Highlights

- Bitcoin was initially not supposed to compete with anything like gold or listed stocks, but to compete with fiat currencies

- The term ‘mining’ in the cryptocurrency verse is not at all comparable to the traditional mining process of gold

- Gold has definite utility in jewellery and as a reserve asset, which has given it the status of ‘safe haven’

What was the purpose of the world’s first cryptocurrency Bitcoin? If one reads the Bitcoin Whitepaper, it appears that Bitcoin was primarily intended to serve as a better alternative to fiat currencies. However, not too long after its launch in 2009, many enthusiasts started comparing Bitcoin with assets like listed stocks and gold. Today, the cryptocurrency can be traded on many platforms, including Binance, which to some extent resembles how the equity market operates.

But can Bitcoin be compared to a tangible item like gold? Some proponents of Bitcoin have gone as far as suggesting that it can even replace gold. For ages, the precious and one of the costliest metals, gold, has drawn the interest of investors. The value of gold has also appreciated over the longer term, which compels many investors to view it as a safe haven. However, can a cryptocurrency like Bitcoin replace gold? Let us explore this subject.

Bitcoin is totally intangible

Gold is a real, tangible commodity found in mines. The metal has use in the industrial process and people worldwide are fond of gold jewellery. Additionally, central banks hold gold as a reserve asset. The Reserve Bank of Australia has tons of gold reserves, and it is recorded as an asset on its balance sheet. The precious metal was earlier used as ‘representative money’, which means that currencies issued by countries could be exchanged for gold. There is a very broad consensus that gold holds real value and that demand for gold exists at all times.

By contrast, Bitcoin is intangible, and its intrinsic value is a subject of debate. Most importantly, Bitcoin isn’t a metal that can be used in industrial processes or to make jewellery. As far as Bitcoin making it to reserve assets held by central banks is concerned, this is only a figment of the imagination right now. Even though, just like gold, the term ‘mining’ has usage in the world of Bitcoin, this has nothing to do with the traditional mining process. Bitcoin mining simply means working on Bitcoin’s blockchain.

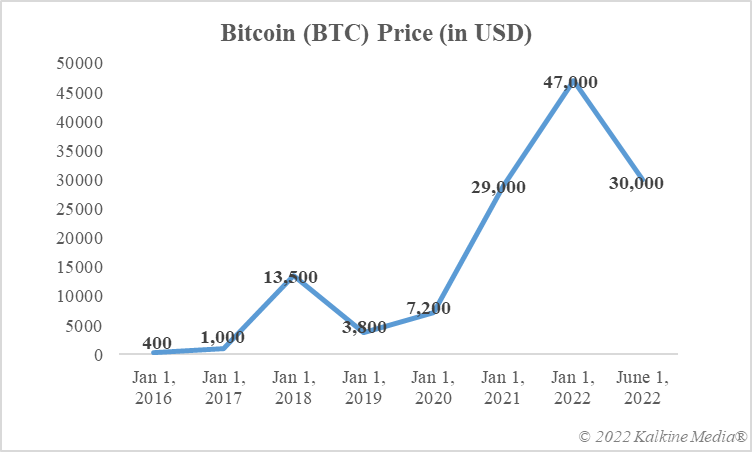

Data provided by CoinMarketCap.com

Far from replacing gold

Gold has real utility, as explained above. Bitcoin, on the other hand, first has to find broader acceptance in the global payments system. Transactions made using the cryptocurrency are said to be relatively quicker and inexpensive. This, proponents claim, makes Bitcoin a better form of money compared with fiat currencies like the US dollar. Gold is a leading store of value in that the broader market considers it a useful asset. Bitcoin has so far not succeeded in demonstrating its ability to be a reliable store of value.

Bottom line

A sharp decline in Bitcoin’s price in 2022 has turned things more difficult for the cryptocurrency. It shares no resemblance with gold in that the latter is a tangible good that people have trusted and used for ages. At present, Bitcoin replacing gold or other assets like stocks seems a far-fetched dream.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.