Highlights

- The crypto market is in a freefall with only a few weeks left to go for 2022. Even Bitcoin, the largest cryptocurrency, is on a downward trend.

- On 11th November, Bitcoin achieved a new all-time high of around US$68,500.

- The market is divided on whether Bitcoin will reach US$60,000 before the end of the year.

Is Bitcoin, the "grandfather" of all cryptocurrencies, growing old? Has Bitcoin lost its ability to withstand the storm of unforeseen events?

It's the burning question on everyone's mind right now. Recently, when Omicron fears invaded the markets, Bitcoin was unable to remain unfazed and the crypto suffered a dramatic fall over the last weekend.

Will Bitcoin make a comeback by the year 2021? Right now, it's a million-dollar question. This question generates a diverse range of responses and viewpoints.

Recent Article: Meet Australia's technology multi-millionaires under the age of 40

Let's dive to see if Bitcoin can recover from its severe decline by the end of the year.

How is Bitcoin performing?

The crypto market is in a freefall with only a few weeks until the end of the year. Even Bitcoin, the largest cryptocurrency, is on a downward trend.

Can Bitcoin bounce back to US$60,000 by end of 2021?

On 11th November, Bitcoin achieved a new all-time high of around US$68,500. Following that, Bitcoin plummeted, affecting the crypto market. As of 6 December, Bitcoin was trading at US$48,096.28.

Recent Article: Meet the tech titans creating metaverse experience for you

What hampered Bitcoin's bull run?

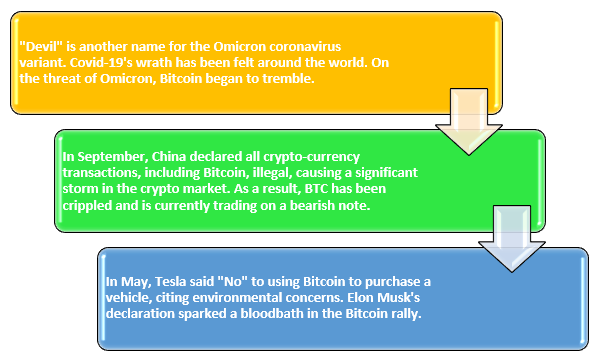

Bitcoin has lost 20.4% in the last 30 days. However, in last one year, BTC has gained 151.4%, which is very low compared to other young cryptos. The factors listed below may have caused mayhem on Bitcoin.

Copyright © 2021 Kalkine Media

Recent Article: 5 tips for crypto investment rookies

According to industry analysts, Bitcoin's price could collapse even further if it fails to regain US$60,000 quickly.

Recent Article: 6 tips to maximise your crypto portfolio return

Last thoughts

As the new year approaches, investors are becoming more and more interested in the performance of the crypto market. However, the market is divided on whether Bitcoin will reach US$60,000 before the end of the year.

Bitcoin entered a bear market in late November. As we all know, anything can happen anytime in the crypto realm, so we should hold off on making any specific statements about Bitcoin's price movement until the right time comes. For the time being, investors can only hope for the best.

Recent Article: Times Studio blends cartoons and the crypto world for kids