Source: sondem, Shutterstock

Summary

- On 16 April, the May aluminium futures contract on the Shanghai Futures Exchange traded at 18,055 yuan a tonne at 3:22 PM AEST.

- Most recently, aluminium futures on the Shanghai Futures Exchange (ShFE) surged to 10-year highs on fears that China will limit output to meet its environmental targets.

- The Egyptian government announced anti-dumping duties on imports of aluminium products for the upcoming three years.

The pandemic that turned out to be cataclysmic for almost all commodities upon its outbreak, has now shaped up as one of the triggers sparking the price rallies for the same commodities. While the precious metals surged early on, the energy and base metals largely suffered sudden demand destruction, leading to significant decline in the prices.

Read Here: Why OPEC Increased Crude Oil Demand Forecast for April Report?

While the coronavirus pandemic continues in 2021, economies across the globe have been trying to reinvigorate the economic recovery and a major focus is on infrastructure boost. The infrastructure development activities have boosted the prospects for base metals including iron ore, copper and aluminium. All of these three commodities have been trending and have surged to multi-year highs in the recent months.

Aluminium futures surge to 10-year highs on the Shanghai Futures Exchange

Source: © Luizribeiro | Megapixl.com

On 16 April, the May aluminium futures contract on the Shanghai Futures Exchange traded at 18,055 yuan a tonne at 3:22 PM AEST. The fluctuations in the aluminium future prices is attributed to - China’s decision of limiting the aluminium output and the changes in inventories at the commodity exchanges globally.

Important Read: This is how Alcoa Corporation’s quarterly result will impact Alumina Limited

Chinese crackdown on pollution - Most recently, aluminium futures on the Shanghai Futures Exchange (ShFE) surged to 10-year highs on fears that China will limit output to meet its environmental targets. As per the media reports, the Xinjiang region of China may limit its aluminium output as the pressure builds on the country to meet its ambitious environmental targets. China had announced to transition to a carbon-neutral economy by 2060.

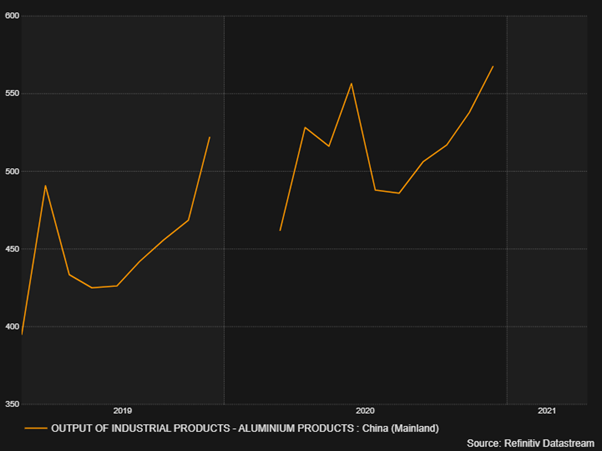

Source: Refintiv Eikon

Aluminium stocks at LME and ShFE warehouses – The combined inventory levels of LME and ShFE warehouses decreased after a three-year high on 19 March 2021, however, they still remain almost ~45% higher than at the beginning of the year.

Suggested Read: Alcoa's Portland aluminium smelter receives $76.8 m Federal Government support

Egypt Imposes Anti-Dumping Duties on aluminium Products – During the week, the Egyptian government announced anti-dumping duties on imports of aluminium products for the upcoming three years.

The government has imposed duties on cylinders, molds, and wires during the week. The sanctions will be set at 16.5% of Insurance and Freight (CIF) value with minimum of US$333 a tonne during the first year.