Hightlights

- The anticipated fall in the lithium market has likely caused the plunge in Pilbara's share price.

- Pilbara also formed a joint venture with Calix to develop a demonstration plant at the Pilgangoora Project.

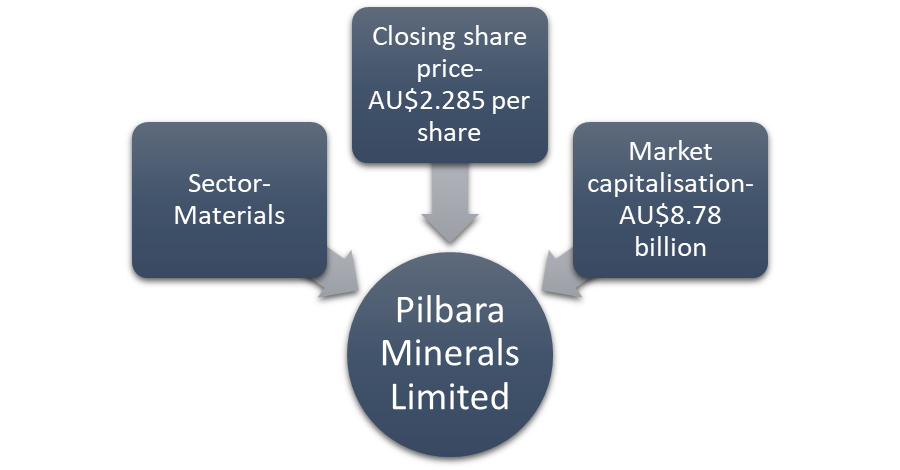

The shares of Pilbara Minerals Limited (ASX:PLS) closed 22.033% lower at AU$2.300 per share on the ASX today (1 June). Approximately 128 million shares of Pilbara Minerals were traded in today's trading session on the ASX.

The ASX-listed lithium explorer announced an update on its project with Calix (ASX:CXL) on the ASX today morning.

The share price of Pilbara Minerals has gained over 76% on the ASX over past 12 months. On the other hand, Pilbara Minerals' year-to-date share price fell almost by 35% on the ASX today (1 June).

Image Source © 2022 Kalkine Media ®

Why did Pilbara Minerals shares tumble on the ASX today?

Today, the company made a significant announcement on the ASX, which revealed recent updates from its project with Calix.

Pilbara informed about reaching an agreement with Calix on key commercial terms for the formation of a joint venture (JV) between the two parties. This joint venture will further enable the parties to develop a demonstration plant at the Pilgangoora Project to produce lithium salts and potential future commercialisation of the Mid Stream Project process.

As a result, Pilbara Minerals and Calix have signed an amended and binding Memorandum of Understanding (MoU), which was initially executed in May 2021. The signing of the MoU was followed by securing a grant worth AU$20 million from the Australian Government under the Modern Manufacturing Initiative (MMI) Manufacturing Translation Stream.

Read more: Pilbara Minerals (ASX:PLS), Calix (ASX:CXL) receive AU$20M grant, shares gain

After the formation of the joint venture, Pilbara will hold 55% interest, and Calix will hold 45% interest. Each party is supposed to fund their share of operating costs and license their technology into the joint venture.

The ASX 200 Materials sector was one of the worst-performing sectors on the ASX today. Meanwhile, the S&P/ASX 200 Materials sector (ASX:XMJ) closed 0.323% lower at 17866.6 on the ASX today (1 June).

Also read: Here's why Core Lithium (ASX:CXO) shares gained 422% in a year