Highlights

- After Celsius and others, CoinFLEX has joined the list of protocols suspending withdrawals

- CoinFLEX promises interest on crypto deposits, as well as on its stablecoin flexUSD

- The DeFi protocol has a native token FLEX, which has lost value in the aftermath of the announcement

Yet another cryptocurrency market participant has suspended withdrawals. This time, it is the CoinFLEX DeFi platform, a provider of crypto lending and borrowing services, to do so.

CoinFLEX joins the popular yield farming service provider Celsius Network and also Binance, which briefly paused Bitcoin withdrawals recently. Separately, a few crypto exchanges in other countries as well, including the CoinDCX exchange in India, have in the recent past halted withdrawal services.

Why has CoinFLEX stopped withdrawals?

A yield aggregator and automated market maker (AMM) service provider, CoinFLEX, has stated in a post that the reason behind suspending the withdrawal service was “extreme market situations”. It has also cited “uncertainty” over a “counterparty” as the cause for triggering this extreme step.

To make things clear, CoinFLEX has also confirmed that it did not refer to 3 Arrows Capital, which is facing a liquidity crisis, as the counterparty.

CoinFLEX’s official website claims to have paid interest amounting to over US$50 million to its users to this day. How these DeFi platforms undertake crypto borrowing and lending is a matter of speculation, but the ongoing crisis indicates some fundamental flaws.

Also read: What future does Celsius Network hold after its suspension?

CoinFLEX crypto

CoinFLEX’s native token is FLEX. CoinMarketCap data suggests the FLEX token has lost value over the past 24 hours. This is in contrast to most major cryptos like Bitcoin which have gained over the same period.

CoinFLEX also has a stablecoin, flexUSD, which it presented as an “interest-earning” stablecoin. TerraUSD’s fall in early May this year indicated that even stablecoins were vulnerable to losing value.

When will CoinFLEX resume services?

The same post that mentions the halt indicates that there is no specific date when the withdrawal service will be resumed. It talks about a “better position” of the DeFi protocol, which can, in the future, resume withdrawals.

Data provided by CoinMarketCap.com

Bottom line

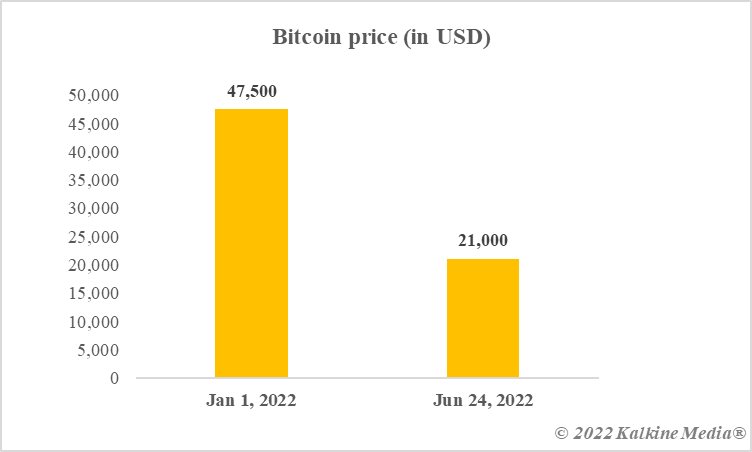

CoinFLEX adds to the pain of the crypto world. The cryptoverse is already reeling under multiple adverse forces, including a huge loss in the market cap of Bitcoin in 2022. Other popular assets that include Dogecoin, Axie Infinity, and Ether, are also deeply in the red. Though assets have rebounded a little of late, the CoinFLEX announcement might bring back some pessimism among its followers.

Also read: Ronaldo plunges into NFT space, inks deal with Binance

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.