Highlights

- Altech has selected a preferred European bank for debt financing.

- Equity strategy is underway with several NDAs signed and draft term sheets shared.

- The company has secured three key offtake LOIs for 100% of CERENERGY® production capacity.

- Grant applications have been submitted at the state, federal, and EU levels for clean energy support.

Altech Batteries Limited (ASX:ATC, FRA:A3Y) has provided an update on financing progress for its CERENERGY® sodium-chloride solid-state battery project, located in Saxony, Germany. The company had engaged ten commercial banks and two venture debt funds in its first financing round, receiving positive initial responses.

Based on these discussions, Altech has identified a European bank with a track record in the technology and innovation sector financing. Although the formal mandate is pending, both parties are engaged in detailed due diligence, with technical teams assessing the project's commercial viability and risk profile. Recent site visits to Dresden and the Fraunhofer testing facilities have been conducted, and a visit to Hermsdorf, where the prototype line is located, is planned in the coming weeks.

In parallel, Altech is progressing efforts to secure a federal government guarantee, which would reduce project risk and bolster the bank’s confidence. Officials from Germany's Ministry of Finance have been briefed, and due diligence for the guarantee is underway.

Equity Strategy Targets Strategic and Industrial Investors

Alongside debt discussions, Altech is actively pursuing equity funding. The company has engaged equity advisers and plans to divest a minority interest in the CERENERGY® project to one or two strategic investors.

Targeted partners include:

- Utility companies and data center operators focused on energy transition

- Investment funds and corporations committed to sustainability

- Industrial groups with capabilities in battery production or distribution

Several Non-Disclosure Agreements (NDAs) have been signed, enabling deeper engagement. Draft term sheets have been distributed, outlining key investment terms.

The partial divestment aims to attract not only capital but strategic support aligned with long-term project growth and sustainability.

Grant Applications Tapping into Clean Energy Incentives

Altech is also actively applying for government grants at various levels:

- State grants from Saxony and Brandenburg

- Federal grants from Germany’s clean energy programs

- EU funding focused on energy transformation and innovation

These grants are intended to support technology development, employment, and infrastructure upgrades in lignite-transition regions such as Saxony.

Offtake Agreements Secure 100% of CERENERGY® Capacity

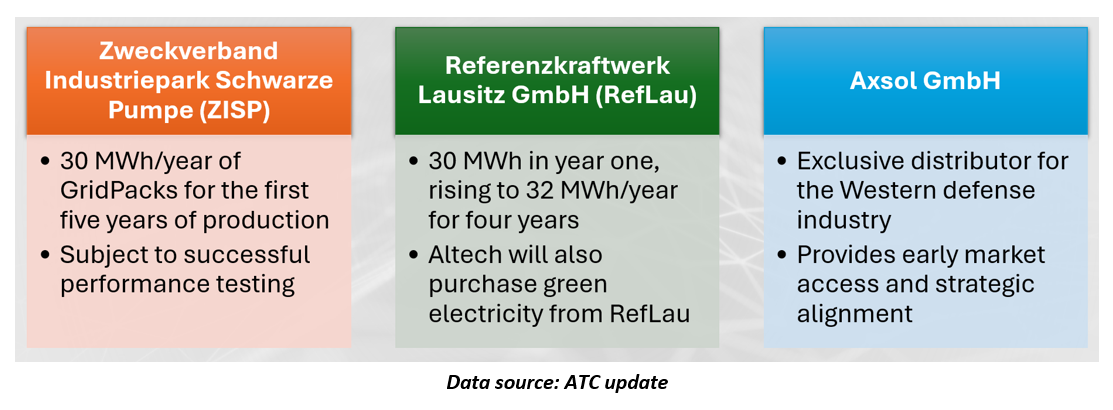

Three Letters of Intent (LOIs) have been signed, securing offtake commitments for the project’s entire production capacity:

These LOIs are instrumental in de-risking the project and facilitating further financing, as stated by Altech.

With progress on debt, equity, grant, and offtake fronts, Altech is steadily advancing toward full-scale development of its CERENERGY® battery facility. The company states that the upcoming months will focus on converting discussions into formal commitments critical for the project's next phase.

Share of ATC was trading at AUD 0.036, up 5.88%, at the time of writing on 23 July 2025.