The broader Canadian stock market index settled in red on Monday, July 26, ahead of the deluge of earnings reports expected from major enterprises this week.

The decline was mainly motored by the technology sector, which descended by around 1.29%, and the industrial sector, which fell about 0.68%. Shares of ecommerce giant Shopify Inc. and cybersecurity firm BlackBerry Ltd. were the worst hit entities in the technology sector. In the industrials, Aecon Group and Westshore Terminal led the decline with a fall of 2.1% and 2.9%, respectively.

The main index’s decline was partially offset by the energy sector’s gain of around 1.37%.

The S&P/TSX composite Index plummeted 23.47 points, or 0.12%, to settle at 20,164.96 on Monday.

1-Year Price Chart. Analysis by Kalkine Group

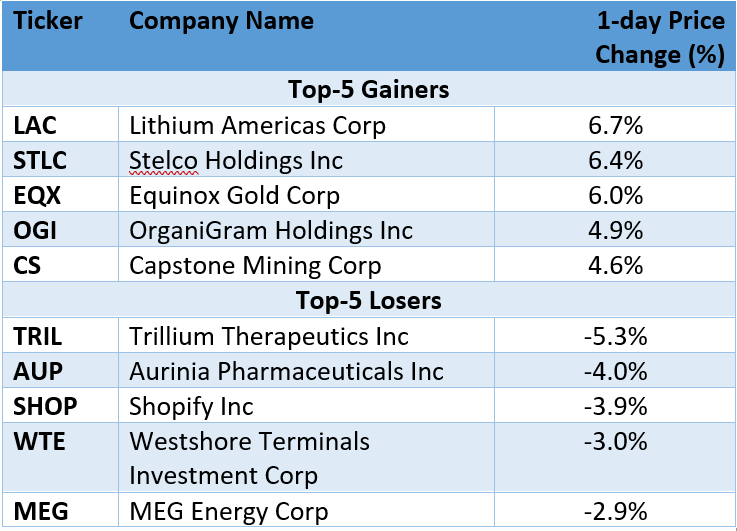

Gainers and Losers

Actively Traded Stocks

The most actively traded stocks on the TSX on Monday were Brookfield Property Partners, with a trading volume of 15.6 million, followed by CAE Inc., with that of 11.14 million, and Enbridge Inc., with that of 7.46 million.

Wall Street Update

The global benchmark indices of Wall Street settled slightly higher on Monday despite the lethargic movement noted through the trading session.

The Dow Jones Industrial Average gained 82.76 points, or 0.24%, to 35,144.31, the S&P 500 rose 10.53 points, or 0.24%, to 4,422.30, and the Nasdaq climbed 3.72 points, or 0.03%, to 14,840.71.

Commodity Update

Gold contracts traded slightly lower at US$ 1,799.20/oz, down 0.10%.

Crude oil traded in mix with International Crude Oil benchmark. The Brent Oil rose 1.02 % to US$ 74.50/bbl, while the WTI Crude Oil reported weakness and dipped by 0.59% to US$ 71.91/bbl.

Forex Update

The Canadian Dollar gained some ground against its US counterpart on Monday, with USD/CAD ending lower at 1.2540, down 0.23%.

The US Dollar index fell for the second-straight session against the basket of major currencies and closed at 92.61, down 0.31%.

Money Market Update

On Monday, the US 10-year Treasury Bond yield was up for the third-straight session, climbing 0.9% to 1.295%.

The Canada 10-year Government Bond yield also ended in green at 1.22%, up 1.33%.

.jpg)