Summary

- The COVID-19 pandemic has significantly impacted the economies of the world with the industrial sector, that thrives on the strength of the economy, severely crippled.

- Most of the prominent players are trading in a range of 10% - 40% lower than a year before.

- Few players such as Transurban Group, Brambles, Sydney Airport, and Aurizon are banking upon debt facilities for a more robust balance sheet and liquidity position.

- Others such as Auckland International are resorting to job cuts and lowering capital expenditure to maintain liquidity.

COVID-19 continues to impact world economies, and the growing uncertainty concerning how long it will continue affecting human life is alarming. The industrial sector, which thrives on an economy’s strength, has been hurt. The impact on players within the sector is reflected in the market with share prices down by as much as 40% compared to the previous year’s levels. However, no matter how much time it takes to recuperate, once the economy recovers, the industrial sector has reasonable prospects of levelling up.

It is imperative to look at companies that are taking various initiatives to sail through the coronavirus storm and come back stronger once the economy starts showing pre-COVID-19 signs.

On that note, let us cast an eye on a few ASX-listed industrial sector players.

Transurban Group (ASX:TCL)

Transurban is a Melbourne-headquartered developer and operator of toll roads across Australia and North America.

On 22 July, TCL announced a fully franked dividend of A$0.16 per security to be paid on 14 August for six months ended 30 June 2020.

Earlier, on 13 July, the Company announced notifying redemption and delisting of notes worth EUR500 million, as part of its Euro Medium Term Note Program at the Singapore Exchange.

TCL had disclosed the opening of M8 (erstwhile New M5) Toll road in the first week of July. From 5 July, the group also commenced tolling on M5 East. The Company emphasized that M8 will assist in easing traffic on M5 East, one of the most congested routes in Sydney. M8 is also an integral part of the WestConnex project which is expected to provide motorists with a continuous 33-kilometre motorway network without any traffic-light, saving up to 30 minutes while travelling from Liverpool to Southern CBD.

On 24 July 2020, TCL closed at A$13.700, down by 1.154% from the previous close. The Company is trading almost 8% lower compared to a year earlier.

Brambles Limited (ASX:BXB)

Brambles Limited is a freight operator focused on unit-load equipment, pallets, crates, and container.

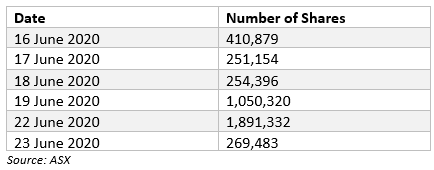

The Company announced the cancellation of ~4.13 million shares last week on the dates mentioned below according to the share buy-back on the ASX:

BXB had earlier highlighted a sales growth of 6% in Q3 and 9M of FY20. According to the Company, the growth demonstrated resilient and defensive business nature experiencing continuous price momentum and strong volume growth at its key markets, regardless of the unprecedented times during COVID-19. Brambles had a steady liquidity position of A$1.1 billion of funds as deposit and undrawn committed credit facilities worth US$1.3 billion as on 28 March 2020.

The Company also revised its FY20 guidance ending June 2020 because of the prevailing uncertainty impacting the performance of the business. BXB expects 5%-7% sales growth for FY20 with an underlying profit growth between 3%-5%.

On 24 July 2020, BXB closed at A$10.670, down by 1.295% from the previous close. The Company is trading almost 11% lower compared to a year earlier.

Sydney Airport (ASX:SYD)

Sydney Airport, on 20 July, published traffic update for June 2020, which reveals a fall of 93.3% in the domestic traffic performance to 140,000 over the previous corresponding period. The data showed a 97.6% decrease in international traffic performance to 32,000. However, the numbers were up when compared to May 2020, which recorded 92,000 total passenger traffic. The Company anticipates a continuous drop in passenger traffic as restrictions continue.

At the AGM 2020, Sydney Airport highlighted flat traffic increase since 2018. However, attributed sensible operational and commercial management as the driving force that allowed the group to experience strong revenue growth and declining operating expenses. The Company also achieved a 5.2% increase in Net Operating Receipts and distributed a 4% increased dividend of 39 cents per security.

SYD has a strong liquidity position of A$2.7 billion. It also highlighted securing an additional A$850 million of two-year and three-year bank debt facilities. The Company said its liquidity position could help SYD to cover debt maturities until the end of CY 2021.

The Company also does not intend to raise any equity presently and did not declare an interim distribution. SYD also reduced its capital expenditure guidance and targets an expenditure of A$150 million to A$200 million for the next 12 months starting April 2020.

On 24 July 2020, SYD closed at A$5.400, down by 1.818% from the previous close. The Company is trading almost 32% lower compared to a year earlier.

Auckland International Airport Limited (ASX:AIA)

Auckland International reported a decrease of 84.9% in total passenger volumes in June 2020 at Auckland Airport when compared to pcp. International passengers (excl. Transits) decreased by 97.0%, transit passengers were down 96.5%, and domestic passengers were down by 70.9%.

In May, Auckland Airport recently highlighted that total passenger volumes decreased by 94.7% compared to pcp. International passengers (excl. Transits) traffic has also decreased by 98.0%, with transit passenger traffic experiencing a fall of 98.3% and domestic passengers’ traffic down by 91.1%.

With business down, Auckland International Airport intends to carry out another round of undetermined numbers of job cuts post a 25% reduction in its workforce during COVID-19. The operator plans to undertake measure to boost liquidity by reducing operating costs and suspending or terminating capital expenditure related contracts, including reducing the number of external contractors supporting the capital programme and wider business and staff changes.

On 24 July 2020, AIA closed at A$5.900, down by 0.169% from the previous close. The Company is trading almost 36% lower compared to a year earlier.

Aurizon Holdings Limited (ASX:AZJ)

Aurizon Holdings is Australia’s leading rail freight operator.

Aurizon recently appointed George Lippiatt as Chief Financial Officer and Group Executive Strategy effective March 2020. Mr Lippiatt has been selected post an internal and external recruitment process.

In the first week of June, Aurizon Holdings completed the refinancing of Aurizon Network’s bank facilities that have provided the Company with an additional A$420 million with the cumulative commitments under the facilities at A$1.3 billion. Post refinancing, the existing syndicated debt facilities which were maturing in 2021 and 2022 will be repaid and cancelled, and the new bank facilities issued will mature between 2023 and 2025.

Along with announcing the refinancing, the Company also reiterated that its underlying EBIT guidance for FY2020 would remain between A$880-A$930 million.

On 24 July 2020, AIA closed at A$4.660, up by 0.866% from the previous close. The Company is trading almost 17% lower compared to a year earlier.