Highlights

- Nufarm Limited has reported a 31% spike in revenue in H1-22, and a profit lift of 61%.

- Nufarm directors have declared an interim dividend of AU$0.04 a share.

- The crop chemical company aspires to cross AU$4 billion in revenue by 2026.

Australian agricultural chemicals company Nufarm Limited (ASX:NUF) today (May 19) announced its financial results for the six months ended 31 March 2022. Nufarm has reported a spike in revenue and profit in the first-half results. The chemical producer has also declared an interim dividend of AU$0.04, a share based on it.

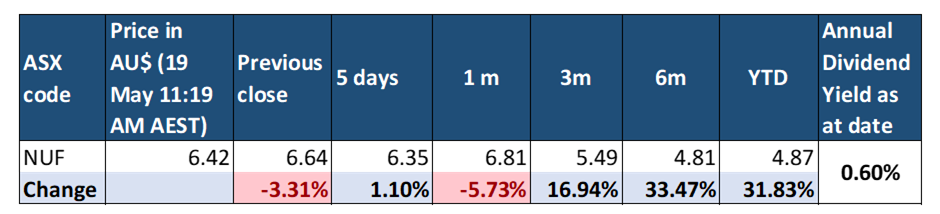

However, on ASX, NUF share price has turned south, losing around 3.313% to trade at AU$6.420 a piece at 11:19 AM AEST today. Nufarm’s market capitalisation stands at around AU$2.52 billion.

Key Highlights from Nufarm’s H1-22 results

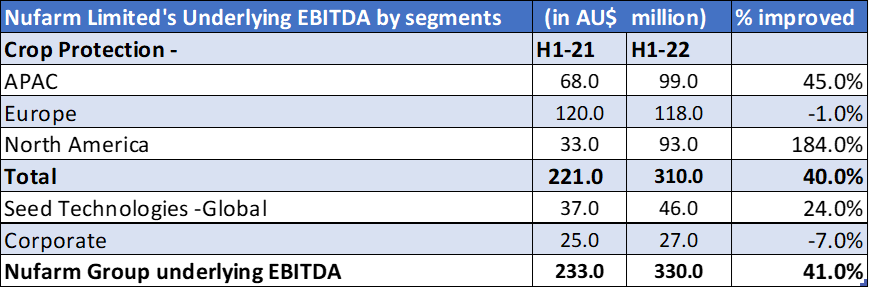

Nufarm Limited has reported a revenue spike of 31% in the prior comparable period (pcp). The underlying earnings before interest, tax, depreciation and amortisation (uEBITDA) increased 41% on pcp. The Underlying net profit after tax (uNPAT) also surged about 112% on pcp.

Nufarm’s Statutory net profit after tax was up 61% on pcp in the first half of financial year ’22. The company’s directors have declared an unfranked interim dividend of AU$0.04 per share. The distribution is Nufarm’s first interim dividend since 2018.

Image Source © 2022 Kalkine Media®, Data Source- company’s ASX announcement

Management commentary

As per Nufarm Limited’s MD and CEO, Greg Hunt:

“The company benefited from healthy seasonal demand in its markets and higher grain prices. The company is also benefitting from its recent years’ transformation work. Nufarm’s focus now is on core crops and key geographies while delivering strong results.”

Nufarm’s seed technologies platforms have also hit strategic milestones and contributed significantly toward business growth. These factors have helped the company navigate through uncertainty and volatility amid the current global setup. The company has also bagged in positive earnings growth for shareholders.

Share price performance

While NUF share price was turning profitable in the last five trade days, it has again entered the red zone. However, the company has remained profitable for a comparatively longer time frame of three to six months.

Image Source © 2022 Kalkine Media®, Data Source-ASX

Talking of Distributions, while Nufarm has declared an interim dividend for the first time after 2018, its annual dividend yield on ASX is still 0.60%.

Nufarm’s business outlook

While there are a few global supply chain and inflation concerns, Nufarm’s growth outlook and industry prospects are clear. It also claims to be having a strong balance sheet, with a leverage of 1.1 times.

As a result, Nufarm’s outlook for the full year remains positive. The company feels the current industry conditions are highly favourable as grain prices are anticipated to remain elevated. The favourable grain price supports more crop growth, which will use up Nufarm’s stock. Based on the facts, the full-year results are anticipated to be more weighted to the first half. The company is already seeing elevated forward sales coming from global uncertainty and volatility in ingredient pricing, global supply chain and logistics challenges.

Nufarm’s five-year growth plan includes an AU$4 billion of revenue by 2026. Even in its seed technologies segment, a revenue lying between AU$600-700 million is expected by 2026.

More from ASX- ASX 200 tumbles 1.8% at open as Dow sees biggest fall in 2 years