Highlights

Canadian Pacific Railway (TSX:CP) and Canadian National Railway (TSX:CNR) recently posted their earnings results for the first quarter of fiscal 2022.

Both the companies are known for their railroad operations across North America and for providing integrated transportation and logistics services to various markets, including agriculture, energy, industrial, metal and mining etc.

Let us talk about these two railway stocks in detail.

Canadian Pacific Railway Limited (TSX: CP)

Founded in 1881, the railway company is known to provide intermodal shipping, transload and trucking, rail siding facility, short line connections etc.

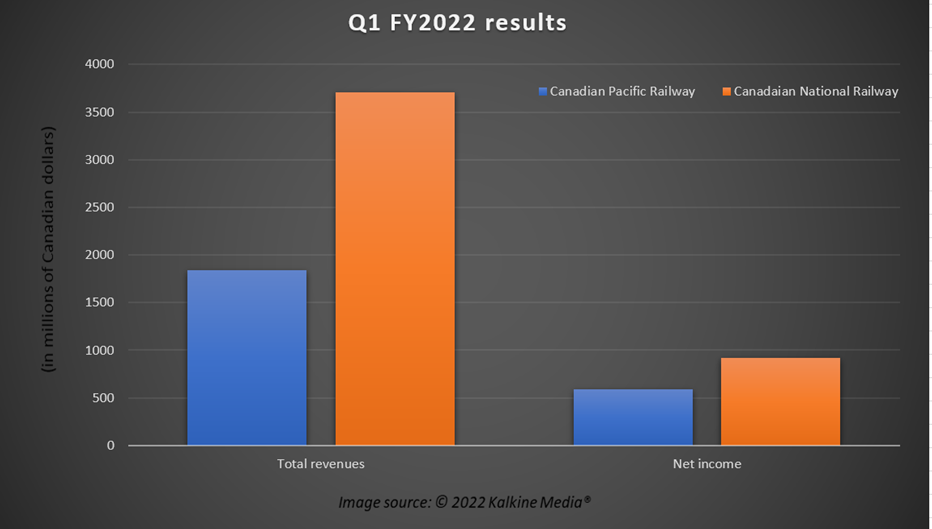

CP is scheduled to dole out a quarterly dividend of C$ 0.19 apiece on July 25. The C$ 86-billion market cap company reported total revenue of C$ 1.83 billion in Q1 FY2022, which was a drop from C$ 1.95 billion earned in Q1 FY2021.

Its operating ratio grew to 70.9 per cent in the latest quarter from 60.2 per cent a year ago. It posted a net profit of C$ 590 million in Q1 FY2022, down from C$ 602 million in Q1 FY2021.

CP stocks spiked by over three per cent in nine months.

Also read: Teck (TSX: TECK.B) stock takes off after Q1 results. Buy call?

Canadian National Railway Company (TSX: CNR)

Canadian National Railway provides rail, intermodal, trucking, supply chain, business development and maps and network services to several industries like consumer goods, petroleum and chemicals, automotive, fertilizer etc.

According to CN’s website, the company transports goods worth over C$ 250 billion every year across different sectors and industries through its 20,000 route miles.

The Montreal-based firm saw its revenue climb by five per cent year-over-year (YoY) to C$ 3.7 billion in Q1 FY2022. Its operating ratio also expanded by 4.4-points to 66.9 per cent in the latest quarter.

However, its net income slumped from C$ 976 million in Q1 2021 to C$ 918 million in the latest quarter.

Canadian National’s free cash flow (FCF) amounted to C$ 571 million in the first three months of FY2022 compared to C$ 539 million a year ago. It is also set to pay a quarterly dividend of C$ 0.7325 on June 30.

CNR scrip jumped by about 16 per cent in 12 months.

Bottomline

Canadian Pacific and KCS are working on building a single line rail network connecting the United States, Mexico and Canada. Canadian National, on the other hand, expects its adjusted earnings per share (EPS) to increase by 15 to 20 per cent in 2022 and aims for an operating ratio below 60 per cent this year.

While both the railway stocks have their pros and cons, investors should weigh all the factors and cautiously take any investment decisions.

Also read: Lion Electric (LEV) partners with US Energy Dept: An EV stock to buy?

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.