Summary

- Consumer Discretionary sector, despite the impact of COVID-19, has performed well with the companies adopting notable management decisions. The S&P/ASX 200 Consumer Discretionary index has closed in on pre-COVID-19 level.

- Breville Group reported revenue growth of 25.3% to A$952.2 million led by impressive performance in Spain and France. The dividend increased by 10.8%.

- ARB Corporation witnessed a 4.6% growth in the total revenue to A$466.988 driven by a substantial rise in exports. The Company declared a total dividend of 39.5 cents.

- Bapcor noted 12.8% growth in the revenue to A$1,462.7 million aided by record performance of Burson Trade and Retail businesses.

While many sectors are still struggling to reach near their pre-COVID-19 levels, S&P/ASX 200 Consumer Discretionary sector index has shown massive improvement and is near to its pre-COVID-19 levels.

Government restrictions because of the pandemic adversely impacted many companies from this sector. However, the strategies and initiatives implemented by the companies from this industry, coupled with impressive FY2020 results, has helped the index to zoom up on the ASX.

GOOD READ: Consumer Discretionary Stocks Amid COVID-19, Is There A Ray of Hope?

Despite this, due to the prevailing uncertainty in the market, the Consumer Discretionary sector, like most sectors, also lost some momentum. The sector index was 1% down at 2,694.2 points on 31 August (at 4:19 PM AEST).

In this article, we would be looking at three ASX 200 listed consumer discretionary stocks and see how they performed during FY2020.

Breville Group Limited (ASX:BRG)

Breville Group Limited, along with its global subsidiaries, small electrical appliances in the consumer products industry.

On 13 August 2020, Breville Group Limited released its FY2020 Results for the year ended 30 June 2020. The Company delivered a strong performance which was in line with the initial expectation.

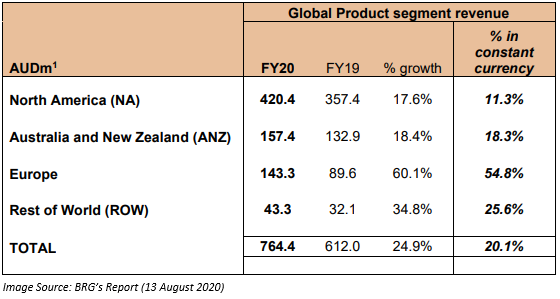

- The revenue grew by 25.3% to A$952.2 million, driven by the successful expansion into Spain and France.

- Global product revenue was +20.1% in constant currency.

- EBITDA improved by 11% to A$126.5 million and EBIT by 3.7% to A$100.9 million.

- NPAT dropped by 1.8% to A$66.2 million.

- Dividend increased by 10.8% to 41 cents (60% franked).

- Net cash with the Company by the end of FY2020 was A$128.5 million.

ALSO READ: Market Participants on Shopping Spree, Stocks Under Chartist’s Lens – NWS, BRG, MSB, SXL

Unlike many other companies belonging to the same industry, Breville was fortunate as there was no COVID-19 outbreak at its manufactures which would force them for an extended lockdown. Breville was in a strong position when the pandemic started.

Brexit, exchange rate, tariffs and COVID-19 acted as a litmus test. The teams at all levels and processes did exceptionally well.

Stock Performance:

BRG share price stood at A$27.230 on 31 August 2020 (at 4:25 PM AEST), down 0.293%. The Company has a market capitalisation of A$3.73 billion, with 136.54 million shares outstanding.

INTERESTING READ: Disrupted Restaurant Industry post pandemic; A look at Consumer Discretionary stock- BRG

ARB Corporation Limited (ASX:ARB)

ASX 200 listed Company, ARB Corporation Limited is engaged in the manufacture, distribution as well as the sale of four-wheel drive motor vehicle accessories plus light metal engineering works.

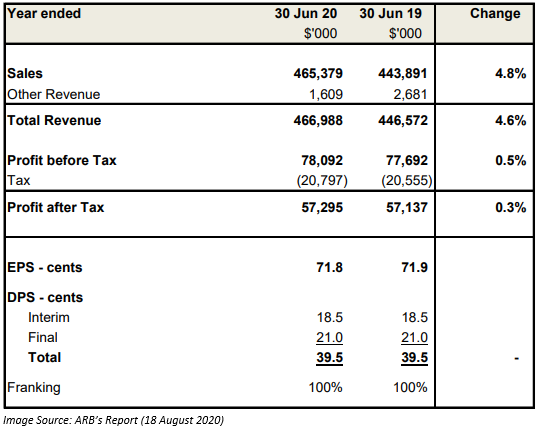

On 18 August 2020, ARB Corporation released its FY2020 results and reported an increase of 4.8% in the sales revenue to A$465.379 million. Revenues from ordinary activities improved by 4.6% to A$466.988 million as compared to the previous corresponding period.

