Highlights

- Software as a service (SaaS) is a method of offering applications over the internet as a service.

- In Q4FY22, the cash receipts of Whispir grew by 25.9% compared to the previous corresponding period.

- Skyfii delivered record revenue in Q4 FY22, a rise of 40% compared to pcp.

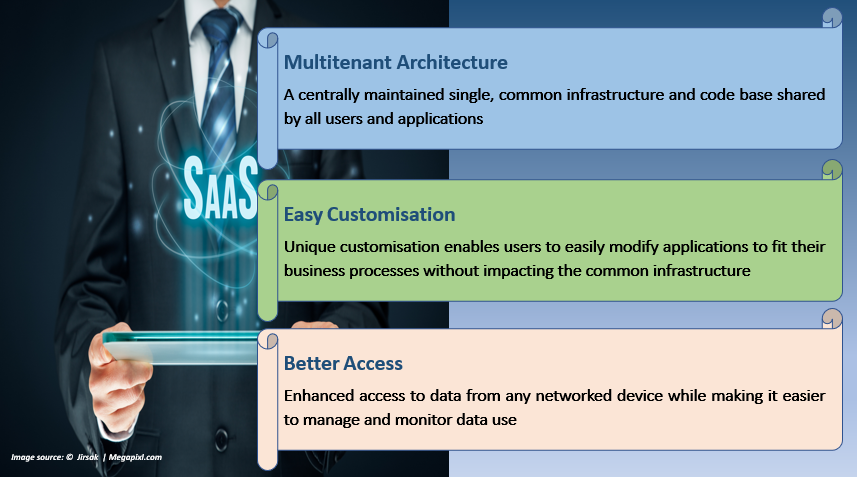

Software as a service (SaaS) is a method of offering applications over the internet as a service. It impedes the need for complicated software and hardware maintenance and allows the users to enable software online rather than installing it.

The picture below depicts the characteristics of SaaS:

Image source: © 2022 Kalkine Media®, data source: SaaS website

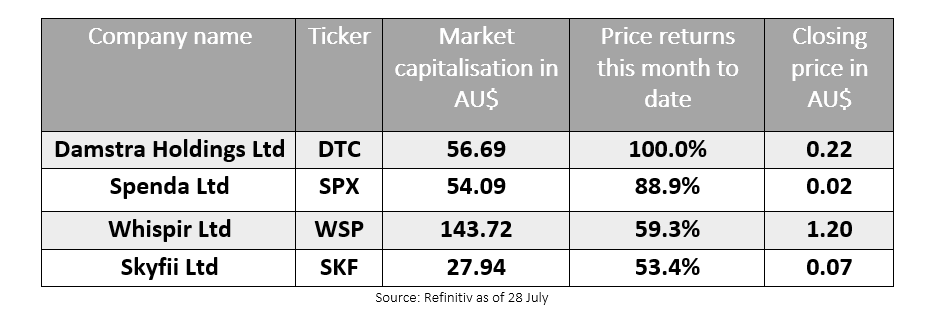

In this article, we will discuss four ASX technology stocks leveraging SaaS that have made decent gains this month to date (MTD).

Damstra Holdings Ltd (ASX:DTC)

Damstra is a workforce management solutions company. Its services include developing, selling, and integrating hardware and software-as-a-service (SaaS) solutions in different industries.

Recently, the company reported breakthrough quarterly results for Q4 FY22 with an unaudited revenue of AU$8 million and won two large clients in North America.

Assuming normal market conditions without any rise in COVID-19, DTC expects to be positive free cash flow in 2H FY23.

Spenda Ltd (ASX:SPX)

Spenda has over 20 years of experience supplying smart B2B software applications, including a range of integrated digital payment and business software solutions. It licenses the features of the Spenda solution via SaaS.

In Q3 FY22, SPX transitioned to a revenue-generating company from pure research and development-based company by commercialising its Spenda product suite. During the quarter, it focused on its existing sales pipeline to strengthen long-term persistent revenue growth.

Whispir Ltd (ASX:WSP)

Whispir is a communication intelligence company assisting the delivery of over two billion interactions globally. It is a SaaS company providing a communications workflow program that automates interactions between businesses and people.

In Q4FY22, the cash receipts of Whispir grew by 25.9% compared to the previous corresponding period (pcp). It has maintained a strong balance sheet with a cash position of AU$26.08 million. Additionally, the company recorded its lowest quarterly free cash outflow for the year.

Whispir is expecting a positive Earnings Before Interest, Taxes, Depreciation & Amortisation (EBITDA) during the second half of FY23.

Skyfii Ltd (ASX:SKF)

Skyfii is a software technology company that offers marketing products driven by analytics and data. The company’s SaaS cloud-based solution, the IO Platform, assists venues in creating improved experiences for their visitors and customers.

The company delivered record revenue in Q4 FY22, a rise of 40% compared to pcp. Similarly, its quarterly cash receipts from customers grew by 4% compared to the previous quarter. SKF also secured a project financing facility with Export Finance Australia worth AU$1.8million.

The company is expecting to improve operating cash outflow during 1H FY23 significantly.