Summary

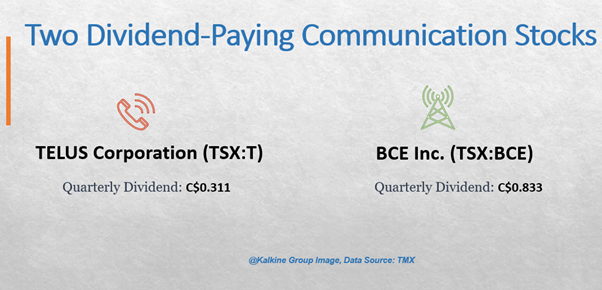

- BCE holds a current dividend yield of 5.892 per cent and distributes a quarterly cash dividend of C$ 0.833 per stock.

- TELUS pays a quarterly cash dividend of C$ 0.311 to its unitholders, with a current dividend yield of 4.887 per cent.

- Both telecom stocks deliver a double-digit return on equity.

Content and communication have been the ultimate refuge for mankind amid the pandemic, offering connectivity in times of social distancing and strict containment rules. The telecom industry is investing billions on their fifth generation (5G) spectrum acquisitions across Canada. Despite accruing losses this year, some communication companies have continued to pay a quarterly cash dividend to their stockholders. We look at BCE and TELUS, two dividend yielding telecom stocks.

BCE Inc. (TSX:BCE)

The telecom company provides a present dividend yield of 5.892 per cent. The company has approved a quarterly cash dividend of C$ 0.833 per share. Its three-year average dividend growth is 4.41 per cent, and the five-year dividend growth stands at 4.78 per cent.

BCE stock made it to TMX’s top communication stocks that have outperformed their peers with the largest price gains across the TSX and the TSXV in the last 30 days. The company also ranks among TMX’s top volume stocks with a 10-day average trading volume of 5.45 million units.

The stock is trading almost flat in the last six months but is slightly down by 6 per cent year-to-date.

The communication stock’s return on equity (ROE) is 13.03 per cent and its current return on assets (ROA) is 3.59 per cent. Its price-to-book (P/B) ratio is 3.057, and the price-to-earning (P/CF) ratio is 6.40. Its present price-to-earnings (P/E) ratio is 23.20, and the debt-to-equity (D/E) ratio is 1.66, as per TMX data.

TELUS Corporation (TSX:T)

The communication stock has fully recovered from its March crash and slightly up by 1 per cent year-to-date.

The company pays a quarterly cash dividend of C$ 0.311 to its stockholders. The company’s current dividend yield is 4.887 per cent. Its three-year dividend growth is 5.58, and five-year dividend growth is 6.78.

TELUS stocks have marginally increased by nearly 3 per cent in the last one month. The stock has added a gradual growth of 8.56 per cent in the last six months.

The stock also made it to TMX’s top communication and top volume stocks with a 10-day average stock trading volume of 2.57 million units.

Its P/B ratio is 2.707, and the P/CF ratio is 7.40. The communication stock delivers a positive ROE of 11.07 per cent and a ROA of 3.25 per cent. It offers earnings per share of C$ 1.05. Its current P/E ratio is 24.40, and the present D/E ratio stands at 1.66, as per the TMX portal.