 401(k) plans to variable return options like listed stocks and commodities, all options are popular these days. Finding its way into this space is a new asset class -- cryptocurrencies.

Despite the underlying volatility, enthusiasts are picking these either with an eye on quick capital gains or as a HODL (hold on for dear life) asset. If that was not enough, the recent announcement by Fidelity Investments -- about Bitcoin in 401(k) plans -- may now start a debate around cryptos as retirement investment assets.

Here are the points you may want to consider.

1. Price volatility

It is possible that the portfolio manager may present an incomplete picture. For example, Bitcoin surged from nearly US$29,500 to nearly US$47,500 between January 1, 2021, and January 1, 2022. In between, it even touched nearly US$67,500 in early November.

Data provided by CoinMarketCap.com

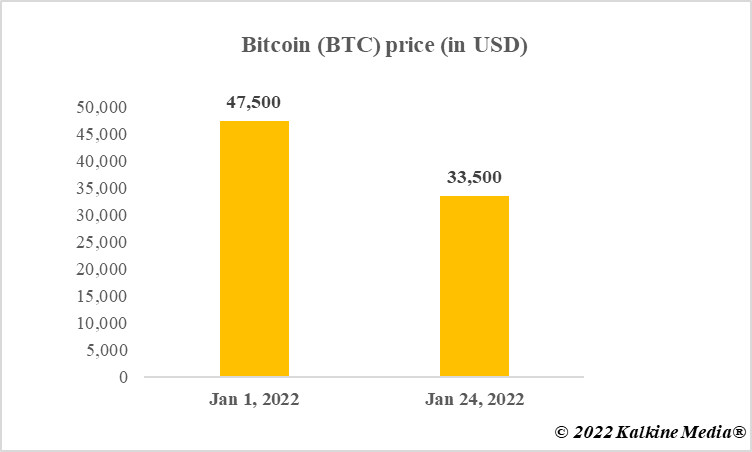

This may appear attractive, but it is also important to take note of volatility and bearish phases. From January 1, 2022, Bitcoin traded mostly in the red, dropping to as low as US$33,500 in late January.

Data provided by CoinMarketCap.com

Retirement investment is a longer horizon thing. A complete picture is hence necessary ahead of making any commitment.

2. Regulatory fears

Crackdowns on cryptos are nothing new. From China outlawing crypto trading and mining to the Ontario province of Canada suspending Binance’s exchange operations, regulatory risks are many.

Also read: What's in Canada Budget 2022 for cryptocurrency enthusiasts?

Besides, the IMF has recently said that countries like Iran and Russia might now start allocating energy resources toward crypto mining to evade sanctions and embargoes. This may in the future lead to some lawmakers in the West doubling down on their criticism of cryptocurrencies. That said, permissions for BTC ETFs in Canada and in the US may indicate a soft stance of authorities.

3. Custody and withdrawal

If everything goes right, one concern may exist, which is losing the holding to hackers. Ronin Network -- which underpins a popular blockchain gaming project Axie Infinity -- recently lost a huge amount in cryptoassets to cybercriminals.

There are also reports about people either forgetting their private keys to access their holdings or wallet holdings attacked by cybercriminals. In a recent incident, an investor reportedly lost some US$650,000 after his MetaMask wallet was accessed by hackers.

Also read: Ronin Network hacking: What is Ronin bridge & its RON token?

Bottom line

Fidelity’s announcement on BTC in 401(k) plan may prompt discussions on cryptoassets as retirement investments. But before that, it is crucial to bear in mind the risks. That said, there is no certainty about what happens to this space in the longer run. Many backers like Jack Dorsey and Michael Saylor are quite bullish on cryptos.

Also read: What is Fidelity’s Bitcoin 401(k) offering? What to keep in mind?

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.