Highlights

- Technically, growth stocks often look expensive as they hold high P/E ratio

- Thomson Reuters stock shot up by over 22 per cent in three months

- Cameco reported a top-line increase of 55 per cent YoY to C$ 558 million in Q2 2022

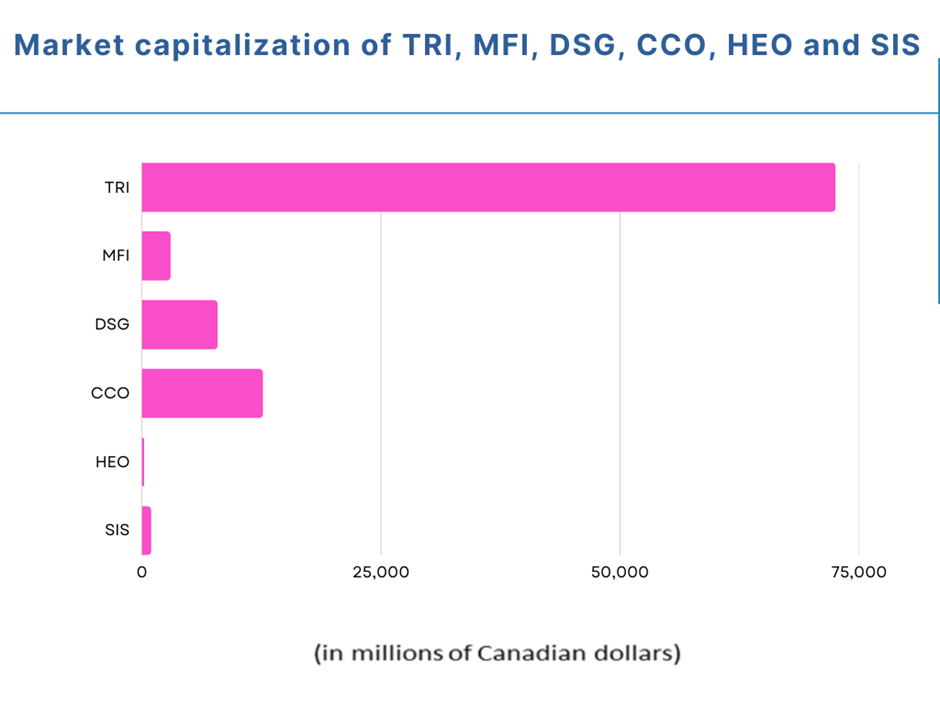

Canadians seeking growth exposure can consider growth stocks like Thomson Reuters (TSX: TRI), Maple Leaf Foods (TSX:MFI), H2O Innovation (TSX: HEO) etc., to try and get returns in the future.

Technically, growth stocks often look expensive as they hold high price-to-earnings (P/E) ratio ( technical indicator that measures the overvaluation or undervaluation of a given stock). Investors often explore growth stocks as they might anticipate that such companies will grow faster than the overall market or industry.

The S&P/ TSX Composite Index swelled by over seven per cent quarter-to-date (QTD), which could be a rebound signal. However, interest rate policy decisions in the upcoming months may keep impacting market sentiments.

Long-term investors focused on capital gains, however, could explore the following TSX growth stocks picked by Kalkine Media®:

1. Thomson Reuters Corporation (TSX:TRI)

Thomson Reuters is a large-cap company offering specialized information-enables software and tools. Thomson Reuters said its revenues were US$ 1.61 billion in Q2 2022, five per cent higher than US$ 1.53 billion in the same period last year. The industrial company revealed that this increase in Q2 2022 was led by growth across its five divisions. Thomson Reuters pointed out that its Big 3 segments (which accounted for 80 per cent of total revenues) posted an organic surge of seven per cent in the top line in Q2 2022.

The business service company reported a double-digit increase of 24 per cent in its operating profit to US$ 391 million in the latest quarter compared to Q2 2021. Thomson Reuters currently has a high P/E ratio of 115.2.

Thomson Reuters stock shot up by over 22 per cent in three months. According to Refinitiv findings, the TRI stock saw a Relative Strength Index (RSI) value of 74.61 on August 18, which signals a bull trend.

