Summary

- Shares of Pioneer Power Solutions surged 205 per cent on Tuesday.

- Stocks of Ocean Power Technologies, which focuses on harnessing energy from ocean waves, jumped 107 per cent in the second week of October.

- Ocean Power Technologies received about US$ 0.9 million from the US government’s Paycheck Protection Program in May this year.

Economic contractions and market volatility continue to loom as the COVID-19 pandemic shows no signs of passing. While some stocks remain under pressure in these critical times, others have rebounded from their pandemic-triggered market lows to register substantial growth. Two such stocks are US-based industrial companies Pioneer Power Solutions (NASDAQ: PPSI or PPSI:US) and Ocean Power Technologies (NASDAQ: OPTT or OPTT: US).

Ocean Power Technologies shares have been in demand among investors for a while now. In the second week of October, the scrips saw a significant jump in value that improved their overall performance this year. Stocks of Pioneer Power Solutions, on the other hand, were down this year until an impressive boost on Tuesday, October 6.

Let us take a closer look at these two companies and decipher their stock market performances.

Pioneer Power Solutions Inc (NASDAQ:PPSI)

Current Stock Price: C$ 4.8

Shares of Pioneer Power Solutions shot up over 205 per cent on Tuesday, October 6. This stock movement came closely after the company scheduled an annual meeting for stockholders for November 12.

The New Jersey-based company deals with the manufacture, sale and services of specialty distribution and power generation equipment. Its business spans across North America.

PPSI STOCK PERFORMANCE

Pioneer Power Solutions’ stocks were drawing negative price returns this year until the surge on Tuesday. Now, the scrips record a 111 per cent year-to-date (YTD) climb.

Its stock price rose over 357 per cent in six month’s time and nearly 216 per cent in the last three months. In the last 10 days, Pioneer Power Solutions shares garnered an average trading volume of 34.1 million.

PPSI FINANCIAL RESULTS

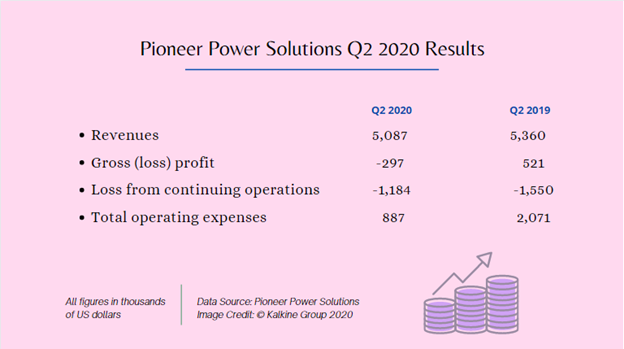

Pioneer Power Solutions posted over five per cent year-over-year (YoY) decrease in its consolidated revenue, amounting to US$ 5.1 million, in the second quarter ending 30 June 2020. Revenue from its switchgear product lines climbed over nine per cent YoY, while revenue its equipment sales was down 15.7 per cent YoY in the latest quarter.

The company also incurred a consolidated gross loss of US$ 297,000 in Q2 2020, as against a consolidated gross profit of US$ 521,000 in Q2 2019.

A nano cap company, Pioneer Power Solutions has a market valuation of C$ 41.8 million. Its price-to-book (P/B) ratio stands at 3.15, its price-to-cash flow (P/CF) is 5.9 and debt-to-earnings (D/E) ratio is 0.11.

Read more on industrial stocks: Virgin Galactic (NYSE:SPCE) and Cargojet (TSX:CJT)

Ocean Power Technologies Inc (NASDAQ: OPTT or OPTT: US)

Current Stock Price: C$ 2.18

Stocks of Ocean Power Technologies Inc also saw a jump in value this week, surging over 107 per cent since Monday, October 5.

In September, the renewable energy company announced its plans to sell its common stocks worth up to US$ 12.5 million to American investment firm Aspire Capital Fund LLC over a period of 30 months.

As the name suggests, Ocean Power Technologies focuses in developing systems that help generate energy from ocean waves. Based in New Jersey’s Monroe Township, it is the manufacturer of buoy batteries called PowerBuoy, which harnesses electrical energy from the waves of the ocean.

Ocean Power Technologies has a market cap of C$ 40.5 million. Its price-to-book (P/B) ratio stands at 4.03 and debt-to-earnings (D/E) ratio is 0.21.

OPTT STOCK PERFORMANCE

Ocean Power Technologies shares were on a rebound from their March market crash lows even before the recent surge in price. They now post a YTD growth of over 150 per cent.

The scrips of this cleantech firm jumped 446 per cent in the last six months and over 2020 per cent in three months.

Stocks of Ocean Power Technologies are currently trending on the stock market, with a 10-day average trading volume of 20.6 million.

OPTT FINANCIAL RESULTS

Revenue stood at US$ 0.16 million in the first quarter of fiscal year 2021 ending 31 July 2020, down from US$ 0.2 million in Q1 FY2020. Ocean Power Technologies said the latest quarter’s revenue primarily came from its Enel Green Power project.

The company’s net loss of US$ 3.3 million rose US$ 0.4 million YoY in Q1 FY2021, mainly due to product development and administrative costs. Its net cash used in operating activities was US$ 2.7 million in the latest quarter, down US$ 0.9 million YoY. Its total cash, cash equivalents, and restricted cash stood at US$ 12 million by the end of 31 July 2020.

Ocean Power Technologies received a support of worth US$ 0.9 million from the Paycheck Protection Program on 5 May 2020. This program was a part of the US government’s Coronavirus Aid, Relief and Economic Security Act, commonly known as the CARES Act.