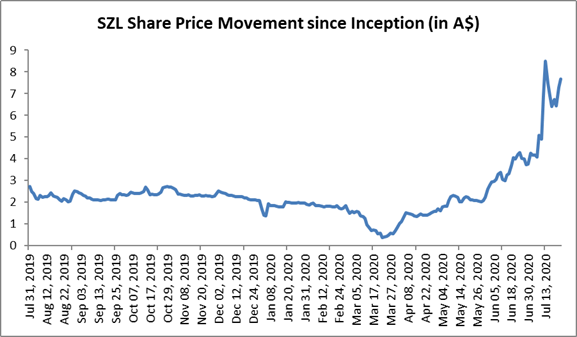

BNPL players have been in the limelight, more so since the outbreak of COVID-19 pandemic. Many BNPL stocks have gained market share not just in Australia but also in major global markets such as the U.S and the UK. One such stock that witnessed tremendous business traction and delivered fabulous returns in excess of 20x for its shareholders since it hit a low price of $0.350 during the COVID-19 market crash in March 2020 is Sezzle Inc. (ASX:SZL).

The BNPL player, Sezzle Inc hit the bourses in July 2019 at $2.5 a share. Since then, the company has been on a strong footing taking the business and stock price aspects into consideration.

The company’s revenue increased at a CAGR of 2,216.6% in three years. The COVID Pandemic acted like a boon with Sezzle witnessing record breaking revenue and customer increase because of liquidity crunch and inclination towards digital contactless transactions.

Summary:

- Since listing on ASX in July 2019, SZL is up 231%.

- Sezzle’s operating model facilitates quick funding to customers at zero costs to be repaid within six weeks through 4 instalments, driving customer base to reach 1.48 million within four years of being founded.

- Key markets including USA and Canada are witnessing constant business growth due to strong customer and merchant on-boarding

- Management is dedicated on creating strong merchant base with a focus on onboarding large enterprise merchants and strengthening its balance sheet backed by raising capital via private placements and share purchase plan to expand to new geographies and grow existing markets

Founded in 2016, Sezzle experienced an incredible journey with the company serving customers and merchants in the US and Canada. The company currently serves 1.48 million active customers through 16,000 active merchants.

ASX Listing

The Company witnessed an oversubscribed IPO raising A$43.6 million and got listed on the ASX in July 2019. Funds raised from the IPO were used to grow merchant base, cover general expenses and improvise on the product through development, engineering, sales and marketing and many more.

On 22 June 2020, Sezzle was added to the ASX All ordinaries index.

Flick through Sezzle Inc’s business model

Sezzle operates a buy now pay later business model and provides credit to the customer for making purchases at merchants who are registered on Sezzle’s platform. The company does not charge any interest from the customer and receives payments through 4 instalments scheduled over a period of six weeks. The company follows an instant approval decisioning process that doesn’t leave any impact on the customer’s credit score. The company’s earning sources include processing fees received from merchants and late fees from customers when instalments are not paid on time. Processing fees (in USD) is 6% + 30c per transaction and the fees vary, and usually go higher, depending upon the risk profile of the industry classification.

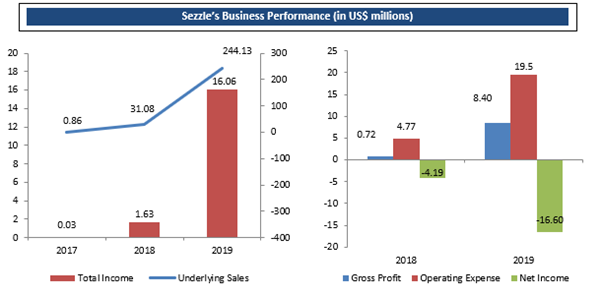

The staggering revenue growth

Data Source: Company Reports

Over the three years to FY19 ending 31 December, the company has grown its Underlying Merchant Sale to US$244.13 million in 2019 from US$0.86 million in FY17 at a CAGR of 1,584.85%. During the same period, the company has grown its revenue to US$16.1 million in 2019 from US$0.03 million in FY17 at a CAGR of 2,216.6%.

During the two-year period to FY19 ending 31 December, gross profit increased by CAGR of 1,066.66% to US$8.4 million in FY 2019 from 0.72 million in FY 2018. Net profit (loss) decreased further to -US$16.6 million from -US$4.19 million.

