Highlights

- Vulcan’s overall income grew 34% year on year (yoy) to nearly NZ$700 million in the nine months ended 31 March 2022.

- Vulcan’s revenue from the steel sector rose by 42% yoy, while revenue from the metal sector increased by 21%

- In the same period, overall sales volume rose by 5% yoy.

Shares of materials firm Vulcan Energy Resources Limited (ASX:VUL) edged lower by 3.599% to trade at AU$ 8.570 per share at 1:00 PM AEST on the ASX. Despite announcing a trading update for the fiscal year ending 30 June 2022 (FY22), the firm’s shares failed to attract investors’ attention.

Vulcan was founded in 1995 and is an Australasian industrial product distributor and value-added processor with 29 processing and logistics facilities.

Good read: From Novonix to Vulcan, why are these 5 ASX-listed lithium stocks soaring high?

Vulcan’s performance in FY22

Vulcan’s overall income grew 34% yoy (year-on-year) to nearly NZ$700 million in the nine months ended 31 March 2022. During this time, Vulcan’s revenue from the steel sector rose by 42% yoy, while revenue from the metal sector increased by 21%. In the same period, overall sales volume grew by 5% yoy. During this time period, steel volume increased by 6% yoy, while metals volume increased by 2% yoy.

As a result of strong trading between February and the third week of April, and taking into consideration the balance of FY22, Vulcan revised its outlook for the year in the following manner.

- On the new guidance range 236-242, Vulcan reported post-IFRS at 16 (pro forma EBITDA).

- On the new guidance range 212-218, Vulcan’s pre-IFRS was at 16 (pro forma EBITDA).

- For FY22 pro forma NPAT, the company expects post-IFRS 16 between 136-140 and pre - IFRS 16 between 140-144.

Good read : What pushed Vulcan's (ASX:VUL) share price up on the ASX today?

Management remark

Rhys Jones, Vulcan’s CEO and managing director commented:

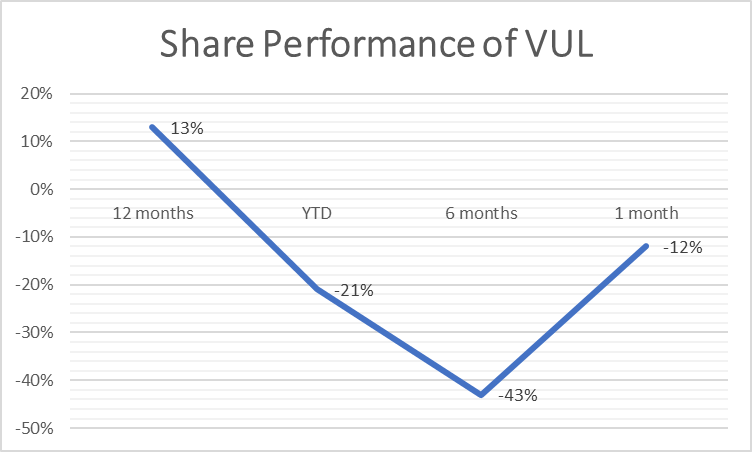

Share performance of VUL

Share performance of Vulcan

Vulcan has been on a positive streak for one year, with the stock increasing by 13%. The company’s performance has been adversely impacted since the middle of the year, with the stock dropping 43% in six months and 21% on YTD (year to date). Recently, the company has failed to pique the interest of investors, falling 12% in one month.

Image source: © 2022 Kalkine Media®

Good read: MLS, VUL, LYC: Look at top performing ASX lithium stocks in March