Highlights

- Rogers Communications (TSX: RCI.B) and Shaw Communications (TSX: SJR.B) stocks sank on Monday.

- The dip came after Canada’s competition regulator said it is looking to block the Rogers-Shaw deal.

- The Competition Bureau said it is looking to stop this merger to “protect Canadians”.

Stocks of Rogers Communications Inc (TSX: RCI.B) sank by over four per cent on Monday, May 9, after Canada’s competition regulator announced that it is looking to block the telecom giant’s plan to buy Shaw Communications (TSX: SJR.B). Notably, SJR.B stocks also tanked by over seven per cent at close on Monday.

Read more: Rogers (TSX:RCI) To Buy Shaw Communications (TSX:SJR) In C$26Bn Deal

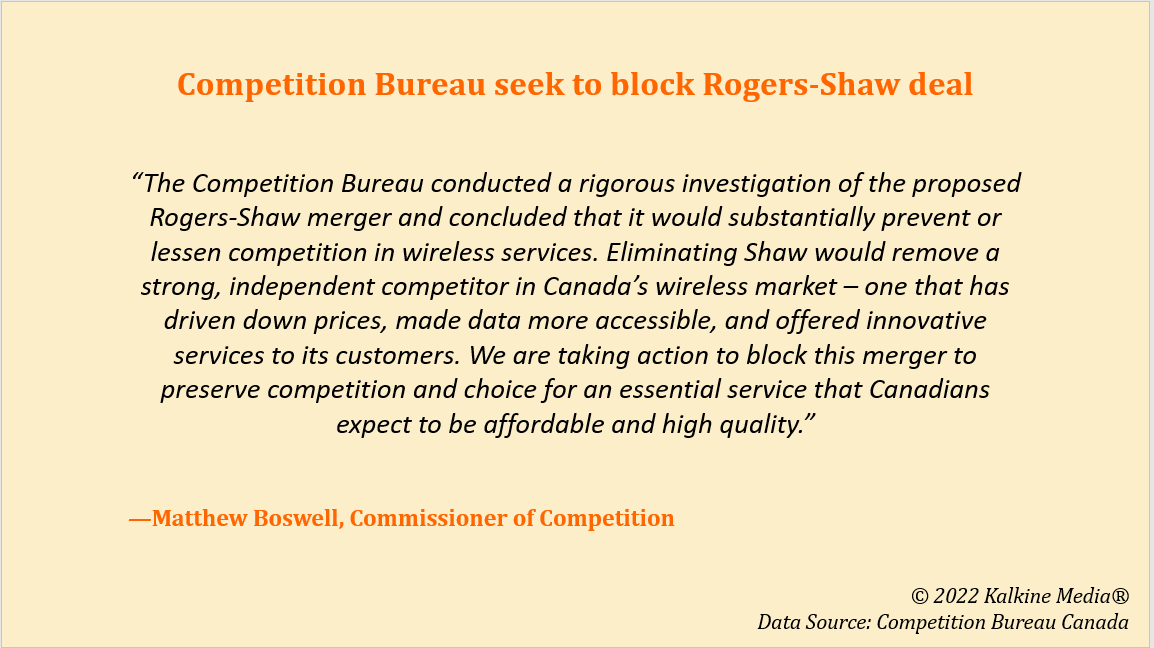

The Competition Bureau has said in a statement that it is seeking to pull the plug on the proposed C$ 26-billion acquisition deal to “protect Canadians” from increased prices, “poorer service quality” and limited options, mainly in wireless services.

What could this mean for the billion-dollar deal and investors of these telecom giants? Well, there are a few things to bear in mind.

What is Competition Bureau’s case against the Rogers-Shaw acquisition deal?

Canada’s telecom space is largely ruled by the Big Three— Rogers Communications, BCE Inc (TSX: BCE) and Telus Corporation (TSX: T) — which reportedly cater to about 87 per cent of Canadian subscribers. Shaw Communication, though a fairly new player in the field, has made its presence felt with its services and competitive prices. It is said to be the fourth top wireless services provider in the country, serving some 2.1 million customers spanning Ontario, Alberta and British Columbia.

The Competition Bureau, in its case to the Competition Tribunal, argues that if Shaw is removed, it would take away a low-priced alternative and prevent future competition in the wireless services market. It also notes that Shaw’s absorption into Rogers “threatens” to reverse the progress it has made in the “already concentrated wireless services market”.

The regulator claims that during its probe it found that Shaw had new business plans lined up for wireless services markets, 5G network, etc prior to the merger announcement. Since the announcement, which was made in March last year, the telecom player’s investment in its network has shrunk, marketing and promotional activity has reduced and, in turn, has led to a general loss of competition in the market.

Apart from approaching the Competition Tribunal to block the Rogers-Shaw merger deal, the Competition Bureau is also looking to get an injunction to stop the closure of the deal until its application is heard.

What did Rogers (TSX: RCI.B) and Shaw Communications (TSX: SJR.B) say?

Following the Competition Bureau’s statement, RCI.B stocks slipped into the red zone and closed at C$ 64.19, while Shaw stocks ended lower at C$ 34.87 apiece.

The companies had responded to the Competition Bureau’s opposition on Saturday, May 7, saying they “remain committed” to their merger plans, which they claim will have “significant long-term benefits” for consumers, businesses and the Canadian economy. However, neither of the firms has acknowledged the regulator’s latest statement yet.

Rogers’ plan, as proposed in March last year, is to purchase Shaw’s outstanding shares for an individual price of C$ 40.5. Comprising the assumed debt, the merger amounts to about C$ 26 billion.

Read more: RCI.B, T, BCE, CCA and SJR.B: 5 TSX telecom stocks for beginners

What’s next for Rogers and Shaw stocks?

The case against the merger is currently expected to go either way for Rogers Communications and Shaw. If it fails, some market experts project that the stocks of both the companies can feel some impact, although Shaw could see some boost in popularity.

If the acquisition is successful, however, Rogers stocks can surge in the wake of becoming a bigger entity with wider resources and reach.

Either way, investors are likely to see this battle stretch out over the coming months, where both telecom stocks could face some friction in the market.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.