Summary

- Ora Banda Mining Limited seeks to recommence production at its Davyhurst Gold Project during the first quarter of CY2021.

- Definitive Feasibility Study has indicated the potential of the project to deliver strong cash flows and financial returns over the mine life of 5.2 years.

- Ora Banda had concluded retail component of its A$55 million capital raising with significant support from investors.

- Phase 2 RC drilling program at Riverina South was completed focused on mineralisation in two discreet areas within the 1.0 km long target corridor.

Distinctively placed gold explorer and developer, Ora Banda Mining Limited (ASX:OBM) owns highly productive Eastern Goldfields region of Western Australia through its 100% owned Davyhurst Gold Project, which is located just 120 km north-west of Kalgoorlie.

Notably, the Directors constituting the Board of Ora Banda have a wealth of experience in the resource as well as finance sectors.

Off late, OBM has been looking to recommence production at its Davyhurst Gold Project. The Project includes 112 mineral tenements totalling approximately 1,336 km2 prospective for gold as well as nickel sulphide and base metal mineralisation.

Previous Update: Ora Banda Mining Boasts Substantial Progress across the June Quarter, Site Works In Progress

Robust DFS Concluded At Davyhurst Project

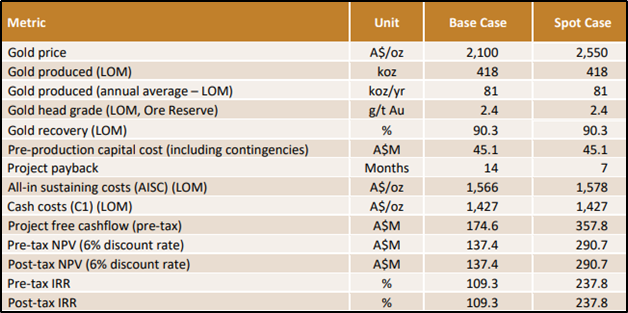

Interestingly, a robust case for a rapid and low-capital path to achieving sustainable gold production was highlighted through the Definitive Feasibility Study (DFS) at Davyhurst. Moreover, the DFS indicates the potential of the project to deliver strong cash flows and financial returns over the mine life of 5.2 years. This is expected to be achieved with an annual free cash flows of A$68.8 million at a gold price of A$2,550/oz.

The pre-development activities to date, as well as those commenced on delivery of the DFS, have been focused on

- Refurbishment of the camp facilities

- Planning for the Davyhurst plant remedial works program

- Early planning works for mine development at both Riverina open pit and Golden Eagle underground mines

Key DFS Metrics (Source: ASX Announcement dated July 31, 2020)

Further, DFS uncovered Underground Mineral Resource of 77,000 ounces @ 5.8g/t at Maiden Callion, and Underground Mineral Resource at Riverina increased to 139,000 ounces @ 5.9g/t.

Detailed Discussion at: Ora Banda Mining Ready to Get the Boots on the Ground; Highlights Key Validations from DFS at Davyhurst Project

Presently, OBM is engaged in ongoing exploration drilling at various prospects, including Mt Ida & Riverina South.

The Company looks forward to commencing plant commissioning in Q4 CY20 and initial gold production scheduled for the first quarter of the calendar year 2021.

Additional Strong Results Revealed at Riverina South

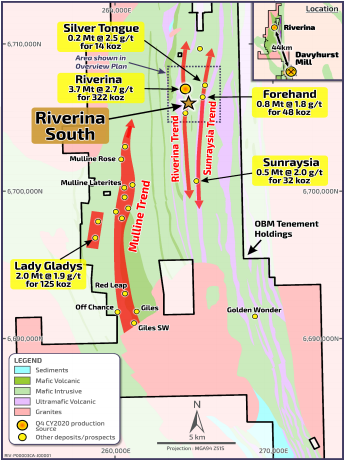

Ora Banda is committed to unravelling major value from its strategic and prospective landholding, Davyhurst project. For this purpose, Ora Banda has been targeting resource development activities at five advanced projects: Riverina, Waihi, Siberia, Callion as well as Golden Eagle.

The principal target within the project is gold mineralisation that occurs throughout all geological domains within the project.

Riverina Area Location Plan (Source: ASX Announcement)

The highly prospective tenements for Nickel and Copper present significant upside for Ora Banda while the Company lays an urgent development focus on its deposits including, the Riverina, Callion Waihi, Golden Eagle, and Siberia deposits.

Off late, Phase 2 infill reverse circulation (RC) drilling program targeted a 1.0 km long, highly prospective strike extension corridor at the Riverina South which has returned robust results for the Company. Within this 1.0 km long target corridor, there was mineralisation in two discreet areas. These include the area adjoining and immediately to the south of the main Riverina open pit and the area around the British Lion Prospect located at the southern end of the target corridor.

At the Riverina deposit, mineralisation is hosted in the main mining area in three separate Lode systems, encompassing the Main Lode, Murchison Lode and Reggie Lode.

Interesting Read: Ora Banda Reports Significant Increase in Mineral Resources at Riverina Project, A Walk-Through Yearly Developments

Significantly, OBM seeks to commence Open-pit mining at Riverina during the fourth quarter of the year 2020.

Ora Banda Well-Funded for Commencing Production Activities

For the purpose of becoming suitably funded for undertaking production at Davyhurst, Ora Banda announced equity capital raising worth A$55 million including

- An institutional placement to raise approximately A$40 million

- A one for nine Accelerated Non-Renounceable Entitlement Offer to raise approximately A$15 million

The Company witnessed strong support from investors for the capital raising and successfully completed the retail component of its one for nine accelerated non-renounceable pro-rata entitlement offer. Pursuant to the closure of the offer OBM was expected to issue around 14.5 million new shares at the offer price of A$0.23 per share, to raise around A$3.3 million.

Detailed Discussion at: Ora Banda Announces Successful Completion of Retail Entitlement Offer, New Shares to Commence Trading on 3 August 2020

In essence, the consistent mineralisation and several solid grades returned from RC drilling have presented a significant opportunity for the Company. Moving ahead, Ora Banda seeks to better define the mining potential across its highly prospective project areas. Moreover, Ora Banda also looks forward to assessing the ways through which potential mining operations can be incorporated into its future mining plans at the area.

"OBM is trading at $0.005 per share, up by 1.58% (AEST: 03:28pm) on August 27, 2020."