Highlights

- CloudMD Software (TSXV:DOC) stock zoomed by nearly 27 per cent on Monday, May 30.

- The Canadian healthcare tech firm saw revenue growth of 372 per cent in Q1 FY2022 compared to Q1 FY2021.

- CloudMD has introduced a new brand identity, Kii Personalized & Connected Care recently.

Stocks of CloudMD Software (TSXV:DOC) zoomed by nearly 27 per cent on Monday, May 30, after it reported a significant revenue surge in its first-quarter results for fiscal 2022. The Canadian healthcare tech company said that it achieved revenue growth of 372 per cent in Q1 FY2022 compared to Q1 FY2021.

CloudMD also recently introduced a new brand identity, Kii Personalized & Connected Care, to offer a full spectrum of mental and physical health solutions.

Let us discuss CloudMD’s latest quarter results and stock performance to assess if DOC stock is a cheap option to explore at its current price.

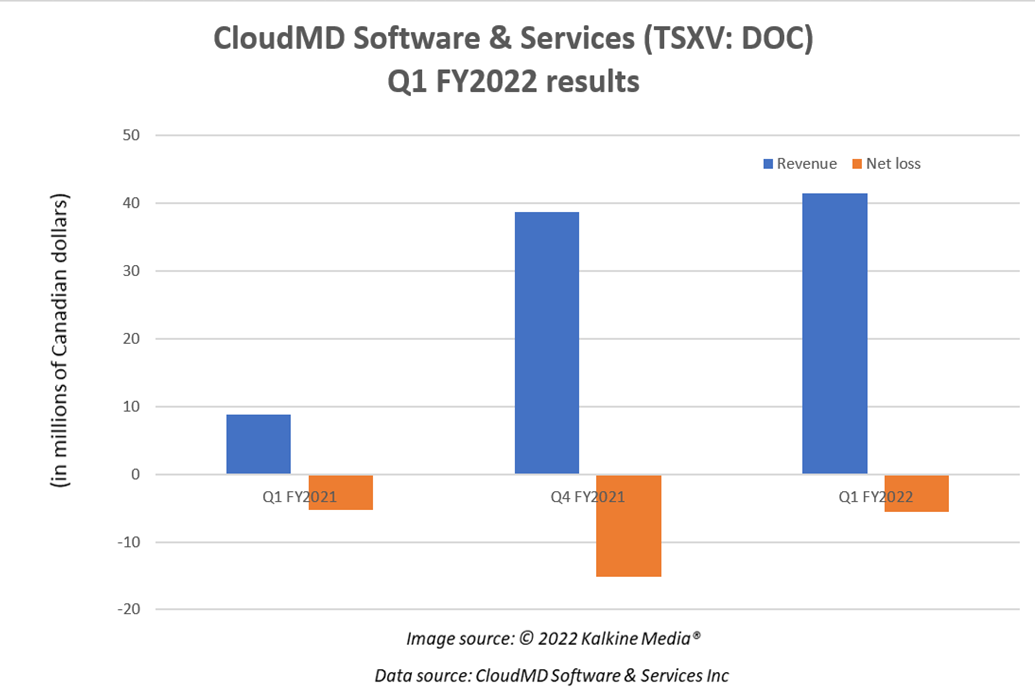

CloudMD Software & Services (TSXV: DOC) Q1 FY2022 results

CloudMD Software reported C$ 41.4 million in revenue in the latest quarter, up from C$ 8.8 million in Q1 2021. The company also pointed out that its latest revenue was higher than C$ 38.7 million earned in the last quarter of FY2021.

The health company said that its gross profit margin increased to 32.5 per cent in Q1 2022 compared to 30 per cent in the previous quarter. However, its gross profit margin was lower than 40.9 per cent posted in Q1 2021.

CloudMD also narrowed its net loss to C$ 5.6 million in the first three months of FY2022 against C$ 15.1 million in Q4 2021. However, the company recorded an increase in a net loss in the latest quarter when compared to a loss of C$ 5.3 million incurred in the same period a year ago.

The healthcare firm said that the acquisition of MindBeacon and net cash acquired resulted in increased cash and cash equivalents (CCE) of C$ 46.9 million by the end of Q1 FY2022.

Also read: Monkeypox spreads in Canada: 5 vaccine stocks to keep on your radar

CloudMD Software stock performance

Stocks of CloudMD Software tanked by roughly 56 per cent year-to-date (YTD). However, the health tech stock jumped by over 42 per cent from a 52-week low of C$ 0.365 (May 12).

As per Refinitiv data, DOC’s Relative Strength Index (RSI) value of 54.33 on May 30, was up from 30 (which represents an oversold market situation). The Moving Average Convergence/ Divergence (MACD) indicator was below the baseline but appears to be heading up. However, there is no guarantee that such trends may continue or not.

Bottomline

CloudMD Software Services is focused on providing personalized healthcare services to individuals to improve their health conditions and boost the company’s return on investment (ROI). CloudMD also said that it aims to streamline its operations by promoting organic growth and operational excellence in the near term with financial sustainability.

Also read: Celebrate Mental Health Awareness month with these Canadian stocks

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.