Highlights

- Paladin Energy’s shares plunged over 3% as it opens its SPP today (6 April 2022)

- Paladin is seeking to raise up to AU$15 million (pre-costs) under the current SPP.

- SPP available to all Paladin Energy shareholders having a registered address in Australia or New Zealand.

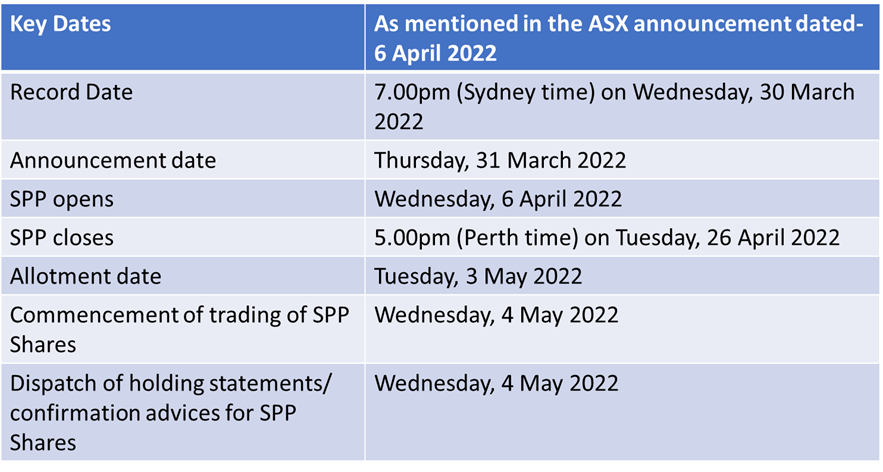

ASX-listed clean energy company Paladin Energy Ltd (ASX:PDN) opened its Share Purchase Plan (SPP) today for its Australia and New Zealand-based shareholders. The uranium explorer is seeking to raise up to AU$15 million (pre-costs) via the SPP. The SPP remains open for the registered shareholders till 26 April 2022 and shares which are expected to rank equally to ordinary PDN shares.

Post announcement in pre-trade hours Paladin Energy Ltd.’s share price fell on the ASX. As of date (6 April 2022) PDN shares were trading low in comparison to previous close, at AU$0.775 a piece at around 3:10 PM AEST.

Details of Paladin Energy Ltd.’s SPP

The SPP is open to eligible Paladin shareholders for up to AU$30,000 worth of shares. New Shares under the SPP are being offered by Paladin at an offer price of AU$0.72 a share. The offer price is at a discount of 8.9% to PDN’s closing share price as of 30 March 2022 on the ASX. It is also at a 12% discount to the volume weighted average price in last five days immediately prior to announcement of SPP. Paladin is to rank the new shares equally with existing shares issued on date of allotment.

Image Source: © 2022 Kalkine Media ®

Data Source: ASX announcement dated 6 April 2022

The SPP is not underwritten yet and follows Paladin’s previously announced placement of AU$200 million to sophisticated and professional investors.

Paladin Energy Ltd.’s recent performance on ASX

Paladin Energy Limited is the owner of a large global portfolio of uranium exploration and development assets. At this point when the world is looking towards nuclear its business seems quite relevant. In the last one month of trade on the ASX PDN’s share price has appreciated by about 5.47%. The movement is notable in comparison to the appreciation in the sectoral index ASX200 Energy Index (XEJ) which has moved up by a mere 0.67% in the last month. However, post announcement of SPP today, PDN’s share price has lost some shine, reversing almost all the gains it made in last 5 days of trade on the ASX.

Why did Nickel Mines (ASX:NIC) Pull Back Its Share Purchase Plan?

Bottom line

While a share purchase plan rewards the existing shareholders with an enhanced stake in the company, it also in a way seems to take away the option of buying into the company from other investors. Also, since a successful share purchase plan results in more ASX shares coming out in the market, the price of shares tends to go down as the demand/supply matrix shifts. The dip in share price of Paladin today appears to be a result of the same.

More from ASX- WTC, SUN, RHC: How are these stocks performing on ASX today?