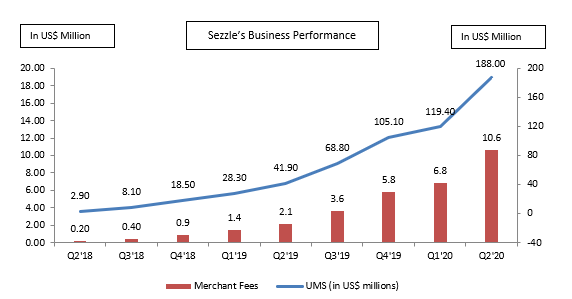

The company recently announced that it anticipates its Underlying Merchant Sales (UMS) to reach US$1 billion (A$1.4 billion) by 2020 end.

Quarterly performance in last two years

Data Source: Company Reports

In the last two years, company’s UMS has grown exponentially to reach US$188 million in Q2 2020 from US$2.90 million in Q2 2018. During the same period, Merchant fees reached US$10.6 million from US$ 0.20 million in Q2 2018.

The rise in the quarterly sales and merchant fees is backed by the increasing number of customers and merchants joining Sezzle.

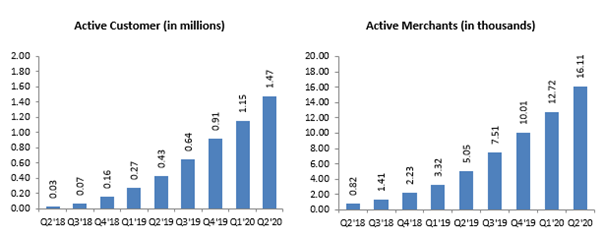

Increasing active customers and active Merchants propelling business growth

Since its inception in 2016, the company has enrolled 1.48 million customers by H1 2020 ending June 2020. Within six months from December 2019, the customer base jumped by almost 65% because of tremendous growth experienced in its U.S and Canada operations, led by the preference for contactless payments and ease of buying during the COVID-19 struck economy that has created considerable liquidity crunch among households. On a yearly basis, the Customer base was up by 244%. Further, the Merchant base has also increased impressively by almost 60% in six months and 217% in a year to reach more than 16,112 active merchants by H1 2020.

Data Source: Company Reports

Capital raise

BNPL players are using the favourable momentum to raise additional capital and solidify their balance sheet for future growth plans. On 17th July, Sezzle opened its share purchase plan of ~A$7.2 million after raising A$79.1 million capital on 15 July 2020 through a fully underwritten institutional placement. The company intends to use the proceeds from the capital raise to execute:

- International expansion including additional market development in Canada and low cost testing in other markets.

- On-boarding large enterprise merchants.

- Fuelling up sales and marketing activities by increasing salesforce and marketing activities.

- Investment in R&D and product enhancement.

- Strengthening its balance sheet. Incurring costs to refinance potential debt facility, cost of the offer and increased cash reserves.

To propel its enterprise merchant capabilities, the Company recently appointed Veronica Kat as Chief Revenue Officer who had been associated with PayPal since 2011.

Cash Position

Sezzle boasts of a strong cash position. As on 31 May 2020:

- The company had total cash and cash equivalents of US$34.4 million.

- Accounts payable stood at US$34.8 million, of which US$29.2 million relates to payables due to participants in the Merchant Interest Program.

- The company had an outstanding of US$20 million as Line of credit. US$20 million is the minimum draw required. As on 31 May 2020, excess borrowing capacity under the line of credit stood at US$16.5M.

Q2 Business Update

By the 2nd quarter ending June 2020, active Consumers reached 1.48 million, up by more than 243% year-on-year (YoY) and 28% on Quarter-on-Quarter (QoQ). Active Merchants reached 16,112, up by 27% QoQ and 219% YoY. This quarter performance has been the company’s best performing one since inception.

UMS witnessed an increase of 58% QoQ and 349% YoY, with an average monthly rate of US$62.7 million, up from US$39.8 million as reported on 1Q’ 20.

Sezzle claims to be well-posited to cater to the increasing number of North American consumers and retailers who are demonstrating a shift to eCommerce with COVID-19 restricting physical contact and driving contactless payments. The company reported that almost 100% of its transactions are through eCommerce. The company also reported that in Q2’ 20 it was witnessing customer loyalty by repeat usage registered for 18th straight month.

Bottomline

SZL has been beating the share market since its inception with COVID-19 Pandemic acting as a catalyst fuelling its business growth further. After reaching an all-time low during the March bear Market, SZL surged over 20x. With the resurgence of cases worldwide and renewed lockdown measures imposed, the focus is shifting on BNPL players as demand for contactless payment looks promising. SZL with a strong capital position in hand is heading the second half of 2020 on a positive note.