Highlights

- Canada is facing record-high inflation, and some analysts believe it could continue.

- The Bank of Canada raised the benchmark interest rate by one per cent this week.

- The equities markets have taken a hit due to unpleasant economic conditions.

When the Bank of Canada (BoC) decided to raise the benchmark interest rate by one per cent this week, observers were taken aback. The benchmark rate now stands at 2.5 per cent overall.

Policymakers are aggressively fighting inflation to relieve pressure on Canadian households. Whether these policy changes will have the desired effect in the near future is still up for debate.

Canada is facing record-high inflation, and some analysts believe that the rising consumer prices could further trouble policymakers. The equities markets have taken a hit due to unpleasant economic conditions, and if you are looking to reshuffle your portfolio, you might consider exploring the following stocks:

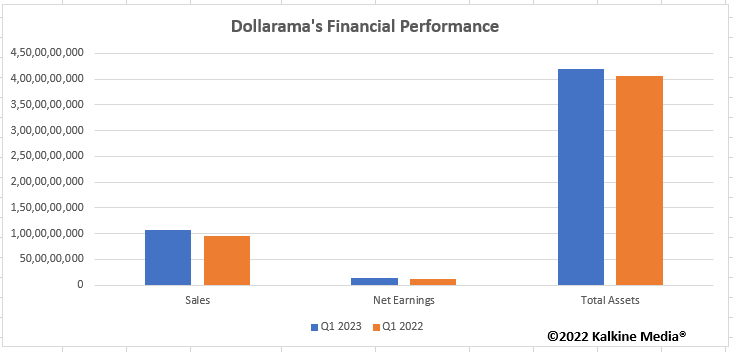

Dollarama (TSX:DOL)

Rising prices have significantly strained the average consumer. Following the financial crisis of 2008, dollar stores became more popular. In this inflationary environment, they could once again gain momentum and Canada's largest network of dollar stores, Dollarama, could benefit from that.

The DOL stock surged 34.5 per cent year-over-year (YoY) and 21.1 per cent year-to-date (YTD). On July 8, the Dollarama stock clocked a 52-week high of C$ 78.41 per share.

The DOL stock appears to be showing resistance in the current market situation, as evidenced by its RSI value of 57.7, according to Refinitiv data. Some analysts believe the Relative Strength Index value between 50 and 60 represents a resistance zone.

Imperial Oil Limited (TSX:IMO)

The main cause of recent inflation has been rising gas costs. The price of crude oil and natural gas have increased after the Russia-Ukraine war. However, thoughts of a recession have caused the sector to wane.

Calgary-based Imperial Oil produces and markets oil and natural gas. In the first quarter, the company achieved the highest net income of C$ 1,173 million and cash flow of C$ 1,914 million in over 30 years.

Imperial Oil's upstream production was 380,000 barrels per day in Q1 2022.

Alimentation Couche-Tard Inc. (TSX:ATD)

We have shortlisted this company in this article as Alimentation Couche-Tard operates convenience stores across the world.

The company's merchandise and service revenues increased by one per cent YoY to US$ 3.8 billion in Q4 2022. Meanwhile, the adjusted net earnings amounted to approximately US$ 573 million.

In the past six months, the ATD stock returned 2.4 per cent to shareholders and 5.1 per cent quarter-to-date.

Please note, the above content constitutes a very preliminary observation or view based on digital trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.