Summary

- Virgin Galactic Holdings (NYSE:SPCE) stocks surged nearly 25 per cent on Monday, September 28.

- Cargojet (TSX:CJT) was named among the top ten stocks on the Toronto Stock Exchange’s (TSX) list of best performing stocks in 2020.

- These two stocks have rebounded from their March lows and recorded healthy YTD growths.

The COVID-19 pandemic shows no signs of going away any time soon. And as it persists, so does the market volatility and economic crisis. But in the midst of these critical times, some stocks have rebounded from their losses and registered noticeable growth. Two such stocks are Virgin Galactic Holdings (NYSE: SPCE or SPCE: US) and Cargojet Inc (TSX:CJT).

Space tourism company Virgin Galactic’s shares saw a boost during intraday trading on Monday. Cargojet scrips, on the other hand, have been a favorite among Canadian investors for a while now. The freight carrier secured a substantial growth both at the stock market this year and its latest quarterly earnings report. On Monday, both the companies were among the most actively traded stocks in Canadian markets. Let us take a closer look at these two companies and decipher the stock performances.

Virgin Galactic Holdings, Inc (NYSE:SPCE)

Current Stock Price: C$ 20.51

Sir Richard Branson’s Virgin Galactic Holdings is all over the news for its stock price jump on Monday (September 28). During Monday’s intraday session, Virgin Galactic shares surged nearly 25 per cent in value, closing at US$ 20.51. This was the third-highest level for its stock price this year.

The concept of space tourism has triggered much interest among people over the last decade and companies like Virgin Galactic, Elon Musk’s SpaceX and Blue Origin are working on making it a reality. Virgin Galactic’s Chief Space Officer George Whitesides said in the second quarter report that it has successfully conducted two glide flights from Spaceport America.

The company’s paid enrollments via the ‘One Small Step’ program for future space tours are also on the rise, he added. By the end of the second quarter, Virgin Galactic made deposit agreements with 12 clients for orbital spaceflights. In April this year, the company’s subsidiary Virgin Orbit won a US$ 35-million contract to launch the US Space Force.

Virgin Galactic’s scrips recorded a year-to-date (YTD) growth of nearly 78 per cent. After climbing to US$ 37.35 on February 20, its stock price declined 79 per cent in exactly a month’s time, toppling to US$ 10.49 on March 20 amid the pandemic. But the shares have recovered significantly since the March market crash. The shares have rebounded about 33 per cent in the six last months and nearly 32 per cent in three months.

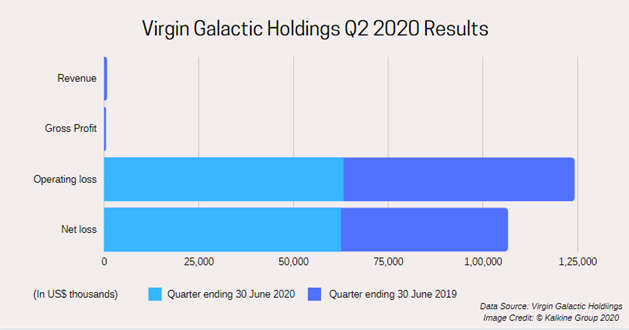

Now, let us dig into the financial results of this vertically integrated aerospace company. In its second quarter ending 30 June 2020, the company secured zero revenue and zero gross profit.

One of the reasons behind Virgin Galactic’s lack of substantial revenue is because its business of taking people on space tours is yet to kickstart. Having postponed it a few times in the past, the company promised in August that it plans to take its first flight to space by the first quarter of 2021, carrying founder Richard Branson. If this happens, it will mark the start of Virgin Galactic’s commercial service.

The company’s net loss, on the other hand, climbed to US$ 63 million in Q2 2020 from US$ 60 million in Q1 2020. Its adjusted EBITDA too incurred a loss of US$ 54 million in the latest quarter, up from a loss of US$ 53 million in Q1 2020.

Virgin Galactic said that its cash position “remains strong” with cash and cash equivalents of U$ 360 million at the end of its second quarter.

The company’s current market cap is C$ 4.3 billion and price-to-book ratio is 12.208, as per data on the TSX. Virgin Galactic recently closed an underwritten public offering of 23.6 million shares, raising approximately US$ 460.2 million.

The company will release its the third quarter 2020 results on November 5.

Cargojet Inc (TSX:CJT)

Current Stock Price: C$ 190.50

While passenger airlines continue to suffer a rough journey amid the pandemic, freight airline Cargojet’s fortunes have been soaring. Most recently, the Canadian cargo carrier was ranked among the list of top ten best performing stock on TSX in 2020.

Cargojet stocks have been flying in full steam this year. It saw an increase of 84 per cent YTD and an impressive 102 per cent in the last six months. Its shares, like so many others, also dipped when the markets crashed back in March. But then, the pandemic-led lockdown restricted flying and implemented travel bans. Passenger airlines could no longer carry freight and their loss became Cargojet’s gain. Cargojet, quite literally, flew solo in the Canadian cargo delivery business amid the pandemic. It is also one of the largest Boeing 767 operators flying for e-commerce and other freight.

Cargojet stocks are currently outperforming the market as well as its peers in the industrial sector. Its latest 10-day average trading volume is 70,728.

The C$ 2.9-billion market cap company’s recent surge came closely after Amazon (NASDAQ:AMZN) bought a 9.9 per cent state in it in 2019. As Amazon’s business surged amid the lockdown so did Cargojet’s, being its chief freight carrier.

As most airline companies incurred losses, Cargojet raked up nearly 65 per cent YoY growth in its total revenue of C$ 196 million in its second quarter ending 30 June 2020. Its gross margin was C$ 90.7 million, up a whopping 241 per cent YoY. It also pays a quarterly dividend of C$ 0.23 and currently yields 0.491 per cent, as per the data on the TSX.