Profit from ordinary activities before tax attributable to members grew marginally by 0.5% to A$78.092 million. Net profit for FY2020 attributable to members went up slightly by 0.3% to A$57.295 million. The interim dividend for FY2020 was 18.5 cents, and final dividend per Ordinary Share was 21 cents.

ARB During COVID-19:

Amid COVID-19 pandemic, the Company focused on the health and safety of its staff and customers. ARB also implemented several measures to prevent the spread of COVID-19. These measures include social distancing, restricted on-site access to non-employees, promotion of good hygiene methods, temperature inspection on the entrance, working-from-home wherever feasible and required testing and isolation in case any symptoms were found.

Because of the pandemic, the government across the globe implemented lockdowns in late March and throughout April 2020. Because of this lockdown in the key markets of the Company like Australia, the USA, New Zealand, the United Arab Emirates, Thailand and all over Europe, the Company noted a rapid decline in customer orders globally in the second half of March 2020. In April, the demand finally collapsed as customers stopped ordering and de-stocked.

The sales grew consistently at 7.6% during the FY2020 to March 2020. However, as a result of a drop in the customer orders in March and April 2020, ARB’s sales declined significantly in April and May 2020. In March 2020, the Company had also withdrawn its guidance. ARB got qualified for the JobKeeper subsidy from April 2020. In May 2020, the sales rebounded significantly, which resulted in strong sales during June and July 2020.

Stock Performance:

ARB share price stood at A$26.350 on 31 August 2020 (at 4:25 PM AEST), up 4.563%. The Company has a market capitalisation of A$2.01 billion, with 79.83 million shares outstanding.

Bapcor Limited (ASX:BAP)

ASX 200 listed Company, Bapcor Limited is a leading provider of vehicle parts, accessories, equipment, service, and solutions in the Asia Pacific region.

On 19 August, the Company released its FY2020 results for the year ended 30 June 2020 and reported strong results despite the challenges experienced due to the bushfires and ongoing drought in Australia, together with the COVID-19 pandemic. Bapcor, however, recovered stronger than expected.

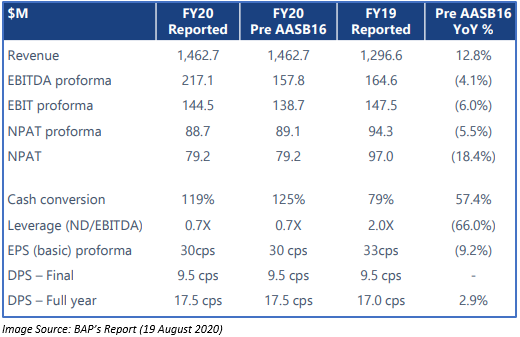

- Revenue from operations increased by 12.8% to A$1,462.7 million.

- Pro-forma EBITDA (before AASB16) declined by 4.1% to A$157.8 million.

- Pro-forma Net Profit after Tax (before AASB16) slipped 5.5% to A$89.1 million.

- Pro-forma EPS (before AASB16) was 30.36 cents per share, down 9.2% from the previous corresponding period.

- Raised A$236 million via equity issue. Thus, increasing share capital by ~20%.

- Dividend for FY2020 improved marginally by 2.9% to 17.5 cps.

Outlook:

July 2020 had a strong start for Bapcor after the impressive results in May and June. The Company has an excellent start in FY2021 driven by increased consumer cash availability, low restaurant, travel, entertainment expenses coupled with government stimulus / super withdrawals. Bapcor feels that COVID-19 would likely to bring about changes with a substantial net positive for the automotive aftermarket.

In FY2021, BAP has plans to add Truckline and continuing enhancements in other businesses. Also, the Company feels that any lockdown in the upcoming period in Melbourne and Auckland or any restrictions imposed by the government could have an impact on trading conditions and earnings.

Stock Performance:

BAP share price stood at A$7.010 on 31 August 2020 (at 4:25 PM AEST), up 3.088%. The Company has a market capitalisation of A$2.31 billion, with 339.41 million shares outstanding.