Summary

- Dividend forms a part of a Company’s profit that it provides to its shareholders during a specific financial period.

- The dividend amount provided to the shareholders is decided by the Company’s Board of Directors and requires shareholders’ consent.

- Companies pay dividends in different forms, including cash, stock, property, and scrip. They also pay dividends during partial or full liquidation.

- Dividend income is taxable and relies on whether the dividends are qualified or non-qualified.

Dividend stocks are those businesses that provide regular dividends to their shareholders. The companies offering dividend are generally well established and have a track record of distributing earnings to their shareholders. A dividend refers to the reward paid by a Company to its shareholders in cash or other forms. The dividend amount is finalized by a Company’s board of directors and requires the shareholders’ consent.

Dividends are a part of an organization’s profit that it provides to its shareholders for a specific financial period. After paying the creditors, the Company can use a part or overall earnings as dividends. However, paying dividends is not mandatory for a Company, and it may choose to pay them, especially when looking to invest for future expansion.

GOOD READ: Why do investors look for dividend stocks?

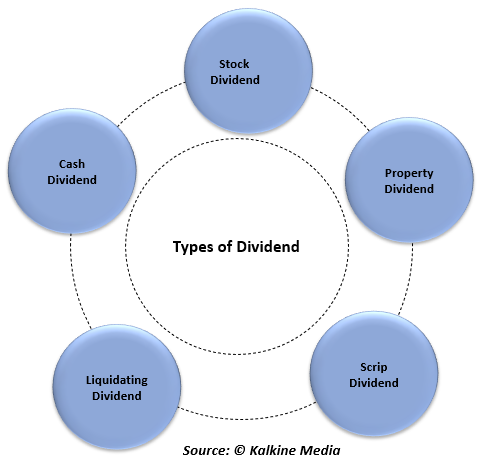

Types of dividends

The Companies provide dividends to improve an investor’s faith. It also indicates the position of the Company and its optimism towards future earnings.

Dividends can be offered in various forms. Different types of dividends include cash dividend, stock dividend, scrip dividend, property dividend, and liquidating dividend. The Company also decides the frequency at which it would provide a dividend.

Cash Dividend

A cash dividend is the most common and popular form where the Company provides dividend in the form of cash.

Stock Dividend

A stock dividend refers to the dividend paid by issuing a Company’s shares to its shareholders without any consideration. In simple words, a stock dividend is the payment of dividend in the form of company shares.

Property dividend

Property dividend is a form of payment where shareholders receive property from a Company instead of cash or cash equivalent. It is a non-monetary form of dividend. Property dividends include either the shares of a subsidiary company or any physical asset like inventories, real estate, or equipment.

Scrip dividend

In scrip dividend, the Company gives its investor an option to receive additional shares instead of cash. These dividends are exempted from stamp duty and dealing charges. Also, in this case, the Company can keep the cash within the business. Also, the investors can get tax benefits in case the capital gains by selling the scrip dividend in the market drops below the annual tax-free allowance for capital gains.

Liquidating Dividend

Liquidating dividends are payments by a Company during partial or full liquidation.

Why do companies opt to pay dividends?

Companies pay dividends from their earnings as an appreciation for their shareholders who provide the capital by investing in them. Shareholders also receive a dividend when a Company does not see a better opportunity to reinvest.

What’s in it for the investors?

Below are some of the reasons why dividends are of significance for investors:

- Dividend tells the financial health of the Company. Even if the Company is experiencing financial distress and still continues to pay dividends, it has positive prospects and outlook.

- Dividend attracts investors as many investors prefer a regular stream of income from the dividend payment.

- They also provide a tax advantage.

- Dividend also helps investors aiming to build wealth irrespective of the current level of the wealth. When an investor earns dividend, he/she can use those dividends to purchase more shares of the Company. These additional shares would further support in earning dividends too.

INTERESTING READ: Can you live off dividend stock?

Dividend vs buyback

Dividend and buybacks are two ways by which Companies reward their shareholders when there are excess funds.

Dividend, as highlighted above, is the sum paid to the shareholders from a Company’s earnings. On the other hand, buyback of shares is a corporate action in which a company buys back its shares from the shareholders and offers a price slightly above the market price. Reasons companies go for buybacks include company consolidation, equity value increase, and financial attractiveness to investors.

Choosing dividends over a buyback or vice versa depends on an investor’s preference, whether he/she is looking for regular income or long-term gains.

How are dividends taxed?

Dividend income is taxable and relies on whether the dividends are qualified or non-qualified. A qualified dividend is taxed at a lower long-term capital gain rate instead of at an increased tax rate used on an individual's regular income. On the other hand, non-qualified dividends are taxed at the regular rate.

_07_26_2025_04_17_35_745741.jpg)