Highlights:

- Rio has recently shared a second update on its communities and social performance (CSP) report.

- The mining giant has inked an MoU with National Amusement Park LLC and the mayor’s office of Ulaanbaatar City on 6 September 2022 to restore a part of the Amusement Park.

- Rio share price closed 1.41% down at AU$96.67 apiece on 7 October 2022.

Australian mining giant, Rio Tinto Limited (ASX:RIO) produces titanium dioxide, borates, aluminium, coal, iron ore, gold, copper and other metals and minerals. This AU$36.39 billion company has marked a rise of 41.55% in the past five years.

On a year-to-date (YTD) basis, Rio shares have outperformed its benchmark index, ASX 200 Materials index (INDEXASX:XMJ). Rio share price has fallen 3.15% on YTD, and the materials index has dropped 6.40%.

While looking at the yearly performance, Rio shares have reported a fall of 3.83%, whereas the index has gained 7.40%. In the past six months, Rio share price has fallen 18.85%, and the index has dropped 14.94%.

What has been happening in Rio recently?

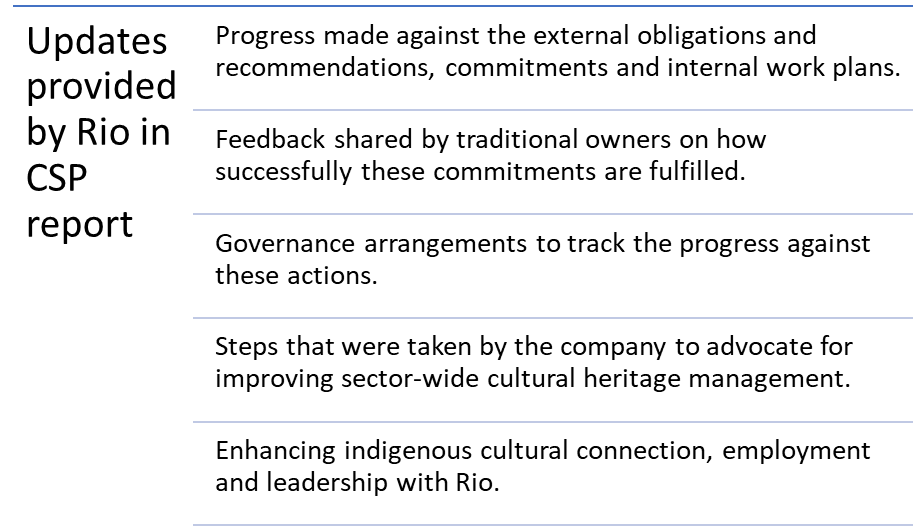

Rio established the communities and social performance (CSP) report in September 2021 to maintain transparency regarding its approach to cultural heritage protection. On 7 September, the company provided a second update about its CSP report.

In the report, the company has provided updates on:

Rio Tinto has recently signed an MoU with National Amusement Park LLC and the mayor’s office of Ulaanbaatar City to restore 10 hectares of land in National Amusement Park.

According to the media release, Rio would undertake restoration work in the western section of the Park.

On 6 September 2022, Rio informed that it has partnered with Voltalia and Black Economic Empowerment to supply renewable solar power to Richard’s Bay Minerals (RBM). RBM would use renewable solar energy for its operations in KwaZulu-Natal, South Africa. Reportedly the construction at the Bolobedu Solar PV project would begin in 2023 and is expected to be completed by 2024. Rio said that the project would deliver a generation capacity of around 300GWh.

As per the release, the renewable energy supply is expected to reduce greenhouse gas emissions of RBM by a minimum of 10%.

Through a media release, Rio shared that it has finalised work with Energy Resources of Australia (ERA) to amend the AU$100 million credit facility to assist it with the management of liquidity issues. Rio informed that ERA would renew its board committee to bring new perspectives to handle schedule overruns and material costs on the Ranger rehabilitation project in the Northern Territory of Australia.

_10_07_2022_07_08_32_636227.jpg)