Highlights:

- Australia is home to several commodities like gold, iron ore, lithium, graphite, etc.

- Gold mining primarily takes place in Western Australia.

- Gold is the third highest-produced commodity in this region, followed by iron ore and petroleum.

Australia is said to be a mineral-rich land, hosting several commodities starting from iron ore, gold, lithium, nickel, aluminium, graphite, etc. Gold is one such commodity that is widely mined and developed in Australia. Western Australia is specifically considered to be a rich source of oil, minerals, and commodities.

Gold is the third-largest produced commodity in Western Australia, followed by the production of iron-ore and petroleum.

Here, we have featured three ASX-listed gold mining companies, some of their recent updates and a summary of their ASX performance today (2 November 2022). These gold mining companies are- Newcrest Mining Limited (ASX:NCM), Northern Star Resources Ltd (ASX:NST), and Evolution Mining Limited (ASX:EVN).

Newcrest Mining Limited (ASX:NCM)

Newcrest Mining Limited’s (ASX:NCM) shares opened Wednesday's trading session on a positive note on ASX. The share price appreciated by 1.648% to AU$17.880 apiece at 10:33 AM AEDT today.

On 27 October 2022, Newcrest announced its September quarterly activity report for the period ended 30 September 2022. Following are the key highlights of Newcrest's quarterly activity report:

- Newcrest reported a gold production of 527koz and a copper production of 32kt during the quarter.

- During this period, Newcrest's All-In Sustaining Cost (AISC) was AU$1,098/oz, and it delivered an AISC margin of AU$579/oz.

- Furthermore, the company is expecting the gold and copper production to rise more during the December 2022 quarter.

Newcrest is a Melbourne-based company with a market capitalisation of AU$15.50 billion at present.

In the last 12 months, Newcrest's share price has dropped almost 26%, and on a YTD basis, the company's share price declined almost 27% on ASX (as of 10:33 AM AEDT today).

Image source: © Bendicks | Megapixl.com

Northern Star Resources Ltd (ASX:NST)

Shares of Northern Star Resources Ltd (ASX:NST) were buzzing in the green territory on ASX on Wednesday morning. The shares opened trading 1.470% higher on ASX at AU$8.970 apiece at 10:27 AM AEDT today.

On 19 October 2022, Northern Star came up with its quarterly activity report on ASX for the period ended 30 September 2022. Key pointers from the company's September quarterly report are:

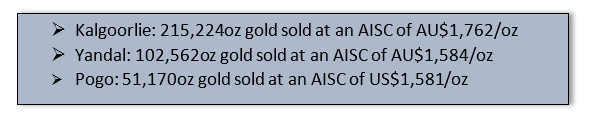

- Northern Star reported a total gold sales volume of 369koz at an AISC of AU$1,788/oz (US$1,228/oz) and AIC of AU$2,361/oz during the September quarter.

- September quarter performance by production centre:

- Furthermore, the commissioning of Thunderbox mill will continue with nameplate capacity expected H2 FY23, said Northern Star.

- Northern Star's Pogo will continue to perform at a nameplate capacity of 1.3Mtpa, sustaining Q4 FY22 mining and milling rates, however at lower-than-expected grades.

Northern Star is a Western Australia-based gold mining and exploration company with a market capitalisation of AU$10.24 billion.

The share price of Northern Star has reduced by 0.89% on ASX in the last one year. Furthermore, on a YTD basis, the company's share price declined almost 5% on ASX (as of 10:27 AM AEDT today).

Evolution Mining Limited (ASX:EVN)

Image source: © Bashta | Megapixl.com

Shares of Evolution Mining Limited (ASX:EVN) were spotted trading at AU$2.090 per share on ASX at 10:21 AM AEDT today.

On 20 October 2022, Evolution Mining shared the quarterly report for the September quarter ended 30 September 2022. Highlights of the company's September quarter are:

- Evolution's safety performance has improved in the September quarter with a 5% reduction in TRIF to 10.15.

- The company has reported gold production of 161,098 ounces during the quarter. Furthermore, the quarterly production is expected to increase for the remainder of FY23.

- Evolution's Mt Rawdon production was impacted by almost 6,500 ounces due to heavy rain.

- The company's All-in Sustaining Cost (AISC) was of AU$1,513 per ounce (US$1,034/oz) during the given period and is further planned to come down over FY23.

- Evolution said that its achieved copper price for the quarter increased AISC by almost AU$145 per ounce against the plan.

- The company has also reported a high margin operating mine cash flow of AU$206.3 million or AU$1,266 per ounce sold in the given period.

- All sites of Evolution have generated positive cash flow before major capital in the September quarter.

Evolution is a Sydney-based gold mining company with a market capitalisation of AU$3.83 billion.

The share price of Evolution has come down 41.24% in a year, and on a YTD basis, its share price declined almost 49% on ASX (as of 10:21 AM AEDT today).

Meanwhile, the S&P/ASX 200 Materials sector (INDEXASX:XMJ) was quoted at 15771.8 points, up 0.89% or 139.2 points on ASX at 10:52 AM AEDT today (2 November 2022).