Highlights

- Bill Gates has commented on both cryptos and NFTs, but this has not impacted Bitcoin’s price

- Finding another ‘fool’ to purchase goods at a higher price is what the greater fool theory is all about

- The total market cap of cryptocurrencies, which once touched US$3 trillion, is now below US$1 trillion

Cryptocurrencies might be passing through an intensely dull phase, but this sector does not fail to create headlines. One reason is regular commentary from some of the richest people in the world.

The latest addition to this is Bill Gates commenting that cryptos are “based on greater fool theory”. Not only cryptos, the co-founder of tech giant Microsoft also blasted non-fungible tokens (NFTs). He used the TechCrunch conference to voice his concerns regarding cryptoassets. What is the greater fool theory? Is the tech billionaire justified in saying that cryptos are based on this? Let us explore.

What is greater fool theory?

When a party purchases something, with only one objective of selling it to some other party at a higher price, that other party is a ‘greater fool’ in this theory. More often than not, the transaction can go on for a very long time, with multiple parties becoming buyers and then sellers. The entire scene comes to a halt when the last ‘fool’ fails to locate another ‘greater fool’.

Let us understand the greater fool theory using an example. Suppose, A believes that the price of a particular thing can surge in the near to long term. Even though the price that A is willing to pay is more than the intrinsic value of that thing, A is motivated by the anticipated price appreciation. A acquires the thing. Then, B is ready to pay A the appreciated price and become a fool greater than A. C might then purchase it from B, and so on.

The greater fool theory is usually linked to something the intrinsic value of which is lesser than the price. The theory can exist in any market. Even tulips were sold for exaggerated prices in the 17th century, for the bubble to ultimately burst when no greater fool could be found.

Also read: Bitcoin at $30,000: What does 5-year historical price data indicate?

Are cryptos based on greater fool theory?

It is being said by many economists that cryptocurrencies have no intrinsic value. Warren Buffett does not favour Bitcoin and so do many other billionaires. Jack Dorsey, however, feels that Bitcoin could be some day the “native currency” of the internet. Critics have contrasting views, and this remains a wait-and-watch game, with little clarity as of now.

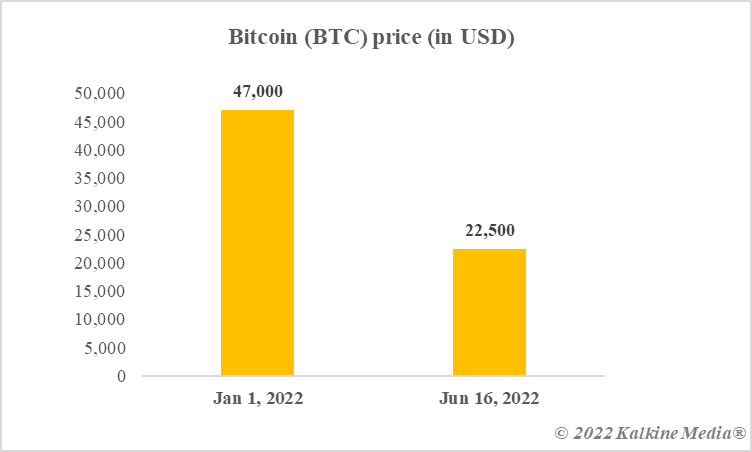

Bitcoin price

Bitcoin (BTC) was priced at nearly US$47,000 at the beginning of this year. As of writing, BTC is trading at over US$22,500, having gained over 3% in the past 24 hours. Bill Gates’ comment does not seem to have created any downward pressure on BTC’s price.

Data provided by CoinMarketCap.com

Viewpoint

Gates is not the only billionaire to criticise cryptos, which are on a downward slide this year. Only time can tell whether these assets are based on the greater fool theory or if they truly hold the intrinsic value that justifies their prices.

Also read: 3 reasons why cryptos could be crashing

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.