Highlights

- The pandemic-led quarantine rules and work from home culture have accelerated the demand for internet, cloud computing and other communication solutions worldwide.

- In addition, advanced communication technologies like 5G can help connect people in a better and improved manner.

- A telecommunication scrip mentioned here returned a one-year gain of almost 19 per cent.

The pandemic-led quarantine rules and work from home culture have accelerated the demand for internet, cloud computing and other communication solutions worldwide. In addition, advanced communication technologies like 5G can help connect people in a better and improved manner.

Keeping this in mind, let us explore two TSX-listed stocks that might see growth in the year ahead.

1. Rogers Communication Inc (TSX:RCI.B)

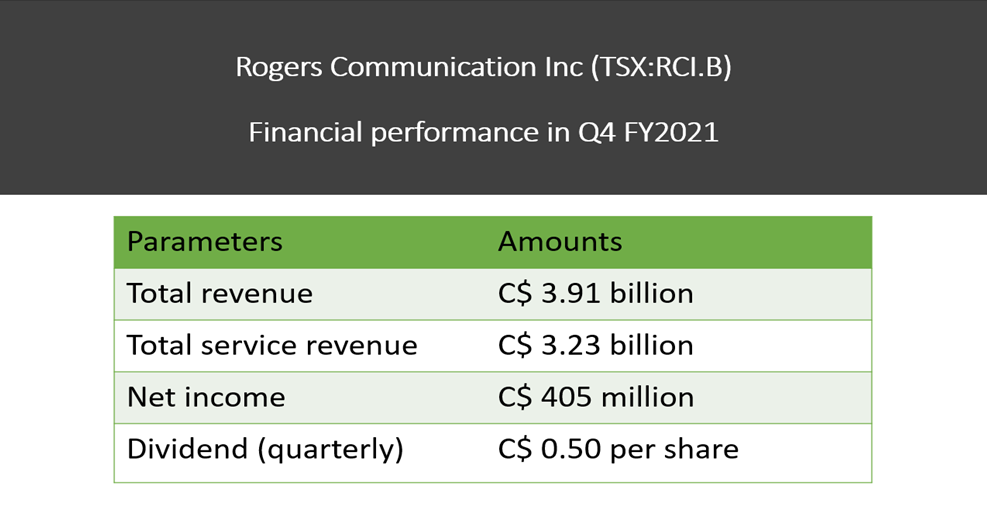

Rogers Communication saw its top line increase by six per cent year-over-year (YoY) to C$ 3.91 billion in the fourth quarter of fiscal 2021. Its total service revenue grew by seven per cent YoY to C$ 3.23 billion in the latest quarter.

Also read: Magna International (MG) & Birchcliff (BIR): 2 TSX value stocks to buy

The Toronto-based telecom giant, however, reported a YoY decrease of 10 per cent in its net income to C$ 405 million in Q4 FY2021. On the other hand, its adjusted net income was C$ 486 million in the latest quarter compared to C$ 500 million a year ago.

The wireless service provider, which has a price-to-earnings ratio of 19.50, also declared a quarterly dividend of C$ 0.50 per share, payable on April 1.

Image source: ©2022 Kalkine Media®

Data source: Rogers Communication Inc

Stocks of Rogers galloped by over three per cent on Thursday, January 27, to close at C$ 63.85 apiece. The telecom stock clocked its 52-week high of C$ 67.59 on July 20, 2021. The scrip shot up by over 10 per cent in the past three months.

2. BCE Inc (TSX:BCE)

The C$ 59-billion market cap telecom operator, BCE, posted operating revenues of C$ 5.83 billion in Q3 FY2021 compared to C$ 5.78 billion in Q3 FY2020. The communication service company generated net earnings of C$ 813 million in the latest quarter, a YoY surge of 9.9 per cent.

BCE is scheduled to announce its Q4 FY2021 results and guidance for 2022 on February 3.

The BCE stock closed at C$ 65.61 apiece on Thursday, down by over two per cent from its 52-week high of C$ 67.25 on January 17. The telecommunication scrip returned a one-year gain of almost 19 per cent.

Bottom line

Telecommunication companies focus on increasing their revenue growth underpinned by a solid subscriber base and network infrastructure. However, investors should look deeply into the financials to check if the company is earning profit and research other market forces.

Also read: Canadian National (TSX:CNR) sees Q4 diluted EPS soar 18%. A buy alert?