The TSX Composite Index continued its fall for the fifth day in a row as oil prices fell again Tuesday, December 14. Over the last five trading days, the index has lost 2.45 per cent. The index is now at 20,648.57 points after having seen an all-time high of 21,796.16.

The season is traditionally a good one with holiday gains but it would seem that the falling oil prices, the supply chain crisis, the Omicron variant and high inflation have compounded to create stumbling blocks.

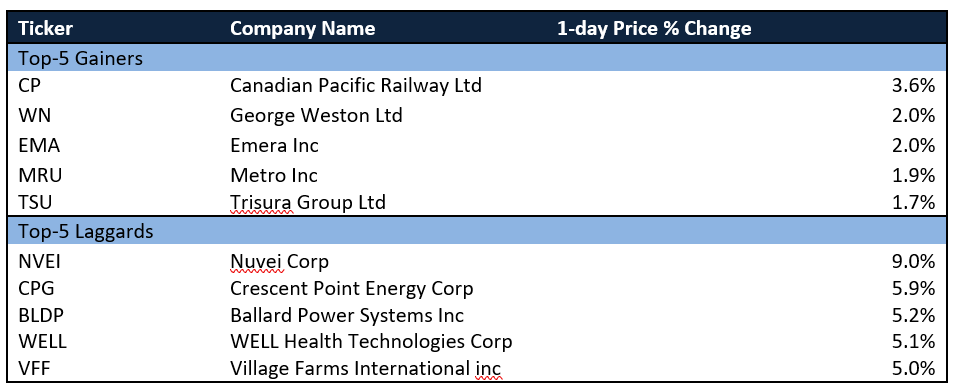

Energy and IT were each down over 1.5 per cent and healthcare over one per cent. Industrials managed to finish in the green, up 0.4 per cent, and base metals also gained a little. Nuvei Corp’s stock sank nine per cent.

One-year price chart (December 14). Analysis by © 2021 Kalkine Media®

Volume actives

Suncor Energy Inc saw 8.08 million shares traded, making it the most active stock. It was followed by Argonaut Gold Inc that saw 7.81 million shares switch hands and Canadian Natural Resources Limited saw 7.53 million shares traded. All three ended the day with losses, Argonaut falling as much as 24.84 per cent.

Movers and laggards

Wall Street update

Data Tuesday showed wholesale prices spiked at a record rate as November’s 0.8 per cent inflation overshot the expected 0.5 per cent. The current 9.6 per cent annual rate is the highest it’s been in over a decade.

Over on Wall Street, there were falls. The Dow fell 0.3 per cent, 106.77 points, to 35,544.18, while the S&P 500 sank 0.75 per cent, 34.88 points, to 4,634.09. Nasdaq lost 1.14 per cent, 175.64 points, to 15,237.64.

Commodity update

Gold was down 0.89 per cent to US$ 1,788.30. Brent oil lost 0.93 per cent to US$ 73.70/bbl. Crude oil sank 0.79 per cent to US$ 70.73/bbl.

Currency news

The loonie posted a 0.45 per cent loss Tuesday while USD/CAD ended at 1.2861. The US Dollar Index was at 96.57, up 0.26 per cent against the basket of major currencies.

Money market

The US 10-year bond yield gained 1.92 per cent to 1.441 and the Canada 10-year bond yield was up 2.58 per cent to 1.433.

.png)