Highlights

- Canadian Pacific Railway, on Thursday, January 27, announced its financial results for the fourth quarter of fiscal 2021.

- Canadian Pacific is one of the top industrial companies in North America, with a railroad network that connects major ports on the west and east coast.

- Canadian Pacific is also set to dole out a quarterly dividend of C$ 0.19 per share on April 25 against an ex-dividend date of March 24.

Canadian Pacific Railway, on Thursday, January 27, announced its financial results for the fourth quarter of fiscal 2021. Canadian Pacific is one of the top industrial companies in North America, with a rail network that connects major ports on the west and east coast. The Calgary, Alberta-based transportation company provides freight, logistics and other supply chain solutions.

Let us find out more about Canadian Pacific and its overall performance.

Canadian Pacific Railway’s (TSX:CP) financial results in Q4 FY2021

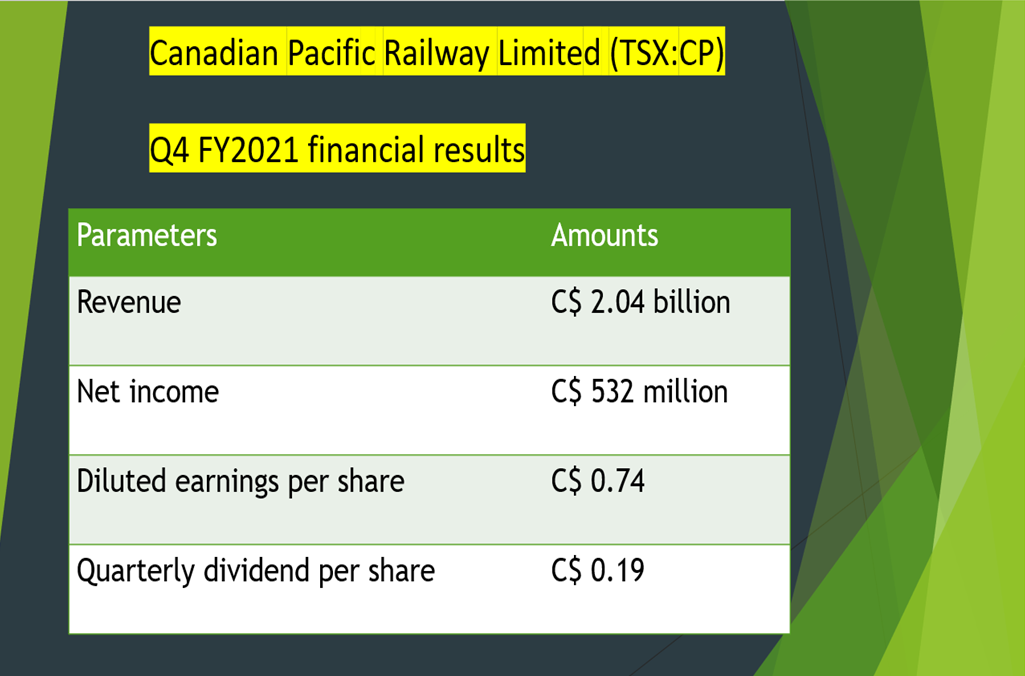

Canadian Pacific reported a top line of C$ 2.04 billion in the fourth quarter of fiscal 2021, up by one per cent year-over-year (YoY) from C$ 2.01 billion.

The railroad giant, which currently has a market capitalization of over C$ 87 billion, saw its operating ratio at 59.2 per cent in the latest quarter, including the costs of C$ 36 million related to the acquisition of Kansas City Southern.

When excluding the acquisition costs, its adjusted operating ratio reached 57.5 per cent.

Also read: Magna International (MG) & Birchcliff (BIR): 2 TSX value stocks to buy

The Canadian railway company generated a net income of C$ 532 million in the last quarter of FY2021 compared to C$ 802 million in Q2 FY2020. The railroad operator earned diluted earnings of C$ 0.74 per share in Q4 FY2021 compared to C$ 1.19 per share in the prior-year quarter.

Canadian Pacific is also set to dole out a quarterly dividend of C$ 0.19 per share on April 25 against an ex-dividend date of March 24.

Image source: ©2022 Kalkine Media®

Data source: Canadian Pacific Railway Limited

Canadian Pacific’s stock performance

The railroad stock returned almost 11 per cent in the last one year. Stocks of Canadian Pacific closed at C$ 93.82 apiece on Thursday after touching a day high of C$ 95.50. The transportation scrip climbed over three per cent in 2022.

Bottom line

Canadian Pacific might see its transportation business grow with the acquisition of Kansas City Southern. However, apart from financial and operational results, investors need to keep an eye on the market conditions and factors that can impact the company’s business.

Also read: Canadian National (TSX:CNR) sees Q4 diluted EPS soar 18%. A buy alert?