Highlights:

- Iron ore miner Grange Resources, in last one year, has gained a whopping 109% on ASX.

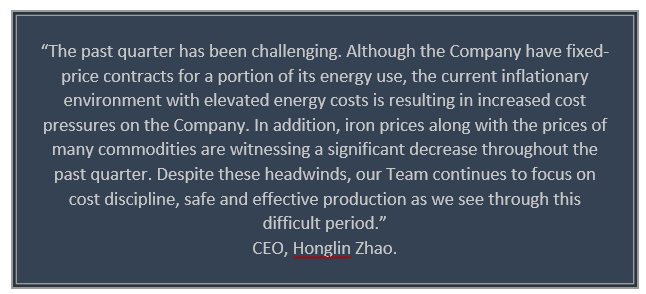

- The company, in its last financial update, informed that it has been facing increased cost of pressures.

- Grange’s June quarter’s cash and liquid investments rose to AU$369.47 million from AU$356.93 million in March quarter.

Shares of Grange Resources Limited (ASX:GRR), which is the owner and operator of one of Australia’s biggest integrated iron ore mining and pellet production businesses, were spotted trading 10% higher at AU$1.375 apiece at 12:52 PM AEST on Wednesday, 24 August 2022.

Around the same time, the broader benchmark S&P/ASX 200 Materials sector was 0.952% higher at 16,521.1 points.

Things to know about Grange Resources:

Grange Resources, a premier producer of iron ore pellets, is based in the northwest region of Tasmania and has projects like Savage River, Port Latta and Southdown to its credit.

The Savage River is a magnetite iron ore mine, 100kms southwest of the city of Burnie and produces high concentrated magnetite; Port Latta is located 70kms northwest of Burnie and is wholly-owned pellet plant and port facility at Port Latta, producing more than 2.2 million tonnes of iron ore products annually; Southdown is a joint venture between Grange (70%) and SRT Australia Pty Ltd (30%) and is an advanced project with more than 1.2 billion tonnes of high quality mineral resources.

Image source: © Crazymedia | Megapixl.com

Company’s financials:

In its report for the quarter ended 30 June 2022, Grange stated due to income tax payment for 2021 fiscal year, the trade receivables fell from AU$63.39 million in March quarter to AU$8.52 million in June quarter. The cash and liquid investments stood at AU$369.47 million against AU$356.93 million in March quarter.

Share price performance of Grange Resources:

In last one year, the stock GRR has gained 109.23% on ASX. On year-to-date basis, the stock has appreciated its value by more than 72%. While in last six months, GRR has gained 81.33%, in last one month, it has gained 3.03%. In last five trading days, the stock has gained 10.12% (as of 1:00 PM AEST, 24 August 2022).