Highlights

- Ioneer’s wholly-owned subsidiary has signed MoU with Nevada based NexTech Batteries.

- INR will supply lithium carbonate and lithium hydroxide from its Rhyolite Ridge Lithium-Boron Project to NextTech.

- The stock has gained over 52% in the last 12 months.

The shares of lithium–boron supplier, Ioneer Ltd (ASX:INR), soared over 4% today following an MOU announcement.

INR shares traded 4.629% higher at AU$0.565 per share at 12:30 PM AEDT.

Investors are keeping the stock on their radar following the completion of a memorandum of understanding (MoU) between INR’s wholly-owned subsidiary -Ioneer USA Corporation, and Nevada based NexTech Batteries.

How Does Metadata Impact Users’ And Companies' Privacy?

NexTech is a global leader in proprietary lithium-sulphur battery technology-based in Carson City, Nevada.

MoU details

Image source: © A2dstudiodesign | Megapixl.com

Both companies have reflected their mutual interest in acquiring lithium carbonate and/or lithium hydroxide supply from INR’s Rhyolite Ridge Lithium-Boron Project for NexTech’s production facility in Carson City to manufacture next-generation solid-state batteries.

Related read - Global Lithium (ASX:GL1) races 18% higher on Suzhou TA&A agreement

The company aims to revolutionise the automotive industry, renewable energy, grid storage applications, drones/eVTOL aircraft, and more.

INR further intends to produce upwards of 22,000 tonnes of lithium materials per year in Esmeralda County.

Once production has commenced, both the companies intend to discuss the potential for long-term supply to NexTech.

Also, it is worth mentioning that the introduction between both companies was facilitated by Northern Nevada Development Authority (NNDA).

Management comments

INR’s managing director, Bernard Rowe, said that although both entities have prioritised the need for a domestic battery supply chain, developing Rhyolite Ridge will be challenging with little current supply.

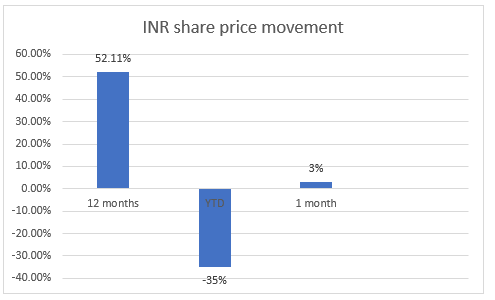

INR share price movement

Image Source © 2022 Kalkine Media ®

While the stock has gained over 52% over the last 12 months, it has dropped 35% on YTD this year. Meanwhile, it has gained 3% over the last one month.

Outlook

This collaboration supports Nevada’s clean energy strategy. It is another example of how the region can move toward a more sustainable future by creating jobs across the supply chain, from mining to high tech manufacturing.