Highlights

- Consumer goods generally experience high demand throughout the year, making consumer stocks a preferred investment option.

- Dollarama has booming retail business across Canada with its latest operating revenue reported to be CA$ 1.28 billion for Oct ’22 quarter.

- Alimentation Couche-Tard is another retail giant, with its operations spread across North America and Europe.

Consumer-oriented products are expected to remain forever in demand. These stocks are generally considered goods that consumers require for their daily living. These companies remain in their heyday if the economy functions normally.

Grocery shops and retail stores are often a one-stop destination for all one’s home needs. These companies typically develop into household names and sometimes large businesses. On that note, here are 2 TSX-listed consumer stocks that investors can examine:

Dollarama Inc. (TSX: DOL)

Dollarama has earned the reputation of being the relatively cheaper source of all household needs. With products priced under five dollars, the retail giant has become one of the biggest names in the Canadian market for items less than five dollars.

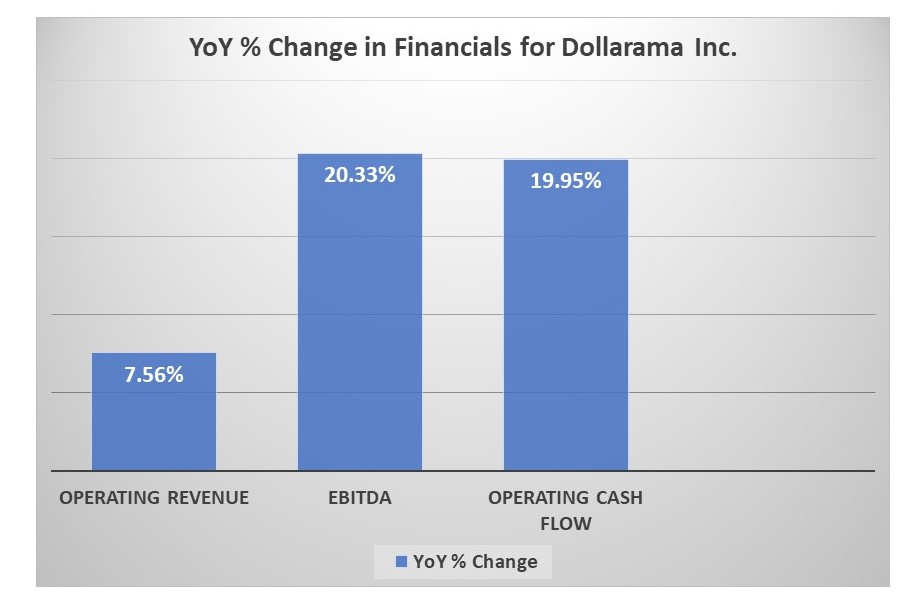

The company reported operating revenue of CA$1.28 billion in the October 2022 quarter. The EBITDA for the same quarter was CA$ 386 million. The basic EPS for Dollarama increased from CA$0.61 in the October 2021 quarter to CA$0.70 in the October 2022 quarter.

© 2023 Krish Capital Pty. Ltd.

Alimentation Couche-Tard Inc. (TSX: ATD)

Alimentation Couche-Tard (or Couche-Tard) has a network of retail stores across North America, with operations running in Europe as well. The main revenue generation occurs across three major categories – merchandise and services, road transportation fuel and others.

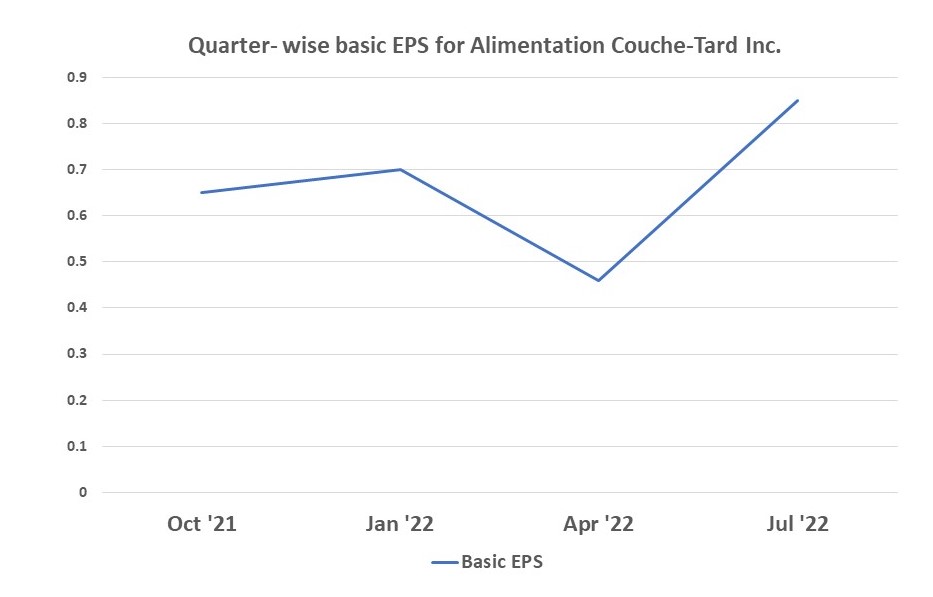

The company’s operating revenue for the July 2022 quarter was reported to be CA$18.65 billion, with a year-on-year growth of 37.26%. The EBITDA for the October 2022 quarter was CA$1.5 billion, which marked a year-on-year growth of 4.32%.

© 2023 Krish Capital Pty. Ltd.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.