2. Maple Leaf Foods Inc (TSX:MFI)

Maple Leaf Foods is a mid-cap company producing and offering consumer-packaged meat products. The food company reported sales of C$ 1.19 billion in Q2 2022, up by 3.1 per cent year-over-year (YoY). Maple Leaf stated that revenue from Meat Protein Group increased to C$ 1.16 billion in Q2 2022 from C$ 1.11 billion in the second quarter last year. In comparison, Plant Protein Group saw a decreased revenue of C$ 40.8 million in the latest quarter compared to C$ 48.1 million a year ago.

Maple Leaf stock lost over 18 per cent year-to-date (YTD). As per Refinitiv data, the MFI stock recorded an RSI value of 44.81 on August 18.

3. Cameco Corporation (TSX: CCO)

Cameco reported a top-line increase of 55 per cent YoY to C$ 558 million in Q2 2022. The large-cap uranium producer also saw its net profit jump notably to C$ 84 million in the latest quarter, up from a loss of C$ 37 million a year ago. While delivering its Q2 2022 financial results, the uranium exploration company said that it has tier-one assets (backed by idle tier-two assets) that are licensed and have expansion capacity.

Cameco currently possesses a P/E ratio of 197.6. Cameco stock jumped by nearly 56 per cent in 52 weeks. On August 18, the CCO stock held an RSI value of 51.95, as per Refinitiv findings.

©Kalkine Media®; ©Garis Studio via Canva.com

©Kalkine Media®; ©Garis Studio via Canva.com

4. Descartes System Groups Inc (TSX: DSG)

Descartes System Groups announced in July that Blue Sky Distribution, a New Mexico-headquartered distributor of grocery and tobacco products, is utilizing Descartes OzLink™ Mobile Warehouse solution to manage its e-commerce growth and extreme peaks. Aside from this, the technology company extended its product reach in August as C.H. Robinson expanded options and freight updates to carriers via Descartes MacroPoint™. Descartes posted US$ 116.4 million in revenues in the first quarter of fiscal 2023, representing a YoY surge of 18 per cent.

Descartes System stock jumped by nearly 21 per cent in three months. As per data collected from Refinitiv, the DSG stock held an RSI value of 63.1 on August 18, pointing to a medium-to-high trend.

5. H2O Innovation Inc (TSX:HEO)

H2O Innovation acquired Leader Evaporator’s business in June, strengthening its maple syrup equipment offering to support producers and improve manufacturing capacity. The utility company also mentioned that H2O and Leader products and equipment would be available via a distribution network in the US (almost 80 distributors in 10 states). H2O Innovation leverages its membrane filtration technology to provide a wide array of water and wastewater solutions.

H2O Innovation saw a revenue surge of 32.6 per cent YoY to C$ 51.91 million in the third quarter of fiscal 2022. The HEO stock spiked by nearly 29 per cent quarter-to-date (QTD). H2O Innovation scrip seems to be overbought in the stock market as its RSI value was 75.89 on August 18.

6. Savaria Corporation (TSX: SIS)

Savaria Corporation said that organic growth in its Accessibility and Patients Care segments helped its revenue to climb by 7.5 per cent YoY to C$ 192.06 million in Q2 2022. The small-cap industrial products firm saw its gross profit at C$ 65.58 million in the latest quarter, up by 9.5 per cent YoY. Savaria stated that the latest quarter’s gross profit represents 34.1 per cent of revenue, a slight increase from 33.5 per cent in Q2 2021. Savaria posted a net income of C$ 8.12 million in the second quarter this year, higher than C$ 2.02 million a year ago.

Savaria stock swelled by about 14 per cent in one month. According to Refinitiv information, the SIS stock appears to be on a moderate-to-high trend, with an RSI value of 60.08 on August 18.

Bottom line

Growth investing could be suitable for high-risk investors to earn substantial gains. Hence, investors ready to bear risk can explore the TSX growth stocks mentioned above, as these companies have seen revenue growth in their latest quarter and appear to be expanding their footprints.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.