Highlights:

- The EU embargo on Russian coal can offer growth opportunities to Australia, one of the largest coal exporters in the world.

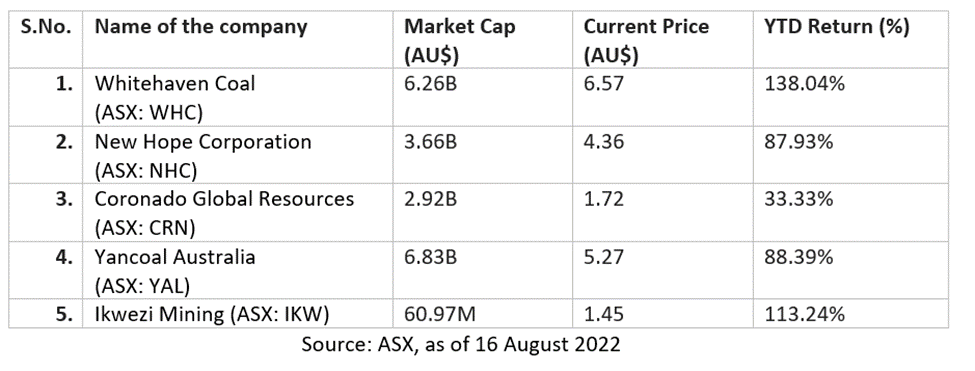

- Many ASX coal stocks have delivered double-digit year-to-date returns.

The import ban on Russian coal into the European Union is now effective for almost a week. Putting an embargo on Russian coal is expected to hit Russia’s lucrative fossil fuel revenue. This embargo is part of the steps taken against Russia to target its economy with sanctions on SWIFT payments, hydrocarbon exports, travel, flights, and other areas in response its invasion of Ukraine.

Meanwhile, there are concerns over the European Union’s dependence on coal imports as approximately half of the region’s coal requirement is fulfilled by Russia.

However, this news seems favourable for Australian coal companies as Australia is among the top coal exporting countries. As per the latest Resources and Energy Quarterly report, Australia is the world’s largest thermal coal exporter and second largest metallurgical coal exporter.

On that note, here is a glimpse of the latest performance of few of the leading ASX-listed coal stocks as of midday 16 August 2022 - Whitehaven Coal Ltd (ASX:WHC), New Hope Corporation Limited (ASX:NHC), Coronado Global Resources Inc (ASX:CRN) and Ikwezi Mining Ltd (ASX:IKW).

Whitehaven Coal Limited (ASX: WHC): Based on the quarterly report for the period ended on 30 June 2022, the company achieved record coal prices at AU$514/t for the quarter and AU$325/t for FY22.

Total equity sales of produced coal reached 4.4Mt for the June quarter, 23% higher quarter-on-quarter. Thermal coal and metallurgical coal constituted 84% and 16% respectively for the June quarter coal sales.

The company’s managed sales of produced coal stood at 17.6Mt for FY22 and as per the guidance for FY22.

The company expects to register EBITDA of around AU$3.0 billion for FY22, which is much higher than the FY21 value of AU$0.2 billion.

New Hope Corporation Limited (ASX: NHC): The ASX-listed company recently wrapped up the acquisition of a 15% interest in Malabar Resources Limited for a total investment of AU$94.4 million. The Maxwell Mine project owned by Malabar received final state and federal approvals after being granted a mining lease in November 2021. Construction of the underground metallurgical coal project commenced in May 2022.

On the operational performance part, the company updated that disruptions due to wet weather in Bengalla and the Hunter Valley’s logistics chain were partially offset by strengthening of the coal price.

The company is set to release its quarterly activities report during the current month.

Coronado Global Resources Inc. (ASX: CRN): During the June 2022 quarter, the company posted a record Group Revenue of US$1,033 million, beating the previous quarter's record by 9.0%.

Group Capital Expenditure stood at US$91.5 million for the six-month period ended June 2022. Dividend payments of US$351 million for H1 2022 were completed in April and June. Closing cash stood at US$486 million, while net cash was at US$171 million as on 30 June 2022.

The company also highlighted its inclination towards the environment and climate. It includes emission reduction plans and targets as mentioned in the 2021 Sustainability Report.

Yancoal Australia Ltd (ASX: YAL): For the June 2022 quarter, the company reported attributable saleable coal production of 7.4Mt and attributable coal sales of 7.9Mt.

The average realised coal price stood at AU$368/t for the June quarter and AU$314/t for 1H. The combined thermal and metallurgical coal sales delivered a 234% year-on-year increase in total realised price for 1H. The company reported a record high of cash generation at AU$2.8 billion for 1H 2022.

The company expects 31 to 33 million tonnes of attributable saleable coal production during 2022, down from the previous guidance of 35 to 38 million tonnes. Also, cash operating costs are expected at AU$84-89/tonne (previously $71-76/tonne).

The company revised its operating cost guidance because of the COVID-19 impacts, rising diesel prices and flooding rain events which heavily impacted its output during the June quarter.

Ikwezi Mining Ltd (ASX: IKW): As per the company's activities report for the June 2022 quarter, the Kliprand pit reported a 37% decrease in Run-of- Mine (ROM) production. Moreover, a significant decrease in production for the Emoyeni Wash Plant was observed.

The main reason for this substantial decrease in production is flooding in the KwaZuluNatal Province.

E&D expenditure was nil for the June quarter, while for mining production, the expenditure was AU$ 15,957 million.