Summary

- Franking credits refer to the tax rebate offered on franked dividends, that can be availed by shareholders to avoid double taxation.

- In Australia, the Australia Tax Office is tasked with regulating and issuing the franking credits.

- Unfranked dividends do not come with a franking credit as they are not taxed at source, thus, shareholders must pay taxes on unfranked dividends.

Shareholder lingo can be hard to grasp, especially if one is new to the domain of investing. Most investors are familiar with dividends and franked dividends, but what are franking credits? To begin with, dividends are a portion of a company’s earnings that are promised to the shareholders by certain dividend-paying companies.

Since these dividends can be understood as a part of the investor’s income, they should be taxed just like any other income is taxed. However, it is important to note that the dividends have already been taxed once at their source, i.e., when they are received by the company as earnings. If the same earnings are taxed when they are passed to shareholders as dividends, then it would lead to double taxation.

Consequently, the concept of franking credits was developed to use as a tax credit to compensate for double taxation. These credits are given by the Australian government when the shareholders are due to pay their taxes. The tax credit is also referred to as an imputation credit.

How do franking credits work?

In Australia, the Australian Tax Office (ATO) oversees handing out franking credits. These credits ensure that the tax burden des not fall on shareholders who are already receiving the dividend amount after tax cuts.

These credits are handed out in proportion to the individual tax rate and are inversely related to them. For instance, an individual with 0% tax rate would receive full tax payment as franking credits, and inversely if the tax rate is high, lesser amount of franking credits would be issued. This makes franking credits attractive for those investors who fall in the lower tax bracket.

Post 2001, certain changes were introduced by the Howard Government for self-managed super funds and individuals. If the franking credits on an investment are more than the amount of tax, they owe then the government would write them a cheque for the difference in both amounts. This was a big leap as prior to this law, any excess credits were worthless.

A working example

Shareholders are required to include the dividend and the franking credits while filing their income tax return. A tax credit if offered for the value of the franking credit to offset against other income.

Now, consider the company tax rate is 20%, and a shareholder has the same personal tax rate of 20%. In this case, the dividends would be tax free as the franking credits would compensate for the 20% tax already paid on the earnings.

However, consider the case when the shareholder’s personal tax rate is 30%. In this case, the investor must pay 30-20 = 10% additional tax over the company’s taxation amount. Conversely, if the shareholder’s personal tax rate was 15%, lower than the company’s tax rate, then the investor would receive a refund on the additional tax paid by him.

Are franking credits considered as income?

While filing income tax, dividend payments and franking credits both are recorded as a part of income. Franking credits are as good as cash. This is so because, they can be reimbursed to pay the tax on dividends or, if the tax rate is lower, then they can even be converted to cash. Thus, they are listed as income in the shareholder’s personal records. Together, dividend payments and franking credits are known as grossed up dividend.

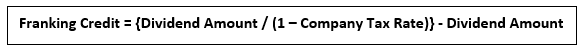

How are franking credits calculated?

Franking credits can be calculated with the help of a simple formula, which is given as:

Consider a shareholder receiving a dividend of AU$20 from Company A, and the company must pay a tax rate of 10%. Thus, in such a case, full franking credit would be approximately AU$2.22.

Now suppose that the investor is only entitled to a 50% franking credit. Thus, the franking credit received by him would be only AU$1.11.

Why are franking credits important?

Through franking credits many shareholders can bring in thousands of dollars as tax refund. This amount becomes especially pronounced when the personal tax of shareholders is very low. The salient feature of franking credits attracts more investors, making them feel they are receiving more for the amount they are investing.

Franking dividends also provide an edge over unfranked dividend. These are the dividends which are not paid from the company’s profits, and are thus, not taxed at the source. Thus, the income received by investors in the form of dividends is taxed, without any franking dividends being issued for the same. Investors must thoroughly check their investments and then file the taxes, as applicable.