Highlights:

- Bigtincan Holdings Ltd (ASX:BTH) ended Monday zooming as much as 15%.

- BTH has confirmed that it has been receiving a takeover offer from Siris Capital.

- BTH’s independent board committee does not think the offer to be in the best interests of stakeholders to go ahead with it currently.

The Australian benchmark index S&P/ASX200 closed Monday, 22 May 2023, falling by 0.22% to 7,263.30 points. However, one of the ASX-listed companies – Bigtincan Holdings Ltd (ASX: BTH), ended Monday zooming as much as 15%.

Let’s find out the reason behind the price surge in ASX technology stock-BTH.

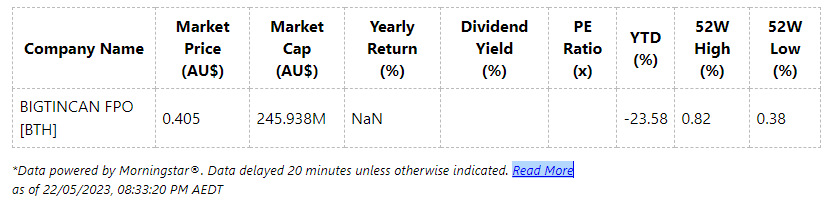

On Monday, the provider of enterprise mobility software ended Monday’s trading session rising by 15% to AU$0.575 after it notified in the 1Q 2023 that it had engaged Morgan Stanley Australia Limited as its financial advisor to assist BTH with the management and evaluation of inbound inquiries and expressions of interest concerning any prospective control transactions.

As a response to the latest media speculation, BTH confirmed that since the above announcement, it had obtained a confidential, non-binding, incomplete and indicative offer from Siris Capital Group, LLC at and at an indicative offer price of AU$0.80 a security.

However, BTH’s independent board committee (IBC) does not think the offer to be in the best interests of stakeholders to go ahead with it currently. Further, BTH has obtained other confidential approaches since it made the announcement.

The IBC, with the help of its financial, as well as legal advisers, will keep on thoroughly contemplate any proposal that increases stakeholder value and persist in making sure that it stays in line with its confidentially and continuous disclosure obligations.

The company added that there was no surety that proposals of such kind will result in a transaction.

In March this year, BTH provided a business update, where it confirmed that it had no material exposure from the US Government regulatory changes concerning Silicon Valley Bank, with its major banking partners like NAB and Citizen’s Bank.

BTH had also launched GenieAI, AI technology that facilitates sales, partners etc to increase their productivity, improving how humans work and sell. The new features are steered by the recent technology “large language model tools”.

BTH also mentioned that it continues to work with Morgan Stanley, as financial advisor, developing both the management and evaluation of inbound queries and expressions of interest concerning possible control transactions.