Highlights

- Labrador Iron (TSX:LIF) held a high dividend yield of almost 13 per cent

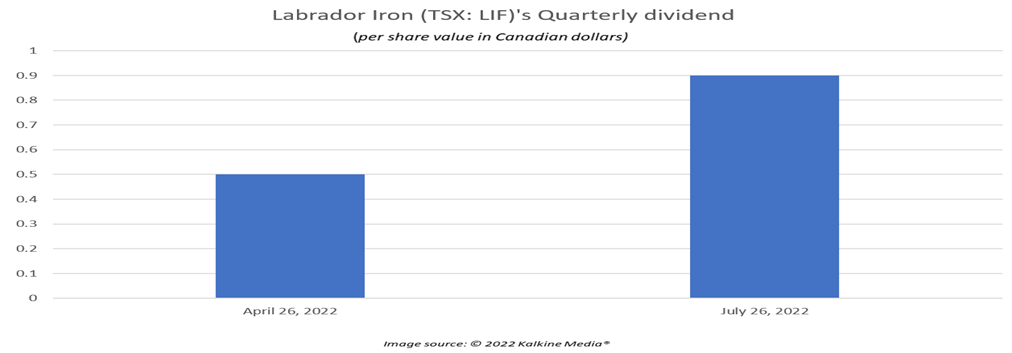

- The next dividend payment of C$ 0.9 is scheduled for July 26, up from C$ 0.5 paid on April 26

- Labrador’s profitability, depicted by its return on equity, was over 60 per cent

The Bank of Canada noted in its quarterly survey released on Monday, July 4, that consumers, whose expectations for inflation have grown in line with price concerns, believe that the inflation is likely to last longer than earlier expected. Amid this grim projection, Canadian investors can explore TSX dividend stocks like Labrador Iron Ore (TSX: LIF), which could help weather inflationary effects in the near and long terms.

The central bank said that short-term expectations are at record-high levels, while long-term expectations also rose significantly in Q2 2022. The BoC added that expectations of rising inflation and policy rates affect consumers’ behaviour, leading them to opt for affordable options and cut down spending.

In such a market environment, Canadian investors could consider stocks like Labrador Iron, which have a high dividend yield of almost 13 per cent. The dividend yield refers to the annual dividend paid by the company, reflected as a percentage of its current stock price. Such dividend stocks could help Canadian consumers offset inflationary pressure to some extent. On that note, let us explore this TSX-listed midcap stock.

About Labrador Iron Ore Royalty Corporation (TSX:LIF)

According to Labrador Iron’s site, the C$ 1-billion market cap company offers exposure to the iron ore market as it holds an equity stake of 15.1 per cent in Iron Ore Company of Canada (IOC) a premium producer of iron ore in North America. Besides this, the Canadian basic materials company receives royalties and commission on IOC’s production, shipments and sales.

Labrador Iron Ore Royalty’s financial results in Q1 FY2022

Firstly, let us talk about its dividend payout. Labrador doles out a quarterly dividend. The dividend payment of C$ 0.9 is scheduled for July 26, an increase from the previous payout of C$ 0.5 on April 26.

The Toronto-based metal company raised its dividend for Q2 FY2022 despite reporting negative impacts of lower sales, and reduced average realized concentrate and pellet prices in Q1 FY2022 compared to Q1 2021.

Labrador posted decreased royalty revenue of C$ 53.7 million in Q1 2022, up from C$ 65.2 million in the first three months of 2021. Equity earnings from IOC were also down at C$ 40.4 million in the latest quarter compared to C$ 57 million a year ago. As a result, Labrador noted a year-over-year (YoY) decrease of 27 per cent in its net profit per share to C$ 0.99 in Q1 2022.

Labrador Iron’s stock performance

LIF stock closed at C$ 28 on Monday, after clocking a day low of C$ 27.61 during this session. LIF stock slid by over 41 per cent in the past 52 weeks. According to Refinitiv, Labrador’s Relative Strength Index (RSI) was 34.09 on Monday, slightly above the oversold range of 30.

Labrador’s profitability, depicted by its return on equity (ROE), was over 60 per cent. Furthermore, return on assets (ROA) which measures a company’s performance by comparing its net profit generated from capital invested in assets, was roughly 46 per cent for Labrador.

Bottomline

Labrador Iron stock is presently available at much-discounted rates from its 52-week high and could significantly improve stock price movements and financials with price improvement in its respective commodity, iron ore.

The TSX material index jumped by over two per cent on July 4, along with the TSX energy index. Hence, when thinking about commodity-based stocks, investors should ideally keep tabs on the prices of underlying commodities.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.