Highlights

- The total market cap of cryptocurrencies has now crashed to under US$950 billion

- September is viewed as a bad month for the global stock market, which is also in the red at the moment

- Inflation is forcing central banks to suck money from the economy by raising the interest rate

The crypto market is substantially down at the moment, and both Bitcoin (BTC) and Ether (ETH) have lost at least 6% over the past day. Other major assets like BNB, XRP, DOGE, and SHIB are also trading at losses.

Why is crypto down today? Is it just the crypto market that is in the red, or is the global stock market also subdued? Is September, a month notorious for causing losses in stocks, to blame for the ongoing downturn in cryptocurrencies? The once-US$3 trillion-strong cryptoverse is now not even a US$1-trillion market cap space. Let us quickly explore two of the probable causes that are ailing the cryptoverse at the moment.

1. Stress in global stock market

From the US to Australia, stocks have been under intense pressure since the beginning of this month. On Tuesday, NASDAQ fell for the seventh consecutive trading session. This is the tech-heavy index’s longest downward streak in almost six years. The ASX 200 benchmark index of Australia has also been in the red ever since September began.

The stress in the stock market is largely due to rising interest rates and fears of a sharp economic downturn in the near term. From the Fed to the Reserve Bank of Australia, most central banks have adopted a deeply hawkish approach in the wake of record-high inflation. To tackle the price rise, banks have raised rates on multiple occasions this year. It is possible that these hikes are triggering fear in the crypto market as well.

2. September Effect

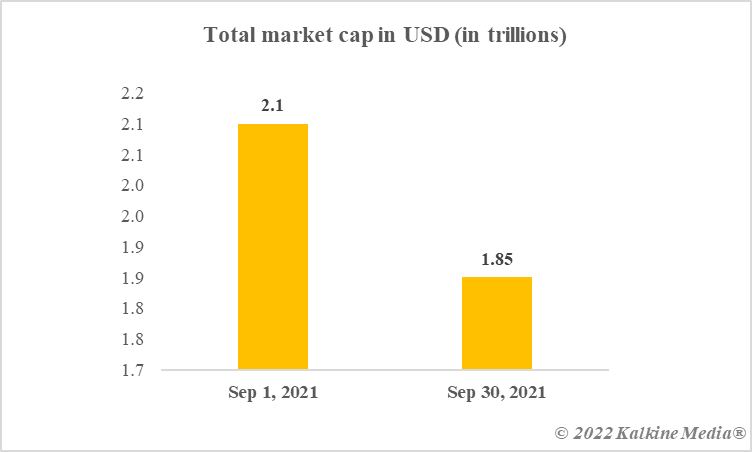

There is enough data to suggest that the global stock market has a historically tense relationship with the month of September. Last year, even cryptos suffered losses during this month. Notably, 2021 was overall a good year for both Bitcoin and altcoins like AXS and SHIB, however, September was an outlier.

Even though the ongoing trouble in the crypto market cannot be attributed to the September Effect alone, the sharp slide could not be just a co-incidence. The total market cap of cryptos has come crashing down below US$950 billion at the moment.

Data provided by CoinMarketCap.com

Bottom line

There could be a slew of factors like lack of interest of new investors, profit booking, concerns around utility, capitulation, and so on, behind the sharp fall in cryptos of late. The two reasons explained above might also be shaping sentiments of crypto enthusiasts.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.