Summary

- Stocks of leading American companies Apple Inc (NASDAQ:AAPL), AMD (NASDAQ:AMD) and Tesla (NASDAQ:TSLA) have performed well amid the COVID-19 crisis.

- Tesla’s stocks saw a recent surge in value following ‘Battery Day’ event and news of its rival car maker Nikola under scanner for fraud.

- AMD is set to launch its new product Zen 3 CPU by this year-end, which analysts believe has the potential to impact its stock performance.

- Apple is one of the largest companies in the world in terms of market capitalization.

The coronavirus pandemic has not been able to rob some high-quality stocks of their glory. Top American tech companies like Apple Inc (NASDAQ: AAPL or AAPL: US), Tesla Inc (NASDAQ: TSLA or TSLA: US) and Advanced Micro Devices (NASDAQ: AMD or AMD:US) have weathered the March market crash, coming out stronger. After experiencing massive stock market highs this year, the September tech sell-off disrupted the growth of Apple and AMD stocks. Shares of electric car company Tesla, which also surged this year, is currently witnessing a rise following the announcement of its ‘Battery Day’ event. We look into the recent performance of these stocks in detail in this article.

Advanced Micro Devices Inc (NASDAQ: AMD or AMD:US)

Current AMD Stock Price: C$ 78.93

Stocks of Advanced Micro Devices (AMD) have a track record of performing well. In the last five years, its scrips have soared about 3,700 per cent in value. The coronavirus-triggered market crash saw its share value dip around mid-March, falling to C$ 38.71 on March 17, but recovering quickly. In the last six months, AMD stock price rose by over 77 per cent.

Based in California, AMD manufactures processors and other electronic products for computers. After releasing its Zen 2 processors in July last year, AMD is now looking forward to the launch of Zen 3 CPUs by this year-end. Market analysts opine that this future launch could also benefit AMD stocks.

AMD’s success reflects in its financial results for the second quarter of 2020. The company posted revenue of US$ 1.93 billion in Q2 2020, up 26 per cent year-over-year (YoY). It also registered an operating income of US$ 173 million, net income of US$ 157 million and diluted earnings per share (EPS) of US$ 0.13. Its gross margin, posted at 44 per cent in Q2 2020, was up three per cent as compared to Q2 2019.

The US$ 92.6-billion market cap company expects a 42 per cent YoY increase in its revenue in the third quarter of 2020, chiefly driven by the sales of its Ryzen and EPYC processors.

At the moment, AMD has a price-to-book (P/B) ratio of 27.99 and a price-to-cash flow (P/CF) ratio of 107.80. In the last 10 days, it has seen an average share trading volume of 59.6 million.

Tesla Inc (NASDAQ: AAPL or AAPL: US)

Current TSLA Stock Price: C$ 449.76

Tesla Inc’s shares have been rallying once again after facing a slump earlier in September amid a broader tech sell-off. The excitement surrounding the company’s ‘Battery Day’ event on September 22 is likely to have fueled this growth. Since falling to C$ 330.21 on September 9, its stock price increased over 27 per cent. Another factor that may have had an impact on Tesla stocks is media reports of Securities and Exchange Commission (SEC) probing its rival Nikola Corporation (NASDAQ:NKLA) over fraud charges.

The COVID-19 pandemic had pulled down Tesla Inc’s stock price to a low of C$ 72.2 on March 19, but since then, it has been steadily climbing. In the last six months, its scrips have increased by nearly 284 per cent in value. Its shares also recorded a 50-day average trading volume of nearly 82 million.

Lockdown restrictions had forced Tesla to shut down its main factory in California’s Fremont for about four months in the first half of 2020. This affected the electric car marker’s Q2 2020 financial results, which posted a 5 per cent YoY decrease in total revenue as well as total production. The company, however, recorded its fourth sequential GAAP profit and a free cash flow of US$ 418 million in the same quarter. It also saw a total gross profit of US$ 1.26 billion in Q2 2020, up 38 per cent YoY. The US$ 419-billion market cap company, which has ramped up its production to pre-pandemic levels, expects to deliver over 500,000 vehicles by the end of this year.

Tesla’s YTD performance (Source: Refinitiv, Thomson Reuters)

Tesla Inc currently has a price-to-book (P/B) ratio of 42.59 and a price-to-cash flow (P/CF) ratio of 148.10.

Apple Inc (AAPL:US)

Current AAPL Share Price: C$ 115.54

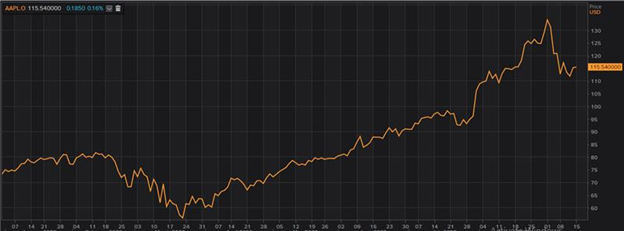

Before the tech stock sell-off around the first week of September, American tech giant Apple Inc saw its share price reach the highest level of C$ 134.18 in five years on September 2. In the last six months, Apple stocks have climbed nearly 66 per cent in value, steadily recovering from the COVID-triggered market crash in March.

In August, the leading smartphone maker implemented a four-for-one stock split, following which its market cap crossed US$ 2 trillion. This caused Apple Inc to overtake Saudi Arabian oil giant Aramco to become the world’s largest company in terms of market valuation. However, the September slide pulled down its market cap to under US$ 2 trillion.

Apple’s YTD stock performance (Source: Refinitiv, Thomson Reuters)

Despite this, Apple remains one of the largest companies in the world in terms of valuation. The company saw a revenue of nearly US$ 60 billion, up 11 per cent YoY in the third fiscal quarter of 2020 (ending June 27). It also posted a quarterly growth of 18 per cent in its earnings per share (EPS) and an operating cash flow of US$ 16.3 billion in Q3 2020. In its official statement, Apple said that 60 per cent of its third quarter’s revenue was generated from international sales. It also announced a quarterly cash dividend of U$ 0.82 in its Q3 report. The current yield of the dividend is 0.71 per cent.

Apple hosted its much-awaited ‘Time Flies’ event virtually on September 15, where it unveiled its new iPad Air, Apple Watch Series 6, Apple Watch SE, among other products.