Highlights

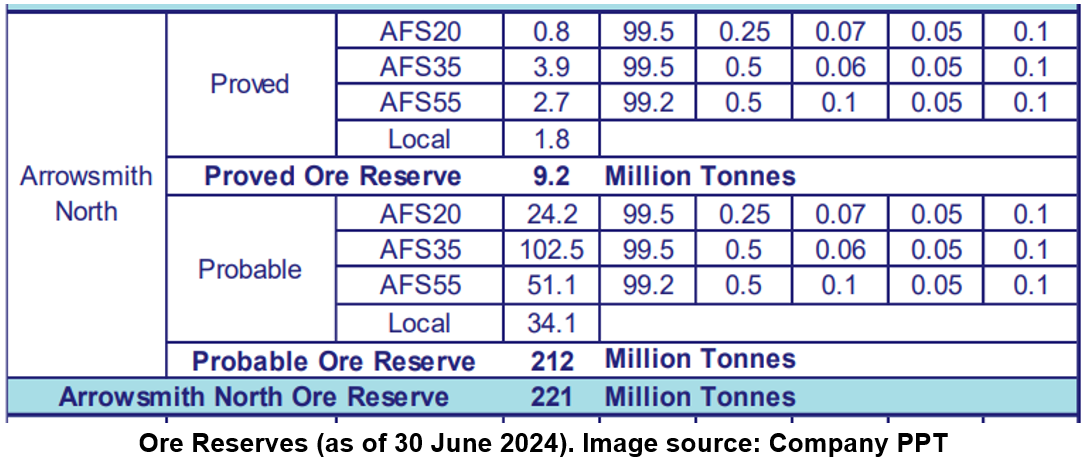

- Arrowsmith North holds a 221Mt JORC Reserve grading 99.5% SiO₂, with a potential 100-year mine life, targeting markets such as glassmaking, solar panels, and precision casting.

- The Updated Bankable Feasibility Study for Arrowsmith North reports NPV10 of AUD 167 million with over 25 years.

- The WA Environment Minister has cleared the EPA assessment as adequate, and Final Ministerial approval for Arrowsmith North is pending.

- Muchea Project silica grades exceed 99.9% SiO₂ with <100ppm Fe₂O₃ – ideal for advanced glass and tech applications.

- VRX shares were trading 7.23% higher at AUD 0.089 per share on 21 July 2025.

VRX Silica Limited (ASX:VRX), an ASX-listed pure-play silica sand company, is rapidly progressing its 100%-owned Arrowsmith Project in Western Australia. Comprising the Arrowsmith North, Brand, and Central deposits, the company is strategically positioning the project to meet growing demand for high-purity silica, critical in high-tech applications such as glassmaking, solar panels, and 3D printing.

Silica sand is an essential raw material for producing glass used in construction, electronics, and automotive industries. With the Asia-Pacific region facing a sharp supply shortfall and escalating prices, the company expects its Arrowsmith North project to serve as a key future supply source. The deposit holds a JORC Reserve of 221Mt grading at 99.5% SiO₂, with a projected mine life of 100 years.

Demand from Automotive and Glass Sectors Markets in Asia

VRX is targeting the high-demand foundry sand market, used in precision casting for the automotive, transportation, aerospace, and rail industries. The company referring to data from the Freedonia estimates highlights that Asian glass production is growing at 5–6% annually, requiring 130+ million tonnes of silica each year for float and container glass manufacturing. Notably, VRX’s Arrowsmith North product meets the stringent 99.5%+ SiO₂ purity specifications necessary for these high-end applications.

Progress Toward Production at Arrowsmith North

VRX has made significant progress in advancing Arrowsmith North toward production, focusing on securing the final environmental and mining approvals. Production is targeted to begin 8–12 months following final environmental approvals, financing, and the final investment decision (FID).

In March 2024, the company released an updated an updated Bankable Feasibility Study (BFS) outlining an ungeared NPV10 of AUD 167 million over a 25-year mine life. The project is expected to produce four high-value products catering to international glass and foundry markets.

Environmental Milestone Reached

In late June 2025, VRX achieved a key milestone in advancing its project, with the Western Australian Minister for Environment concluding that the EPA's assessment process was both adequate and aligned with the current policy framework. The Minister further confirmed that the proposal can proceed without requiring additional environmental assessment. VRX is now awaiting formal Ministerial notification regarding its application for final development approval, bringing the company a step closer to commencing operations at this high-purity silica sand project.

Next in Line: Muchea Project Adds Expansion Potential

Following Arrowsmith, VRX plans to bring its Muchea project online. The project has been granted mining lease and miscellaneous licences for access. Metallurgical testing has confirmed Muchea’s ultra-high purity silica, with results exceeding 99.9% SiO₂ and iron content less than 100ppm Fe₂O₃.

The company believes that Muchea has the potential to supply raw materials for premium ultra-clear cover glass used in solar panels and support local solar panel production within Western Australia. Additionally, the project has the potential to produce high-grade silica flour for use in LCD manufacturing and other precision technologies.

VRX has also secured a grant from the Western Australian Innovation Attraction Fund (IAF) to explore silica flour production. A 1-tonne sample has already been successfully tested by a specialised laboratory in Germany, and further samples have been sent to interested potential buyers. The company has received significant market interest in these high-spec products.

VRX Silica is steadily advancing its Arrowsmith North Project toward production, with key environmental milestones achieved. With growing demand across Asia for high-purity silica in glass, solar, and tech applications, VRX aims to become a leading supplier in the global critical minerals market.

VRX shares were trading 7.23% higher at AUD 0.089 per share at the time of writing on 21 July 2025.