Silver spot prices witnessed a large gap-up opening during the trading session today. The performance can be attributed to the transformation observed in the recent weeks on how retail investors could use the collective capital to play big games in the market.

The movement that began on Reddit’s WallStreetBets has now turned its attention towards the commodity space after fuelling massive gains for GameStop Corp (NYSE:GME) and AMC Entertainment Holdings Inc (NYSE:AMC).

Silver spot prices have witnessed a large influx of money over the past few trading sessions. Consequently, the commodity price spiked ~ 15.35 per cent from USD 24.860 (intraday low on 28 January 2021) to the present high of USD 28.678 (as on 1 February 2021 12:42 PM AEDT).

Interestingly, the massive gain in silver prices was triggered by a recent post by a Reddit user, who suggested executing a short squeeze on the commodity. This has resulted in many large funds taking reverse positions to encash their past longs.

To Know More, Do Read: Silver Outperforms Gold with Over 30% Return; Money Managers Betting on Silver!!

Additionally, silver miners’ shares spiked across global exchanges. iShares Silver Trust ETFs, the largest silver ETF fund, also experienced a frenzy of options buying.

Also Read: Silver Spot Price and Sentiment Data Diverges, What Does it Mean for the Precious Metal?

Though the commodity along with many silver-backed global ETFs and silver stocks have witnessed a spike in prices, industry experts believe that silver is unlikely to maintain these gains. They opine that the price of this commodity would be mainly dictated by the industrial trend, while prices in the underlying products used to gain exposure in the commodity would follow suit.

The sudden and massive increase in silver prices has propelled many ASX-listed silver stocks, adding to their recent strong performance.

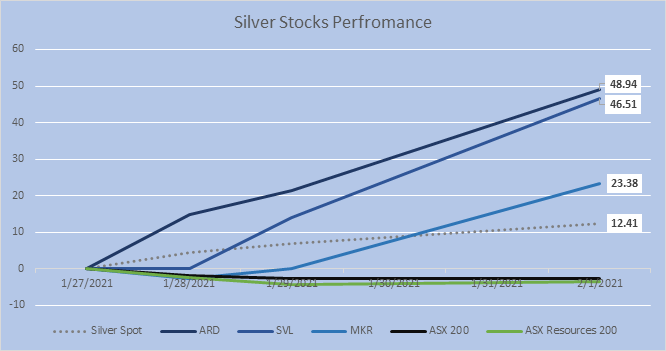

Over the last five days, silver miners on the ASX have outperformed ASX 200 Index and the ASX 200 Resources benchmark while delivering superior returns over the long-term.

ASX Silver Stocks Last 5 Days Total Returns (Data Source: Refinitiv Eikon Thomson Reuters)

While the overall stock market and the resource sector have been pretty shallow over the past 5 days with a total return of -2.55 per cent and -3.43 per cent, respectively, silver stocks have delivered some strong returns, thanks to the short squeeze instigated by retail investors.

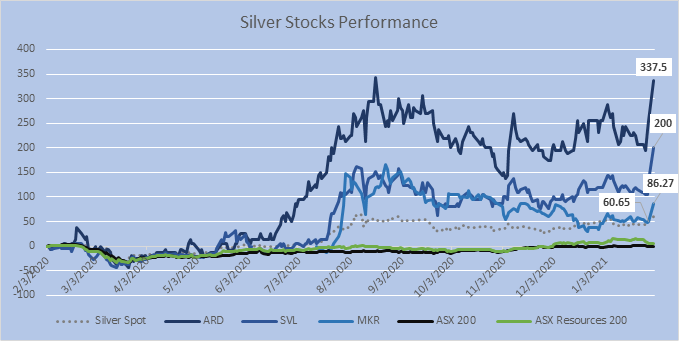

ASX Silver Stocks Past One-Year Total Returns (Data Source: Refinitiv Eikon Thomson Reuters)

The increase in silver prices has now further contributed to the long-term performance of many ASX-listed silver stocks, which rallied in the recent past over a sharp gain in silver spot prices.

Over the last one-year, many ASX-listed silver stocks have outperformed the return delivered by the spot and returns delivered by benchmark indices.

To Know More, Do Read: Silver Mining Stocks Beating Gold Top Guns – Adriatic PLC, Aeon Metals, and Silver Mines Turn Multibaggers