Summary

- E-commerce is not expected to slow down anytime soon amid the work-from-home environment triggered by the pandemic.

- Several ecommerce firms are generating a storm in Canadian stock markets, leading to a tech rally.

- Apart from Shopify, Lightspeed POS and Cargojet are two ecommerce companies that investors have been eyeing this year.

- As the pandemic rages on, e-commerce is likely to benefit from emerging long-term trends in both B2C and B2B segments.

Shopify (TSX: SHOP), Canada’s answer to Amazon, is in the midst of a red-hot rally, its shares surging over 167 per cent this year. The e-commerce giant became Canada's most valuable public company as investors binged on its stock amid pandemic conditions. But this online platform isn’t the only one creating a storm in Canadian markets. There’s Lightspeed POS and Cargojet – both turning out to be investors’ favorites.

More and more e-commerce companies are participating in the TSX’s searing tech rally. The tech index has surged 45.34 per cent this year, in sharp contrast to the broader TSX index that declined by almost two per cent during the same time.

E-commerce is not expected to slow down anytime soon. Statista data shows, the retail e-commerce market?will touch over US$ 33 billion by 2024. While we ponder over this, let’s look at the stocks of Lightspeed POS and Cargojet.

READ: This TSX firm that turned into a legend during the pandemic

Lightspeed POS (TSX:LSPD)

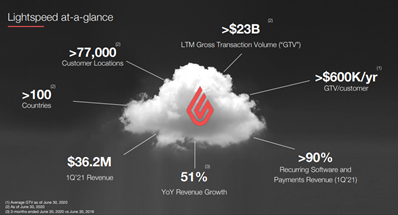

Lightspeed offers cloud-based solutions to small and medium enterprises. It’s point-of-sale (POS) software has been adopted by multiple retailers and restaurateurs. It has 77,000 customers spread across 100 countries, helping develop the e-commerce wing of businesses. It also has a payment processing solution – Lightspeed Payments, which is integrated with its platform.

In 2019, Lightspeed created history with its C$ 240-million initial offering – the biggest technology IPO in Canada at the time. Since then, the shares have yielded 118 per cent returns.

This year, shares of this omni-channel ecommerce solutions company have surged 24 per cent. Lightspeed stocks have yielded 40 per cent returns quarter-to-date (QTD) and 31 per cent month-to-date (MTD).

The global cloud services market is estimated to touch US$ 354.6 billion by 2022, with SaaS (software as a service) platforms accounting for US$ 151.1 billion of the figure, says research firm Gartner. Another research by AMI Partners claims, nearly 226 million small and medium size businesses (SMBs) across the world generated an US$ 59 trillion revenue in 2018 alone.

READ: BlackBerry & Absolute Software - Two Tech Stocks With Cybersecurity Exposure

With such encouraging market figures, investors’ have turned bullish on the Montréal-based e-commerce company.

Lightspeed’s global penetration is also on the rise. Currently, over one third of the company’s revenue originates in nations outside North America. The company also recently launched Lightspeed Capital that provides financing of up to US$ 50,000 per retail location.

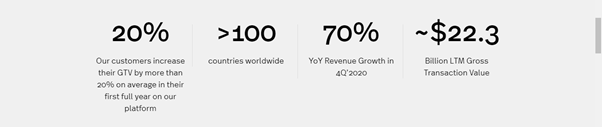

Lightspeed POS: Key Stats At A Glance

(Source: Lightspeed)

Lightspeed earned US$ 36.2 million revenue in the company’s first fiscal quarter 2021, up 51 per cent year-over-year. Gross profit in the same period surged to US$ 21.6 million, up from US$ 15.5 million a year ago. Its revenues are generated from recurring subscriptions and recurring payments.

(Source: Lightspeed POS)

In August, the company announced its eCom venture for restaurants that helps Lightspeed Restaurant users shift their businesses online and adapt to new revenue streams for long-term growth.

The company is currently valued at C$ 3.6 billion and has price-to-book (P/B) ratio of 9.51. The stocks are currently trading at C$ 46.

READ: 15 Hot Tech Stocks To Invest Before Summer Ends

Cargojet (TSX:CJT)

Shares of air cargo company Cargojet have gained with the surge of tech stocks amid pandemic, as people chose to stay indoors and turn to online shopping. Cargojet stocks have surged over 70 per cent this year. The stocks yielded 34 per cent returns in QTD and 10 per cent returns MTD. The scrips are currently trading at C$ 176.24.

Cargojet emerged at Canada’s top cargo airline in less than two decades and currently employs 1,100 people. It generates C$ 500 million in revenues.

Demand for the carriers’ services grew overnight as pandemic hit economies across the world. The e-commerce and health care volumes of Cargojet grew exponentially in this time.

Cargojet has 54 international alliances with the world’s leading carriers. It serves three market segments: domestic network, ACMI (Aircraft, Crew, Maintenance and Insurance) scheduled routes and “All-in Charter” adhoc businesses.

The company’s revenue for the second quarter stood at C$ 196.1 million, up from C$ 119.1 million from same quarter last year. The gains were driven from the rise in e-commerce channels. The gross margin for the quarter was C$ 90.7 million, up from C$ 26.6 million last year. It announced quarterly dividends of C$ 0.23.

Cargojet’s current market capitalization is C$ 2.748 billion and P/B ratio is 12.36. Its current dividend yield is 0.53 per cent, while three-year dividend growth stands at 7.55 and five-year dividend growth is 10.20.

As the pandemic rages on, Cargojet is likely to benefit from emerging long-term trends in both B2C and B2B e-commerce segments.