Summary

- The benchmark index S&P/ASX 200 gauges the performance of the top 200 index-eligible stocks on the ASX as per float-adjusted market cap.

- ASX 200 is dominated by the top ten players, five of whom are from the financial sector.

- The index comprises 11 sectors, 24 Industry Groups, 68 industries and 157 sub-industries.

The S&P/ASX 200 is the benchmark index intended to gauge the performance of the top 200 leading index-eligible stocks on the ASX as per float-adjusted market cap. The index was introduced in 2000 and is rebalanced each quarter so that the constituents meet the eligibility criteria.

ASX200 is heavily dominated by the top ten players that account for more than 45% of the index. Within the top ten, five are from the financial sector, two from materials, and one each from consumer discretionary, consumer staples, and the healthcare sector.

Source: © Ymgerman | Megapixl.com

Top 10 stocks on ASX 200

- Commonwealth Bank of Australia (ASX:CBA)

- BHP Group Limited (ASX:BHP)

- CSL Group (ASX:CSL)

- Westpac Banking Corp (ASX:WBC)

- National Australia Bank (ASX:NAB)

- ANZ Banking Group (ASX:ANZ)

- Wesfarmers Ltd (ASX:WES)

- Macquarie Group Limited (ASX:MQG)

- Woolworths Group Limited (ASX:WOW)

- Rio Tinto (ASX:RIO)

ASX 200 Journey

ASX 200 was launched in 2000 and has completed two decades in the Australian market. The ASX launched ASX SPI 200™ Index Futures and Options.

In 2021, Global Industry Classification Standard (GICS) was introduced for the Australian market. In the same year, SSgA launched ETFs that was designed to track S&P/ASX 200 and S&P/ASX 50.

In 2010, S&P Dow Jones Indices launched the S&P/ASX Dividend Opportunities Index and S&P/ASX 200 VIX Index. In 2020, S&P/ASX All Tech index was launched.

Significance of ASX 200 index

The logic behind applying the float-adjusted market cap is to have a benchmark index that can be traded and is appropriate for usage as a benchmark by prominent institutional asset managers.

A Peek into the Index Family

The S&P/ASX family of indices were introduced to measure the performance of ASX-listed businesses of varying sizes, industries, themes, and plans. Below is the list of the index family:

- S&P/ASX 20: This index gauges the performance of 20 actively traded & highly liquid securities. These securities are the largest on the ASX by float-adjusted market cap.

- S&P/ASX 50: This index calculates the performance of 50 of the biggest and highly liquid index eligible stocks as per float-adjusted market cap.

- S&P/ASX 100: This index measures the performance of the 100 largest ASX-listed stocks by float-adjusted market cap.

- S&P/ASX 200: This index gauges the performance of 200 of the biggest and highly liquid ASX-listed stocks by float-adjusted market cap.

- S&P/ASX 300: This index calculates the performance of 300 of the biggest, very liquid ASX-listed securities by float-adjusted market cap. The index includes Large Cap, Mid Cap, and Small Cap elements of the ASX index family.

- S&P/ASX MidCap 50: The index gauges the performance of the Midcap element of the ASX 100.

- S&P/ASX Small Ordinaries: This index evaluates the performance of businesses within ASX 300 and not ASX 100.

- S&P/ASX Mid-Small: This index assesses the performance of businesses in ASX 300 and not ASX 50.

- S&P/ASX All Australian 50: This index measures the performance of 50 top companies by float-adjusted market cap. These securities are highly liquid securities classified as domestic or Australian for index reasons.

- S&P/ASX All Australian 200: This index measures the performance of 200 top companies by float-adjusted market cap. These securities are highly liquid securities classified as domestic or Australian for index reasons.

- All Ordinaries: All Ordinaries index calculates the total Australian equity market's performance and comprises the 500 major securities on ASX. These securities have no liquidity screen or at least IWF requirement.

INTERESTING READ: ASX 200 falls: What’s weighing on market on the first trading day of new financial year?

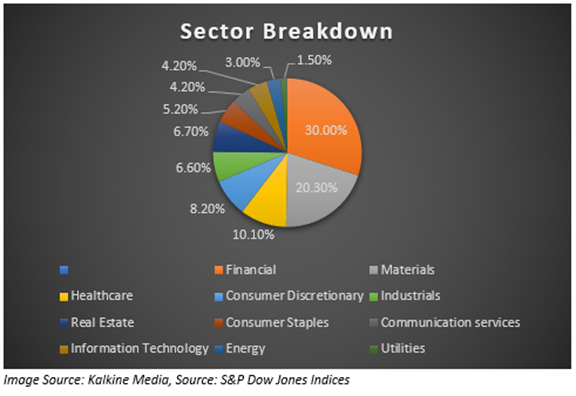

ASX Sector breakdown

The ASX market comprises 11 sectors, 24 Industry Groups, 68 industries and 157 sub-industries. The companies are categorised based on their business activity as per GICS standards. The 11 sectors have respective benchmark index that tracks the performance of ASX-listed companies in that particular sector.

Below is the list of 11 ASX sectors:

- Consumer Discretionary

- Consumer staples

- Energy

- Financials

- Health Care

- Industrial

- Real Estate

- Information Technology

- Materials

- Communication Services

- Utilities

S&P/ASX 200 Performance

S&P/ASX 200 witnessed a growth of 20.75% in the last year and YTD growth of 11.05%. On 05 July 2021, the index last traded at 7314.95, up by 0.088% from its last close.

ALSO WATCH: The Market Movers || How Is ASX 200 Positioned At EOFY Amid Virus Woes?