Highlights:

- Suspension of trading in Dubber shares has been lifted today (10 October 2022).

- The company shared an adjustment in its yearly revenue via ASX announcement on 7 October.

- Peter Pawlowitsch, executive director of Dubber would head the company’s finance function, as an interim arrangement.

- Dubbers CFO would leave the position on immediate basis, informed Dubber.

Shares of Dubber Corporation Limited (ASX:DUB) returned from the trading suspension today (10 October 2022) and fell by over 27% in the early trading hours. At 11:01 AM AEST, Dubber shares were trading 27.03% down at AU$0.40 apiece.

In one month, Dubber's share price has dropped 45.27%, and in six months, it has fallen 64.78%. The yearly fall is 87.58%, and it has dipped 85.06% on a year-to-date basis.

Why were Dubber shares suspended?

Dubber shares were suspended from trading on ASX because it failed to lodge its audited financial statement for the financial year 2022 (FY22). On 7 October 2022, the company shared the annual report to shareholders, and the company audited financial statements via ASX announcement.

Why is Dubber's share price heading south today?

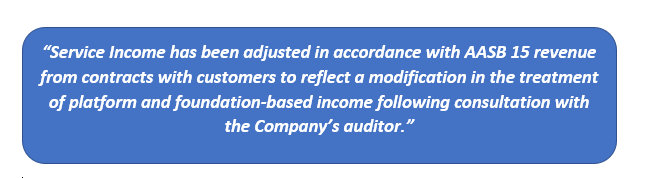

Cloud-based software technology company, Dubber informed the market through its audited financial statements for FY22 about an adjustment in its revenue. Reportedly, the service income has been adjusted from AU$35.6 million to AU$25.3 million.

The company explained that the revenue adjustment had been driven by the timing of recognition of invoices issued in FY22 and a review of the customer's payment history.

Dubber said:

Also, the company has highlighted about the adjustment in its general and administrative costs worth approximately AU$8 million. Dubber said, that this cost adjustment occurred due to the customer’s failure to make contractual payments.

Chief financial officer of Dubber quits

The ASX-listed software and services company said that as a measure to delay in finalisation and release of FY22 statutory accounts and annual report, Peter Pawlowitsch would head the finance function of the group on an immediate basis. It is an interim arrangement. In addition to this, the existing CFO would leave the position on an immediate basis and would help in a smooth transition.

Peter Pawlowitsch is the executive director of Dubber.

In the interim role, Pawlowitsch would lead a comprehensive review of existing systems, processes, and practices in the finance function. Also, he would oversee the new CFO recruitment, as per the announcement.

According to a media release, the CEO of Dubber, Steve McGovern, would relinquish his incentive entitlements for the financial year 2021/22. Reportedly, the incentive entitlements are around AU$250,500.