Highlights

- 45Mt maiden resource confirmed at Tanbreez Rare Earth Project

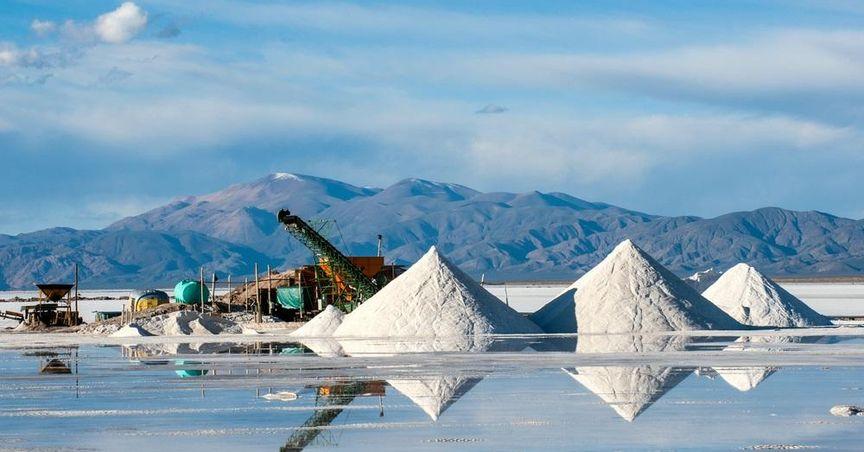

- Strategic progress at Wolfsberg and Ukraine lithium assets

- Gallium discovery adds value amid global supply challenges

European Lithium (ASX:EUR) has reported a strong March quarter, marked by a series of strategic milestones across its global critical minerals portfolio. A key highlight was the announcement of a 45 million tonne maiden JORC-compliant resource at the Tanbreez Rare Earth Project in Greenland, positioning the company for increased relevance in the rare earths market.

Tanbreez, held through its controlling stake in Critical Metals Corp (NASDAQ:CRML), delivered an initial resource grading 0.38% total rare earth oxides (TREO), with a substantial 27% comprising high-value heavy rare earth elements (HREE). Deep drilling at the Fjord prospect returned impressive assays of up to 0.44% TREO and HREE content as high as 28%.

These results have underpinned a Preliminary Economic Assessment (PEA) and scoping study, revealing a Net Present Value (NPV) ranging from US$2.4 billion to US$3 billion and an Internal Rate of Return (IRR) of 162% before tax. These figures underscore the project’s strong commercial potential, particularly as Western markets ramp up demand for rare earths.

Adding further value, significant levels of gallium oxide were discovered at Tanbreez, offering potential exposure to the rapidly growing gallium market. This is particularly notable as global gallium production is heavily concentrated in China, which has restricted exports of the critical mineral. As demand rises from sectors such as electronics, defence, and solar energy, this discovery could boost project economics.

In parallel, infrastructure planning advanced at the Wolfsberg Lithium Project in Austria. The project, which has a long-term supply agreement with BMW AG, is moving forward without needing a full environmental assessment – a key regulatory advantage. Engineering work on a lithium hydroxide refinery in Saudi Arabia also progressed through a joint venture between CRML and Obeikan Investment Group.

In Ukraine, efforts continue to secure long-term extraction permits for the Shevchenkivske and Dobra lithium projects. While field activity remains paused due to regional conflict, Dobra holds a JORC resource of 90 million tonnes at 1.36% Li₂O. European Lithium remains poised to accelerate development should geopolitical conditions improve.

Amid broader market interest in ASX dividend stocks, European Lithium's long-term strategic positioning across multiple battery metal projects adds further depth to its investment appeal. As the company strengthens its presence among ASX200 peers, it continues to deliver key milestones across energy transition-critical projects.

Financially, the company reported A$2.96 million in operating cash outflows, with A$2.82 million directed towards project expenditure. European Lithium’s holding in CRML was valued at US$103.6 million (A$161.6 million) at the end of April 2025.