Australian metallurgical coal markets are reportedly experiencing a demand surge since Russia started its invasion of Ukraine. The booming demand has in turn increased the earnings from Australian metallurgical coal exports.

No doubt that the one big reason is the met coal price reaching historical highs. One ASX-listed resources company seems to have gained good from this price hike for met coal. Also, due to the soaring prices even the company’s credit ratings improved, as reported in its latest quarterly update. In fact, this met coal producer’s share price has seen an appreciation of over 75% in the last 3 months and over 300% in a year.

So here is all you want to know about the company we are talking about,

Coronado Global Resources Inc. (ASX:CRN)

Coronado is one of world’s largest high-quality metallurgical coal producers and operates its business from Australia and the US. Coronado sends across its produce to customers located in Asia-Pacific, Europe and America. The demand for coal produced by Coronado stems majorly from the steel producers, businesses manufacturing steel-based products and renewable energy infrastructure.

Coronado’s operational presence

Image Source-© 2022 Kalkine Media®

These locations comprise of eight active and as claimed by Coronado, these mines are highly productive coal mines having immediate access to transport. Coronado claims to be a low cost and reliable provider of Met coal products sought by the world.

Latest updates on Coronado’s operations

As per the company’s Q1-22 report released on the ASX,

- It completed the quarter with increased coal production. The saleable produce was up 3.5% while sales volumes were up 1.4%.

- As a result, Coronado touched a record quarterly revenue in its March quarter, which was up 22% on previous quarter.

- Met coal made up to 95% and robust pricing in the met coal market helped Coronado reach a net cash position by quarter end.

- As claimed by the company, met coal prices and revenues for its shipments from both its US and Australian operations touched record levels.

Post quarter end, in early April, Coronado paid FY21 dividends and still could retain a net cash position. Also, Coronado switched to a fixed annual dividend policy of US$0.010 cents for each of its CDI (convertible debt instrument) held.

To add on to Coronado’s production uptick and favourable pricing effects in its latest quarter, two globally popular rating agencies S&P and Moody’s upgraded their corporate credit ratings for Coronado.

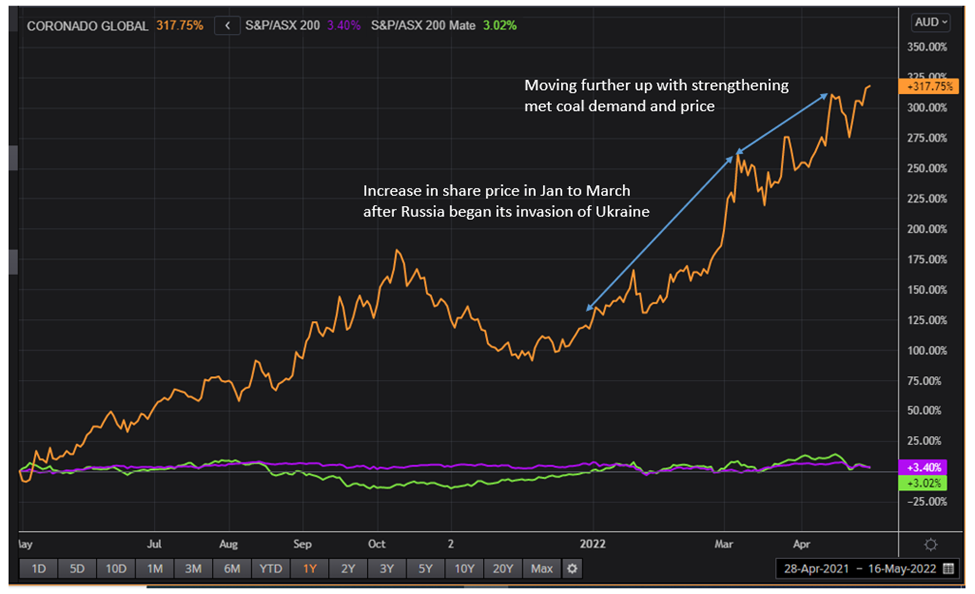

How is CRN share price performing on the ASX?

Coronado shares trade on the ASX with a market capitalisation of AU$3.97 billion (as of 4 May 2022). CRN share price has over an year appreciated more than 317%.

