Highlights

- CSL Limited share price drops about 1.69% by afternoon today (12 May, 1:PM AEST).

- CSL has warned of a delay in the Vifor pharma acquisition.

- CSL shares also track the broader market and healthcare sector downtrend.

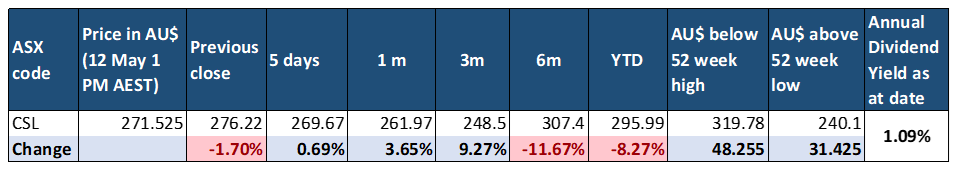

Shares of the Australian pharma giant CSL Limited (ASX:CSL) are grabbing investors' attention today (12 May 2022). CSL Limited's share price is down 1.69%, at AU$271.525 a share by afternoon (1:09 PM AEST), after the company announced an update related to its Vifor Pharma acquisition. Another reason behind the fall in CSL shares seems to be the weakness in the overall equity markets and in the healthcare sector in particular.

What’s in CSL Limited’s update on Vifor Pharma acquisition?

While CSL Limited's Vifor Pharma acquisition deal has been in the news for some time now, investors and the company were expecting a deal closure by June 2022. However, now CSL believes that the deal may get delayed by few more months because of the delay in obtaining regulatory approvals.

Despite the delay in its anticipated timeline, CSL remains confident in acquiring Vifor Pharma AG to expand its presence in the rapidly growing nephrology market. The deal shall also leverage the companies' combined expertise to deliver innovative illness solutions to rare and serious diseases.

What is the delay’s impact on CSL’s share price ?

While CSL Limited shares have been gaining since the last two days on the ASX, they have suddenly dived into the red today. As per the company's announcement, the deal completion has gone off the anticipated schedule; this appears to have made investors and shareholders cautious.

While CSL is still confident in completing the acquisition deal, a delayed schedule seems to be testing investors' patience. As a result, the CSL share price is weak post the delay warning announcement on ASX.

How have CSL shares behaved in near term?

For the last three months, CSL's share price has been on a gaining streak. CSL stock has appreciated by more than 9% since February. However, its shares witnessed some correction today. While the primary reason behind this fall appears to be the delay in Vifor Pharma acquisition, the impact of the broader market weakness is also be visible.

Image Source © 2022 Kalkine Media®

Today, the ASX200 healthcare sector index (XHJ) is down by 1.60%, following the broader market index ASX200, which is about 1.18% lower. All the top 50 stocks (as per market capitalisation) represented by the ASX50 index are also down by 0.98%. The market appears to be bearing the brunt of the US' higher than anticipated inflation data. CSL, a large-cap company in the healthcare sector, also has operations spread across the US, alongside facilities in Australia, Switzerland, and the UK.

Bottom line

While news of an anticipated extension of the Vifor Pharma acquisition has taken CSL shares down in the red zone, the shares price is still much above its twenty- or thirty-day low. How far the Vifor Pharma deal and its dynamics can influence the CSL share price can thus not be assessed precisely. However, the deal being a strategic move for the company does seem to hold importance for investors.

More from Healthcare- Race Oncology (ASX:RAC) Receives RGO Nod For Zantrene Human Trial