CRN Price chart in comparison to ASX 200 and ASX 200 Materials Index (XMJ), as of 4 May 2022 closing

Image Source- Refinitiv

In comparison to the broader Index ASX200 (XJO) and the ASX200 Materials sector index (XMJ) the shares of CRN have seen a huge bull run. Mainly since the beginning of 2022, as the Russian invasion of Ukraine began, prices of resources started hitting new highs and the west’s worries of a resource crunch seem to have pushed CRN’s share price higher. Post march quarter end, the metallurgical coal markets remained strong and coal prices were supportive which appear to have pushed the share price further up. Recent action seems to have been on the back of a favourable Q1-22 production update.

CRN’s share price performance as of 4 May 2022

Image Source-©2022 Kalkine Media®

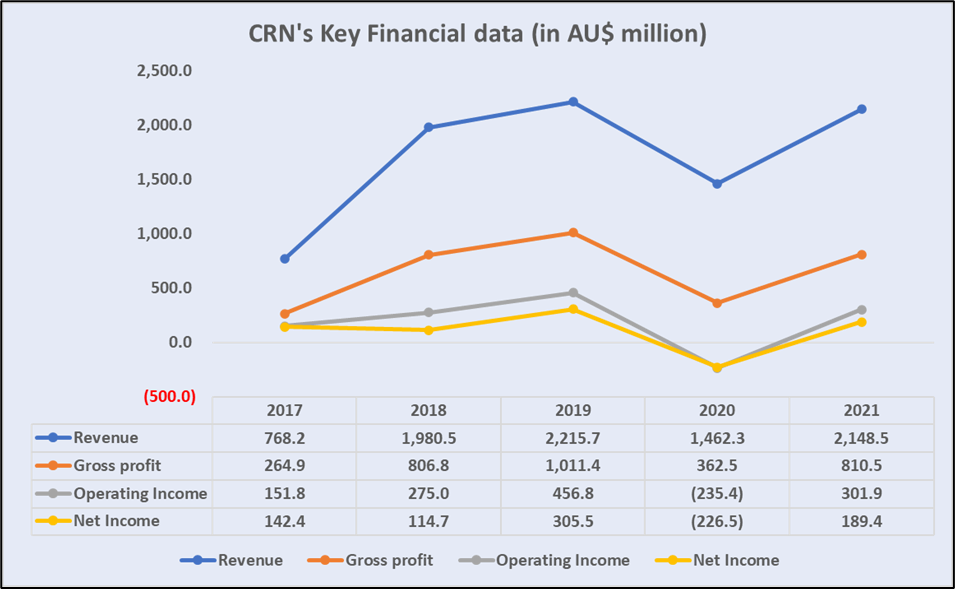

Here is a snapshot of CRN’s financial position-

Considering the financial data of Coronado Global Resources Inc. we have depicted the year on year movement in its key financial data.

Chart depicting CRN yearly financials for FY17 to FY21, Data Source- Refinitiv

Image Source: © 2022 Kalkine Media ®

As it can be seen on the graph above a major dip in revenue, profit and earnings is visible in 2020, which seems to be coming from the supply chain disruptions caused by Covid-19. The company has slowly recovered the traction lost in 2021 as the numbers have returned to the positive zone, helped by the rising coal prices.

The balance sheet analysis of Coronado for the last five years shows the following results.

Source: Data Source- Refinitiv

The current ratio reflects on the short-term liquidity available with the company. From the company’s last five-year financial data, it can be seen that its liquidity position has improved from 2019 to 2021. To add on, even the debt in comparison to the outstanding equity has reduced in 2021.

How does Coronado see its future?

While the uncertainty regarding Russian coal supply and tight market demand supply position continues, Met Coal prices have corrected from March highs. New COVID-19 lockdowns in China have also added on to the troubles on the logistics side of the steel value chain and supply, thus lowering Met Coal demand in the short term. However, Coronado claims that its Met Coal demand is still high demand. Coronado’s high-quality produce and unique geographical diversification helps it to ship products into China from US amid the Australia-China trade tussle.

To add on. heightened demand for Met Coal from existing and new European customers helps sell out Australian supply.

As of now, Coronado expects market to go back to the demand supply balance. It also expects prices to reduce from current highs and yet remain supportive of continued strong Met Coal demand. Coronado also expects trade constraints with China and Russia, and high energy costs to provide the support and floor levels to Met Coal prices. However, since commodity markets are difficult to predict with precision, whether or not Coronado remains profitable will only be known with time.